"The acquisition laid the foundation for bringing Polymarket home - returning to the United States as a fully regulated and compliant platform, allowing Americans to trade their perspectives."

Shayne Coplan made a key footnote in this five-year compliance tug-of-war in the announcement of acquiring QCEX.

A Single License: The "Compliance Redemption Ticket" for Prediction Markets

On July 21, 2025, the world's largest prediction market platform Polymarket announced the acquisition of QCX, a licensed derivatives exchange in Florida, and its affiliated clearing house QC Clearing (collectively QCEX) for $112 million. This seemingly ordinary acquisition is actually Polymarket's "compliance ransom" paid to US regulators with real money - the CFTC (Commodity Futures Trading Commission) contract market operation license held by QCEX became the key pass for Polymarket to tear off the "illegal" label.

Rewinding to 2022, the CFTC issued a $1.4 million fine to Polymarket and prohibited it from serving US users for "operating an unregistered swap trading facility". The regulatory logic at the time was clear: prediction contracts fall under binary options regulated by the Commodity Trading Act and must be provided through registered exchanges. In the following three years, Polymarket was forced to lock US IPs and was even raided by the FBI at executives' homes due to users accessing through VPN.

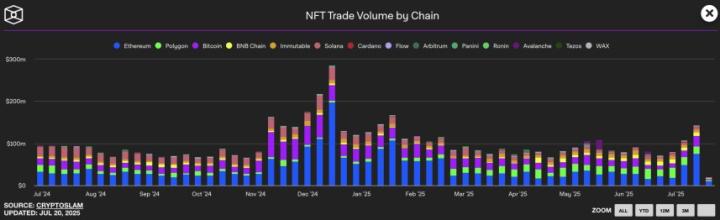

Ironically, during the five years of being shut out, Polymarket demonstrated remarkable vitality. In the first half of 2025, global trading volume broke through $6 billion, attracting over $3.3 billion in bets during the 2024 US election alone, exceeding the total campaign fundraising of both parties. This paradox of "blooming inside the wall while fragrant outside" finally saw a turning point after acquiring QCEX - the compliance license will connect its massive global user pool with the US market, completing a transformation from a "crypto casino" to financial infrastructure.

Regulatory Game: Five Years of Drifting from "Gray Ghost" to "Financial Instrument"

Polymarket's compliance journey can be considered a textbook case of crypto enterprises wrestling with regulators. The core contradiction lies in: regulators have always been conflicted about whether prediction markets are "financial derivatives" or "disguised gambling".

The CFTC's punishment in 2022 first clearly positioned the issue - incorporating event-based binary options into the derivatives regulatory framework. While this brought operational restrictions, it unexpectedly gave it a financial instrument attribute, drawing a line from sports betting. In contrast, its compliant competitor Kalshi faced a legal battle with state attorneys general after launching sports prediction contracts, being accused of "substantially equivalent to illegal gambling".

A turning point emerged with regulatory relaxation after Trump's government returned:

- The Department of Justice and CFTC suddenly ended the investigation into Polymarket in mid-July (which began in November 2024 after Trump's election);

- Brian Quintenz, Trump's nominated CFTC chairman candidate, previously served on Kalshi's board;

- In 2024, the court ruled that Kalshi could provide event betting contracts, creating a precedent for the industry.

The shift in regulatory winds made Polymarket's acquisition timing as precise as a scalpel - quickly securing the license within days of the investigation's end, converting policy dividends into compliance chips.

Data Gold Mine: From Betting Platform to "Public Opinion Alchemy"

As traditional polls are mired in lag and "political correctness" distortion, Polymarket is becoming a radar piercing through information fog. Its unique value lies in: probabilities formed by betting with real money become a more authentic public opinion indicator than votes.

During the 2024 US election, the platform predicted key points like Biden's withdrawal and Vance becoming Trump's running mate in advance. Before mainstream media announced Trump's victory, its odds had been stable in the 62%-69% range, crushing the accuracy of most polls. This capability has even been incorporated into Wall Street's decision-making chain - in June 2025, Goldman Sachs' commodity report cited Polymarket's prediction of "Iran disrupting the Hormuz Strait" as a core parameter for oil price risk analysis.

CEO Shayne Coplan's interpretation is more ambitious: "Polymarket can distinguish signals, noise, bias, and hype". This "collective wisdom" value is being recognized by mainstream institutions:

- Collaborating with Substack to launch "Polymarket Embeds", allowing authors to embed real-time prediction data;

- Connecting with Perplexity AI to provide event background analysis;

- Reaching an official partnership with Musk's X platform in June 2025 to interpret prediction market dynamics through Grok AI.

These moves reveal its ultimate ambition - deeply embedding prediction data into the information distribution system to become a "probability engine" of the real world.

Token Doubts and Superapp Ambitions

Despite securing the compliance license, Polymarket still faces two major uncertainties.

The possibility of a native token continues to ferment. In September 2024, The Information exposed Polymarket discussing token issuance and raising over $50 million. Although officially unconfirmed, user behavior has revealed market expectations: many traders frequently buy and sell positions to potentially benefit from an airdrop. Analysts speculate that acquiring a compliant entity might provide a fiat entry and exit channel for the token, solving the biggest pain point of DeFi prediction markets.

A deeper imagination space lies in integration with Musk's superapp (X). Musk once said directly: "If you want to take over the global financial system, only X will do." Combining Polymarket's prediction data with X's social sentiment and Grok's AI analysis could form an "explainable prediction data stream", providing a key puzzle piece for X to build a "social × financial" closed loop. This architecture is surprisingly similar to WeChat's ecosystem expansion logic of "content + payment", just with decentralized prediction contracts replacing RMB.

Rise of a New Species: The "Wall-Breaking Moment" of Prediction Markets

When Polymarket secured the CFTC license, its significance had long transcended a single company's compliance advancement. It marks the completion of a three-step jump from "edge innovation → regulatory acceptance → mainstream empowerment".

For the financial industry, this alternative data source is reconstructing event-driven trading logic. Macro risks that traditional institutions would take weeks to analyze (such as Middle East geopolitical conflicts), Polymarket provides instant insights through real-time probability fluctuations. This "crowdsourced intelligence" model is even starting to output to Wall Street reports, becoming a new variable in price discovery mechanisms.

For regulators, the QCEX acquisition provides a new paradigm for compliance of innovative enterprises - bypassing lengthy approvals through acquiring licensed entities, transforming "regulatory arbitrage" into "regulatory compatibility". According to Bloomberg, multiple DeFi protocols are already evaluating similar paths.

At a broader level, the deep coupling of Polymarket and the X platform heralds the arrival of a "financialized information society": when social media opinion clashes are converted into tradable prediction contracts, and AI assistants generate investment advice based on market probabilities, the boundaries between information and capital will completely dissolve. This might be the true meaning of Shayne Coplan's "bringing home" - transforming prediction markets from crypto carnival to a measure of the world's real BlockBeats.

"By combining Polymarket's accurate, unbiased real-time probabilities with Grok's analytical capabilities and X platform's real-time insights, we can instantly provide contextualized, data-driven insights for hundreds of millions of global users."

Shayne Coplan's declaration in the X collaboration announcement is now accelerating into reality with the landing of the compliance license.