Author: Frank, PANews

Original Title: Review of 8 Mainstream Public Chains' Performance in the Past 3 Months: Ethereum's Triumphant Return, Base and Hyperliquid's Data Surge

Over the past three months, the crypto market has seen a significant rebound. The performance of mainstream public chains has become the market's focus, with Ethereum making a triumphant return under the dual push of ETF funds and listed company purchases. Prices of Solana, Sui, Hyperliquid, and others have also seen substantial increases. From the price trend, the market seems to be entering a long-awaited altcoin season. But behind the prices, how are these public chains actually developing?

[Image]

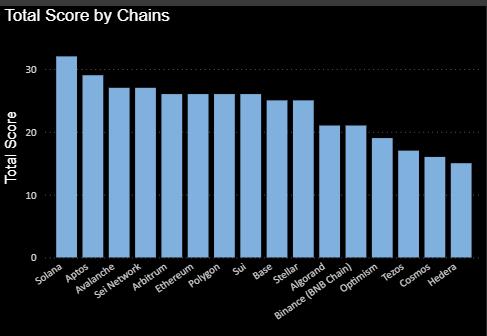

This article has compiled the core indicators of 8 public chains with high TVL and popularity over the recent three months - including price, TVL, capital flow, on-chain activity, and ecosystem progress - to outline the real competitive landscape of this public chain race. The data period is from April 20 to July 20.

[Image]

Ethereum: Capital-Catalyzed Triumphant Return

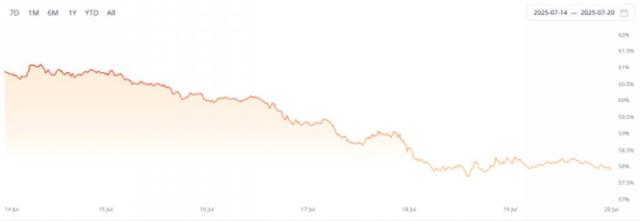

Ethereum has seen significant improvements across various data metrics, closely synchronized with its price performance. Over the past three months, Ethereum's price grew from $1,600 to over $3,800, an increase of more than 130%. Behind the price surge, Ethereum's ecosystem TVL also grew by 61.34% during the same period, with a net inflow of $8.3 billion in on-chain funds, again becoming the public chain with the largest capital inflow. However, TVL growth is mainly due to the ETH token price increase. In terms of ETH quantity, the Ethereum ecosystem's ETH amount has been declining, dropping from 28.39 million in April to about 22.28 million currently, a 21% decrease.

[Images]

In terms of daily active addresses and transaction count, they increased by 11.94% and 16% respectively over the past three months, without particularly notable improvements. Additionally, Ethereum's spot ETF showed clear growth during these three months, with a net increase of about $5 billion. Several US-listed companies following MicroStrategy's lead in using Ethereum as a reserve token have also provided more buying pressure and positive market sentiment. Overall, capital drive may be the primary factor behind Ethereum's significant price increase.

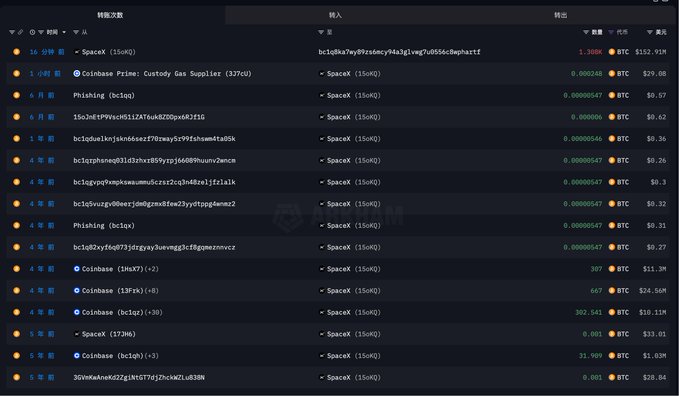

[The translation continues in the same manner for the remaining sections about Solana, BSC, Base, Arbitrum, Sui, and Hyperliquid]Looking at on-chain data, the TVL increased from $640 million to $1.943 billion, a growth of 202%. The stablecoin issuance increased from $2.1 billion to $4.9 billion, quickly becoming the fifth-largest public chain in terms of issuance. After experiencing a previous decentralized trust crisis, Hyperliquid's treasury HLP revenue has recently climbed again and exceeded $68 million, creating a new historical high. After entering July, Hyperliquid's daily new user numbers have also risen to over 3,000.

Aptos: A Latent Performer in Data Deceleration

Compared to other public chains, Aptos appears somewhat underwhelming in both on-chain data and price. The price has increased by 10% in three months, while key metrics such as TVL, capital inflow, and daily active addresses are negative. The most significant change might be a 34% increase in daily transaction count and a $300 million increase in stablecoin issuance. Compared to Sui, which also uses the MOVE language, Aptos seems to be lagging in multiple data dimensions.

Overall, the recent public chain data performance does not appear as intense as the token prices. Although networks like Sui, Hyperliquid, and Base have shown clear improvements driven by the market, the scale of improvement is obviously lower than the token price increase. It is evident that this is a phase of capital recovery preceding ecosystem development. Behind this recovery, whether token price performance can be transformed into ecosystem prosperity, and even drive actual application tracks like DeFi and chain games as in previous bull markets, might be the core factor in sustaining this altcoin season. Therefore, although current prices and on-chain data seem out of sync, these data may become decisive factors for prices in subsequent developments.