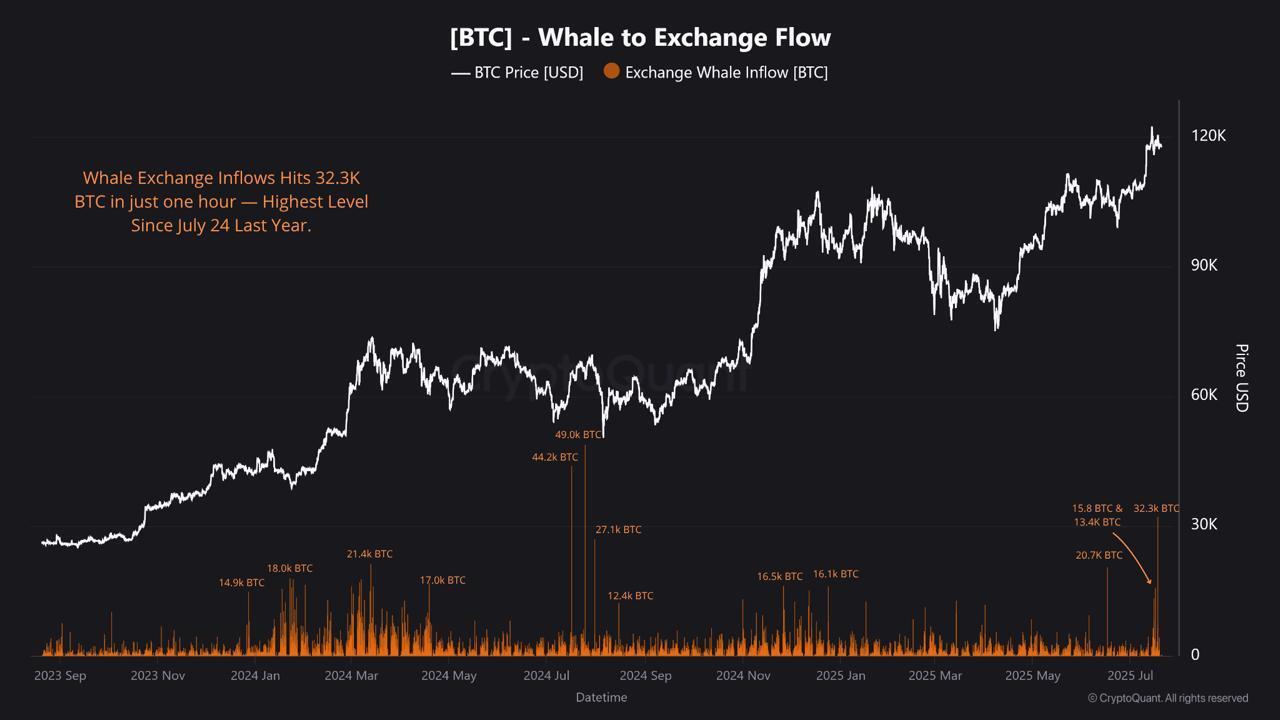

Data from CryptoQuant shows that Bitcoin whales have sent over 61,000 BTC to exchanges on 17/07—this is the largest daily inflow in the past year.

The sudden increase in BTC transfers by whales coincides with a significant drop in BTCD, raising questions about whether capital is shifting to altcoins.

Whale Activity Indicates Bitcoin Consolidation

According to data from CryptoQuant, 32,300 BTC flowed into exchanges in just one hour on 17/07. Previously, there were two transfers of 15,800 BTC and 13,400 BTC from wallets holding over 100 BTC.

These large movements often signal profit-taking, especially after Bitcoin reached a new ATH of 123,000 USD on 14/07.

After the whale inflow, Bitcoin's price dropped and is currently trading between 117,000 USD and 118,000 USD.

Bitcoin Whale Flow to Exchanges. Source: CryptoQuant

Bitcoin Whale Flow to Exchanges. Source: CryptoQuantMost importantly, this coincides with a significant drop in BTCD, from 64% to 60% between 17/07 and 21/07.

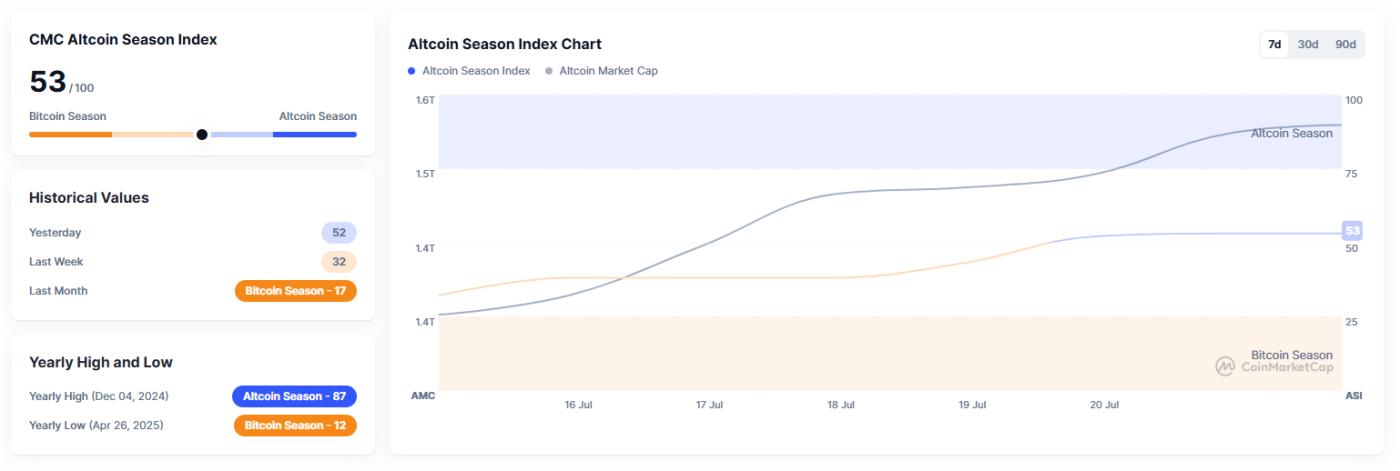

A decreasing dominance index often indicates that investors are moving from Bitcoin to altcoins. This trend is one of the earliest signs of an emerging altcoin season.

When Bitcoin stabilizes and capital flows into Ethereum, Solana, and medium-cap tokens, altcoins tend to outperform.

Bitcoin's short-term outlook currently leans towards consolidation. If whales continue selling, downward price pressure may persist.

However, the current support level around 115,000 USD remains intact.

Meanwhile, the altcoin market is strengthening. Ethereum, XRP, and Solana have recorded double-digit increases in the past week. The meme coin market cap alone has increased 8% today, nearly reaching 90 billion USD.

The Altcoin Season Index has also risen from 32 to 56, further consolidating the shift in market momentum.

Altcoin Season Index. Source: CoinMarketCap

Altcoin Season Index. Source: CoinMarketCapIn summary, whale activity seems to be cooling Bitcoin's surge while quietly driving altcoin profits. The next move depends on whether buyers can absorb the selling pressure or if another whale dump occurs.

Overall, this is a cooling period for Bitcoin and the beginning of momentum for altcoins. Continue monitoring whale flows and BTC.D to confirm the next phase.