U.S. Treasury Secretary Scott Bessent said in an interview this morning on July 22 that the United States is not in a hurry to finalize a trade agreement before August 1, because tariff pressure will force trading partners to negotiate better terms, and if progress stagnates, the 40% of April 2 will be returned. President Trump may not fire Federal Reserve Chairman Powell immediately, but Fed reform will be imperative. Speaking of the productivity revolution brought about by AI, Bessent said it will bring non-inflationary growth. The Fed has the opportunity to cut interest rates in the future to save the housing market and return the United States to the golden age of "high growth and low inflation" in the 1990s.

Table of Contents

Toggle8/1 Negotiations stalled, 40% tax refund, Indonesia made multiple concessions, Chinese exports became an issue

In response to the outside world's continued attention to the progress of tariff negotiations between the United States and its global trading partners, Bessant said that the negotiations are indeed progressing, but more attention will be paid to the content and quality of the agreement, and it will not be hastily signed before the August 1 deadline. He emphasized that President Trump created the greatest negotiation leverage through the high tariff strategy, with the goal of resolving the trade imbalance that has accumulated for 20 to 40 years.

He then added that August 1 would not be the deadline, and if the tariffs return to the 40% rate announced on April 2, the United States would continue negotiations. He emphasized:

"Every trading partner has been made clear that if progress in the negotiations stalls, the tariffs will return to the 4/2 level."

Bessant then took Indonesia as an example. He said that after several rounds of negotiations, Indonesia agreed to purchase a large amount of American agricultural products and Boeing aircraft, and to cancel nearly 11,000 tariffs and non-tariff barriers.

Speaking of China, he pointed out that the United States recently relaxed the export of Nvidia H20 chips, which was an olive branch to China, but then they would start discussing China's large-scale imports of sanctioned Iranian and Russian oil, as well as the impact of excessive exports of manufactured goods on the global market. Bessant emphasized:

"China accounts for 30% of global manufacturing exports. This proportion cannot rise any further. It is better to reduce it."

The EU is eager to talk, but the 27 member states are slow to coordinate

As for Trump's intention to increase the tariffs on the EU to more than 15%, Europe is also preparing retaliatory tariffs. Bessant said that the United States is a country with a trade deficit and the EU is a country with a surplus, and the impact of tariffs will definitely be greater in Europe, so they are eager to negotiate. However, because the EU has 27 countries and needs to go through various approvals, the progress is naturally slow. He added:

"Some member states are also dissatisfied with the pace of the negotiations, but we can do nothing about it because the United States is negotiating with the EU headquarters, not with each country individually."

Japan's post-election negotiations: The United States still puts its own people first

On July 20, Bessant went to Osaka to attend the International Expo and did not discuss the trade agreement with Japan. As for the outside world's view on whether the weakening of the Japanese government after the Japanese Senate election will affect the negotiating position, he emphasized:

"The United States will not change its strategy because of Japan's internal affairs. Its primary goal is to negotiate the most favorable terms for the American people."

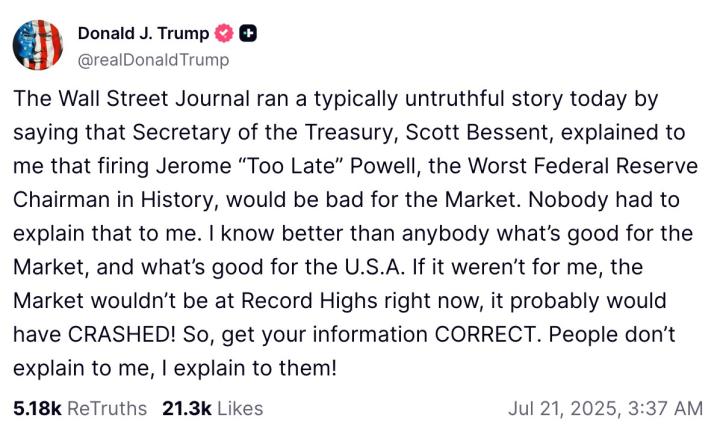

Trump is thinking about whether to fire Powell, Treasury Secretary: The president will decide for himself

Regarding whether President Trump will fire Powell, Bessant said that the information leaked from the outside world is incomplete, the media is not used to a "highly efficient president", and President Trump will listen to opinions from all sides, but in the end he will make his own decision.

In response, the host asked: "If Trump really wants to fire Powell, will you persuade him not to?" Bensent said that the Fed should be examined to see whether it has done its job well. The Fed is in charge of monetary policy, supervision, and financial stability. If mistakes are frequent, the Federal Aviation Administration (FAA) would have been thoroughly reviewed long ago.

Bessant further criticized the Fed for having a lot of PhDs but no groundbreaking achievements.

Trump uses tariffs as a weapon again to sanction Russia and related exporting countries

As for the Russia-Ukraine issue, will the United States introduce new sanctions against Russia? Bessant said that the Treasury Department's sanctions business is handled by the Office of Foreign Assets Control (OFAC), but this time there has been a major breakthrough.

He added that the Senate has passed a new sanctions bill, and President Trump has directly imposed "secondary tariffs of up to 100% on countries that buy Russian oil." He called on European allies not to just say they support Ukraine, but to follow the United States.

Can interest rates be cut even for a strong economy? Finance Minister: AI revolution will bring high growth and low inflation

Regarding whether the Trump administration's emphasis on the strong U.S. economy will weaken the case for future rate cuts, Bessant said that a strong economy does not mean that interest rates cannot be cut. In the 1990s, the IT revolution brought non-inflationary growth. The AI revolution will take effect as early as early 2026, promoting an explosion in productivity, allowing the economy to grow rapidly but maintain low inflation. By then, a rate cut would be quite reasonable and would help to activate the real estate market.

He added that Trump's Big, Beautiful Act will boost corporate capital expenditures. If the policy is advanced in tandem with the AI productivity revolution, the United States will have the opportunity to usher in a golden age of high growth and low inflation.

Risk Warning

Cryptocurrency investment carries a high degree of risk. Its price may fluctuate drastically and you may lose all your capital. Please assess the risk carefully.

Founding Partner, SOFA.org

Augustine Fan is a professional with over two decades of distinguished experience, active in Wall Street, family offices, private equity, and now in the cryptocurrency space. He currently holds leadership positions at SOFA.org and is also a partner and CFO at SignalPlus, a leading digital asset software technology provider in the cryptocurrency options space.

Prior to entering the cryptocurrency space, Augustine worked at Goldman Sachs for ten years as a US interest rate trader and macro expert, serving in New York, London, Tokyo and Hong Kong offices. After leaving Wall Street, he joined a shipping-based family office in Hong Kong, helping to manage one of the most active sub-macro trading portfolios in Asia. He then became the Chief Investment Officer (CIO) of another family office in Hong Kong, focusing on private equity, credit, real estate, listed companies and frontier market investments.

Augustine is a CFA chartered financial analyst, a Leslie Wong Fellow, and graduated with first class honors from the University of British Columbia (UBC) in Canada with a Bachelor of Commerce degree.

Another week, another all-time high. The S&P 500 hit another all-time high on Friday, the third time this week and the sixth time in July. The market continues to ignore the ongoing tariff escalation (30% tariffs on Mexico and the EU), the initial transmission of price pressures in the latest CPI data, and the latest farce of removing Fed Chairman Powell for "just cause".

The recent rally has pushed the S&P 500's price-to-earnings ratio close to its own all-time high, just as the second-quarter earnings season is about to kick off and investors are paying a premium for any kind of stock exposure.

Meanwhile, encouraged by the stock market's performance, President Trump has reignited his tariff escalation war and is making plans to add industry-specific tariffs on top of existing country-specific tariffs, which will reportedly be implemented within two weeks. The initial target industries will be pharmaceuticals and semiconductors, aiming to fully cover US imports.

Despite the new threats, markets have almost completely ignored this round of tariff escalation, with “tariff-sensitive” thematic sectors continuing to underperform the benchmark index. Whether due to expectations of an eventual “TACO” moment (referring to the easing of trade tensions), less targeted attacks on key trading partners (the expected Trump-Xi summit in South Korea), or confidence that the private sector can handle the shock, markets are likely to remain deaf to the trade conflict until further notice.

Speaking of policies, the Trump administration has set off a new round of Fed turmoil, with media reports saying that Fed Chairman Powell may be removed due to serious budget overruns for building renovations. Yes, you read that right!

Powell has been entangled in project management issues over some of the roughly $2.5 billion renovations to the Fed’s Washington headquarters that have cost about $600 million more than initially expected. Asked Tuesday whether the costly renovations constituted a fireable offense, Trump said, “I think to some extent, yes.” — The Hill

After leaking this ridiculous claim, Trump quickly retracted his threat, and the market overwhelmingly believes that Powell will complete his term until 2026.

At the same time, Federal Reserve Board Governor Waller took a slightly unconventional move and expressed his "dissent" in advance, publicly stating that he was inclined to cut interest rates at the July meeting, arguing that "the private sector is not performing as well as everyone thinks" and that the U.S. labor market is also "on the edge" because most employment is concentrated in the public sector.

Is it any wonder that the market is in the same risk-on mode it has been in for the past two months as the Fed rhetoric turns dovish and stocks continue to hit new highs? Or is the market pricing in a dovish Fed, front-running the upcoming rate cuts and contributing to the Goldilocks economics narrative?

In any case, inflation expectations have quietly returned, global long-term yields remain high, while inflation break-even points have climbed to their highest levels in many years, while financial conditions remain loose.

Data from the past week also aligned well, with the University of Michigan reporting a slight improvement in consumer confidence both about current conditions and future expectations, while one-year inflation expectations have fallen to pre-tariff levels (4.4% vs. 5.0% prior).

The earnings season will enter its climax this week, with Tesla and Google's parent company Alphabet set to release their earnings reports on Wednesday. According to Bloomberg, 58 of the 498 S&P 500 components have released their earnings reports, with earnings exceeding expectations by 7.8%. Even with earnings growth, the price-to-sales (P/S) and price-to-earnings (P/E) ratios of U.S. and global stocks have risen to or above historical highs, and investors are paying the "full price" for increasing risk exposure at this moment.

Surprisingly, despite the market’s continued rally, we haven’t seen extreme sentiment readings in traditional momentum indicators: the National Association of Individual Investors bull-bear ratio remains around the mid-range, and search engine queries for “boom” stories remain at historically low levels.

Are the macro doomsayers finally extinct? Have we all accepted the belief that the stock market can only go up and not down? Don’t short the short the trend…

The crypto space certainly hasn’t missed out on our own FOMO moment. Ethereum is having a blast, approaching the $4,000 region (up 22% in 5 sessions), with some major Altcoin also posting double-digit gains this week. Bitcoin has also hit its own all-time high, topping $118,000, though the excitement has been a little restrained. Until further notice, it feels like the good times are back.

The ETH/BTC ratio has temporarily risen from the grave and has improved to its best level since Q1. Some attribute this to the focus on stablecoins/real world assets being good for proof-of-stake networks, while others see Ethereum's new treasury strategy as a catalyst for the rise. We personally believe this is just a classic risk-on spillover, as most of the money in mainstream traditional finance has been fully deployed in Bitcoin over the past 7 months.

As a positive milestone, Congress did finally pass landmark stablecoin legislation last week, exchanging tighter federal and state regulation for more stablecoin payment channels. This may have brought some structural tailwinds, as evidenced by the record inflows into Ethereum ETFs over the past two weeks, with total inflows exceeding $3 billion in July, and daily inflows (US$300 million to US$500 million) trending at 5 to 10 times the daily inflows in the first half of this year.

At the risk of repeating what I have said for most of the past 8 weeks… Never short a dull market, and enjoy the good times rolling in. Good luck and happy trading to all of you as we head into the hot summer months!

Risk Warning

Cryptocurrency investment carries a high degree of risk. Its price may fluctuate drastically and you may lose all your capital. Please assess the risk carefully.