- WLFI bridges DeFi and U.S. ideals, offering governance rights, stablecoin access, and a pro-regulation framework within the U.S.-registered entity.

- Token trading is now approved, enabling WLFI to move beyond governance into a liquid, market-driven asset with speculative potential.

- WLFI’s identity is politically charged, backed by the Trump family and positioned as a symbol of American sovereignty in the crypto age.

WLFI is a Trump-backed ERC-20 token aiming to merge U.S. crypto leadership, DeFi access, and political identity—now transitioning from governance-only to tradable digital asset.

WHAT IS WORLD LIBERTY FINANCIAL?

World Liberty Financial (WLF) is the issuing platform behind WLFI, a digital asset project inspired by former U.S. President Donald Trump’s ideals of financial sovereignty and American leadership in global finance. But this isn’t just another token launch—it’s a bold attempt to redefine how decentralized finance can operate within the framework of U.S. law.

At its core, WLF aims to bridge the gap between traditional finance and DeFi, bringing crypto-enabled financial opportunities to the American mainstream—particularly to communities that have historically been excluded from the digital asset revolution. Through WLFI, the project seeks to democratize access to decentralized finance.

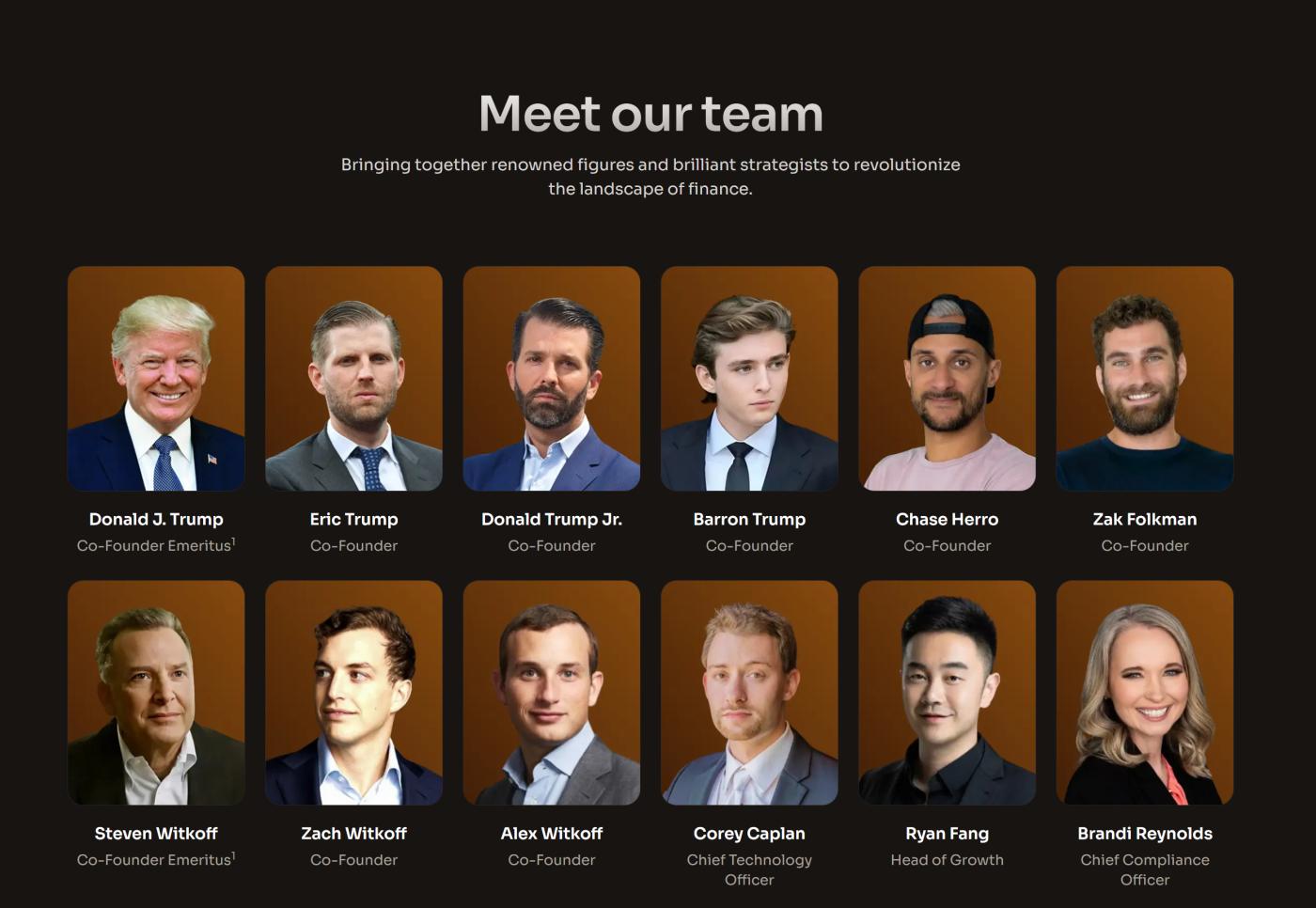

The initiative boasts the endorsement of the Trump family, with Eric Trump, Donald Trump Jr., and Barron Trump all serving as Web3 ambassadors. The founding team also includes Zach Folkman, Chase Herro, and members of the Witkoff family, combining political, entrepreneurial, and financial influence to build long-term credibility.

In a notable departure from many crypto projects that choose offshore jurisdictions, WLF is structured as a Delaware-registered U.S. company. This deliberate decision underscores the platform’s strong commitment to American values and regulatory compliance. Rather than avoiding oversight, WLF embraces it—positioning itself as a model for how decentralized platforms can operate legally and transparently within U.S. law.

This approach directly aligns with the Trump-led vision of establishing the U.S. as the global capital of crypto innovation. The strategy seeks to strike a balance between robust regulatory standards that protect investors and a flexible framework that encourages blockchain development and financial innovation.

In short, WLFI isn’t just a token—it’s a statement. A declaration that freedom, innovation, and compliance can coexist in Web3. It’s a project rooted in American ideals, designed to empower everyday people, and built to shape the future of decentralized finance.

>>> More to read: What is USD1? A Complete Guide

HOW DOES WLFI WORK?

The operation of WLFI revolves around two core components: the World Liberty Financial Protocol and the World Liberty Financial Governance Platform. Together, they form a unique decentralized ecosystem that blends financial functionality with community involvement.

📌 The World Liberty Financial Protocol

This protocol gives users access to a range of third-party decentralized applications (DApps), including digital wallet services, stablecoin asset management, and crypto-based lending pools. At its core, the protocol is designed to promote the widespread adoption of USD-pegged stablecoins, aiming to reduce reliance on central bank digital currencies (CBDCs) and traditional banking systems.

By creating alternative rails for USD-based DeFi activity, WLF seeks to reinforce the role of the U.S. dollar in the global digital economy—empowering users with more decentralized, dollar-backed financial tools.

📌 The Governance Platform

On the other side, the World Liberty Financial Governance Platform gives $WLFI token holders the right to participate in key decision-making processes. Token holders can vote on protocol upgrades, strategic direction, and other essential initiatives—ensuring that the broader community has a voice in the project’s future.

However, it’s important to note that WLFI does not operate as a fully decentralized autonomous organization (DAO). While the voting mechanism empowers the community, core decisions remain under the control of a multi-signature wallet. This setup places a deliberate limit on decentralization, striking a balance between community input and structured governance.

Understanding this hybrid governance model is critical for anyone evaluating the decentralized nature and long-term trajectory of the WLFI ecosystem.

>>> More to read: Trump-Themed Tokens Explained: 8 Key Projects You Should Know

WLFI TOKEN SET TO BEGIN TRADING

After functioning solely as a governance token, WLFI is entering a new phase—public trading and transfer capabilities are officially approved. This change stems from a community governance proposal passed by World Liberty Financial (WLF) on July 16.

Hey $WLFI community! Following our exciting vote announcement we’ve seen your questions and concerns. We’re here to clear the air on tradability, unlocks, and timelines. Let’s dive in.

— WLFI (@worldlibertyfi) July 19, 2025

✅ What’s Changing?

- Previously: WLFI could only be used for voting on protocol upgrades.

- Now: The token will be tradable and transferable, becoming a liquid crypto asset.

✅ Why It Matters:

- Marks a shift from utility-only to a market-driven asset.

- Opens the door for price discovery and speculation in secondary markets.

- Attracts interest from wider crypto investor communities.

✅ Investor Expectations:

- Early holders were drawn to:

- Governance rights

- The token’s association with the Trump family

- Many believed Trump-aligned branding could drive future token appreciation.

✅ Proposal Highlights:

- Token trading launch date and eligibility criteria: To be announced.

- Team and advisor tokens:

- Will not be unlocked immediately

- Are subject to a longer vesting schedule to avoid market dumping.

✅ Trump Family Involvement:

- Received 75% of initial token sale revenue

- Their future gains from public market activity remain unclear

- Value of holdings could rise, but the actual profit impact is still unknown

>>> More to read: What is Trump’s Bitcoin Strategic Reserve Plan?

WLFI TOKENOMICS

The WLFI has a total fixed supply of 100 billion tokens, each representing one vote in the governance platform. To ensure a fair and democratic ecosystem, no single wallet can vote with more than 5% of the circulating supply.

🪙 Token Allocation Breakdown:

- 35% Token Sale (35 billion WLFI)

Distributed through public sales to eligible participants to promote broad-based governance and platform growth.

- 32.5% Community Growth & Incentives (32.5 billion WLFI)

Reserved for expanding ecosystem participation, rewarding long-term contributors, and supporting protocol development.

- 30% Initial Supporters Allocation (30 billion WLFI)

Allocated to founding backers such as DT Marks DEFI LLC, Axiom Management Group LLC, and WC Digital Fi LLC in recognition of their role in developing the WLF platform.

- 2.5% Team & Advisors (2.5 billion WLFI)

Reserved for core contributors, advisors, and service providers who support ongoing development and long-term success.

✏️ Revenue Distribution Model:

- An initial $30 million in net protocol revenue will be retained for operational expenses.

- Any remaining revenue will be distributed to initial supporters.

- Notably, these supporters have expressed their intent to reinvest a significant portion of their proceeds back into the WLF protocol post-launch, creating a sustainable and growth-oriented feedback loop.

>>> More to read: What is $TRUMP|OFFICIAL TRUMP

WLFI FAQ & SUMMARY

Q: What is WLFI, and what makes it unique?

A: WLFI is an ERC-20 governance token issued by World Liberty Financial, backed by members of the Trump family. Beyond its voting utility, the token represents ideals of American freedom, financial sovereignty, and privacy in the digital age. It aims to position the U.S. as a global leader in crypto innovation.

Q: Where can I buy WLFI tokens?

A: Currently, WLFI is only available through a private presale on the official platform and is limited to qualified investors. Public trading is expected in the near future once the token is listed on select cryptocurrency exchanges. Stay tuned to official announcements for listings and eligibility updates.

Q: What is the price of WLFI, and will it go up?

A: The initial presale price of WLFI was $0.015, with a second-round price increase to $0.05. Future price performance will depend on market dynamics, investor sentiment, and political developments. As with all tokens, speculation carries risk.

Q: What are the risks of investing in WLFI?

A: There are several considerations:

- Partial code overlap with Dough Finance has raised concerns.

- Token distribution is relatively concentrated.

- The project carries high political sensitivity.

Investors are advised to evaluate these risks carefully and not rely solely on political affiliation as a basis for investment.

Q: How is WLFI connected to the Trump family?

A: WLFI is endorsed by the Trump family, with Eric Trump, Donald Trump Jr., and Barron Trump serving as Web3 ambassadors. Their involvement has shaped the narrative and appeal of the project, though the extent of long-term financial involvement remains to be seen.

📜Summary

WLFI is more than just a digital asset—it’s a political and financial experiment at the intersection of U.S. sovereignty and decentralized technology. It could become a flagship example of “political tokens” or fade quickly as market sentiment shifts.

If you’re considering investing in WLFI, keep a close eye on:

- Transparency and development milestones

- Regulatory developments in the U.S.

- How political narratives influence price volatility

As always, do your own research and assess whether the project aligns with your risk profile and long-term goals.

ꚰ CoinRank x Bitget – Sign up & Trade!

〈What is WLFI? Inspired by Trump, Powered by USD1〉這篇文章最早發佈於《CoinRank》。