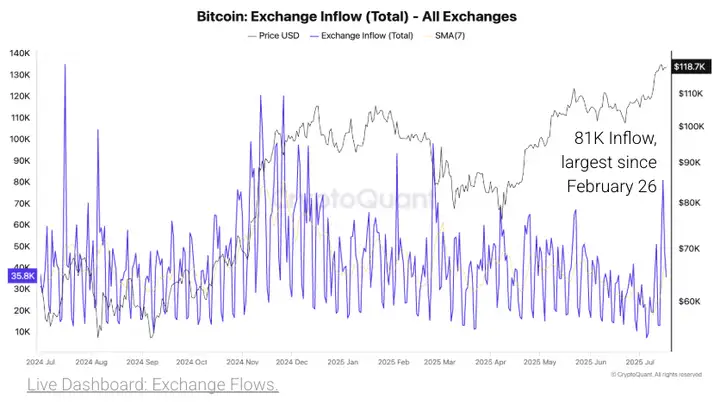

As Bitcoin's price broke through the historical high of $123,000 last week, the inflow of Bitcoin to exchanges also sharply increased, driven primarily by whales and Bitcoin miners.

VX:TZ7971

After Bitcoin's price peaked, a clear profit-taking trend emerged in the market. The daily total Bitcoin inflow to exchanges surged from 19,000 the previous week to 81,000 on July 15, with deposits from whales being the main driver, increasing from 13,000 to 58,000 during the same period.

Simultaneously, Bitcoin miners once again became the primary sellers in the market. On the day after reaching a new high on July 15, the total outflow from miner wallets spiked to 16,000 Bitcoins, the highest since April 7. This is considered an extreme outflow event. Moreover, almost all outflowing Bitcoins were transferred to exchanges, further confirming the view that miners sell when Bitcoin reaches new price heights.

Ethereum's exchange reserves also saw a similar surge, with a single-day inflow approaching 2 million on July 16, the highest since February 26, nearly doubling from a week prior. This inflow growth occurred after Ethereum experienced a strong 131% rally since early April.

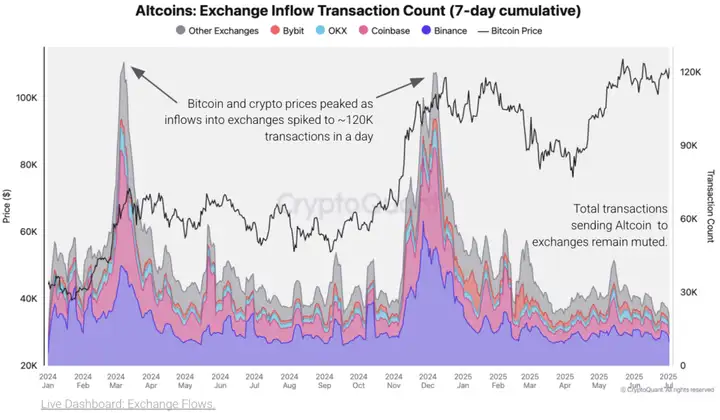

In contrast, Altcoins maintained a steady inflow volume, indicating that crypto investors were not rushing to sell. Generally, Altcoin exchange trading volumes tend to spike after significant market rises, typically signaling traders' intention to take profits and coinciding with short-term price peaks or active trading periods.

For instance, in March and December 2024, such trading volumes reached peaks of around 120,000 transactions, marking local price tops. However, current Altcoin daily trading volume is only 21,000, suggesting low selling pressure and that Altcoins may not have reached investors' target prices.

Altcoin Frenzy Not Yet Here

Bitcoin's market dominance has recently sharply declined, with market funds clearly shifting towards other mainstream cryptocurrencies, and the Altcoin market showing signs of stirring.

According to TradingView data, Bitcoin's market dominance dropped 5.8% in a week to below 61%, the largest weekly decline since June 2022 and the lowest level since March this year.

The decline in Bitcoin's market dominance accompanies rapid expansion of overall crypto market capitalization. Over the past 3 weeks, total crypto market cap rose from $3 trillion to $3.8 trillion, with Ethereum leading the charge and Altcoins rising, replacing Bitcoin as the market's focal point.

Such trend changes often signal imminent market volatility and potential cascading leverage liquidations.

Recently, the average correlation between mainstream coins and Bitcoin has been rapidly declining, even turning negative. In other words, Altcoins are starting to "no longer follow Bitcoin's movement". Historically, reduced correlation is often a prelude to increased market volatility, typically accompanied by massive liquidation waves.

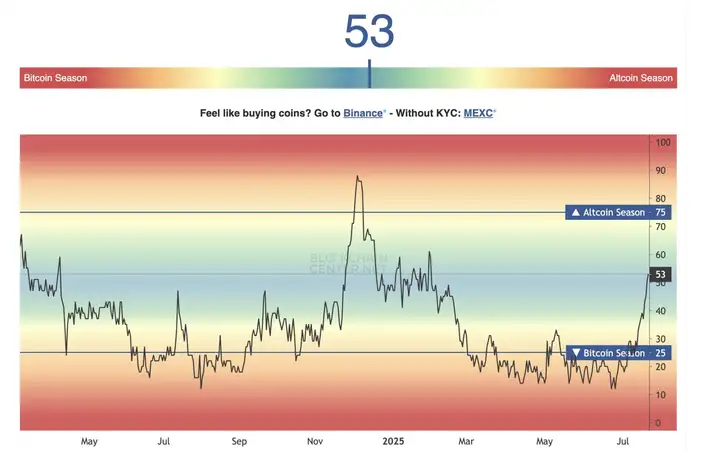

The "Altcoin Season Index" is gradually approaching the threshold of "Altseason".

This index tracks the performance of Altcoins relative to Bitcoin over the past 90 days. When over 75% of the top 50 cryptocurrencies (excluding stablecoins) outperform Bitcoin, "Altseason" is officially declared.

Currently, only about 53% of Altcoins are outperforming Bitcoin, still far from the 75% threshold, but indicating remaining upside potential.

Notably, Ethereum surged 27% last week, simultaneously boosting other Altcoins to multi-month highs. If more coins follow in the coming weeks and outperform Bitcoin, the market could potentially see an Altcoin-led capital wave as early as August. DeFi, public chains, Ethereum ecosystem, SOL ecosystem - one must find opportunities during pullbacks.