The cryptocurrency market saw an increase in trading activity last week, pushing the total capital up by 3%. This momentum increase drove profits on some listed cryptocurrency stocks in the US, with some closing higher on Friday.

With an optimistic sentiment still operating in the cryptocurrency space this week, here are three US cryptocurrency stocks to watch:

Galaxy Digital Inc. (GLXY)

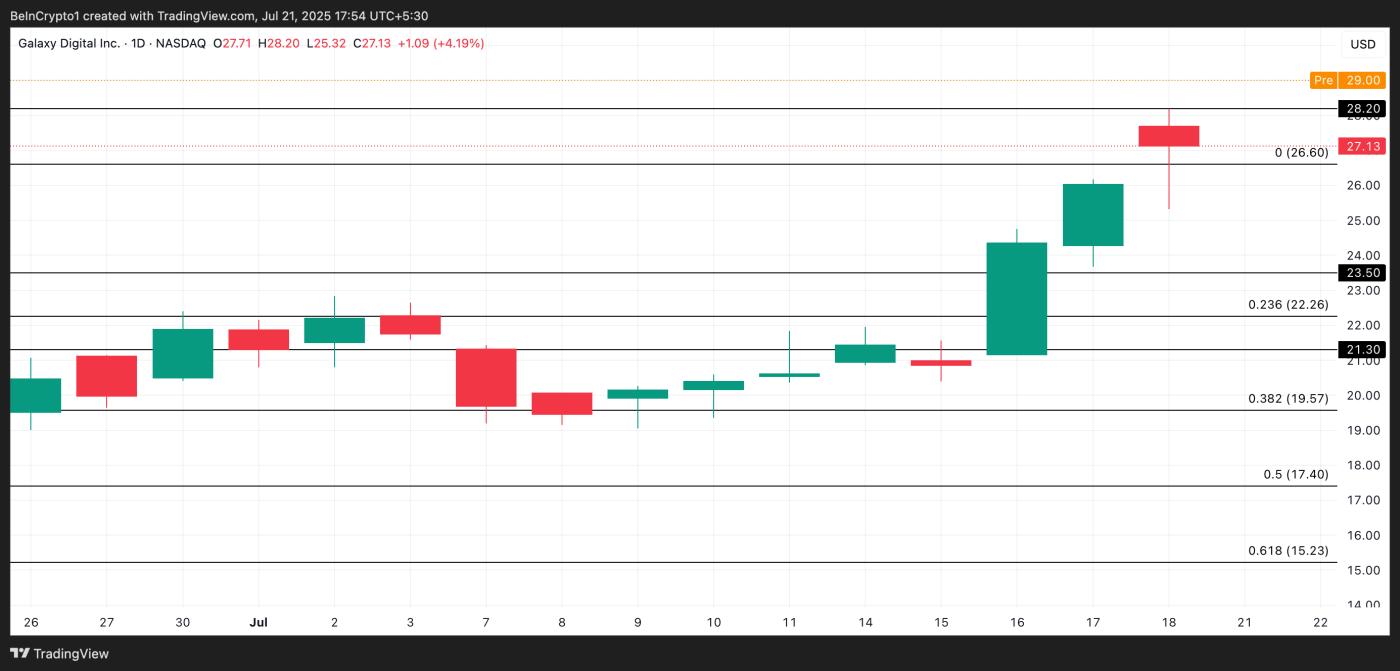

GLXY closed on Friday at $27.13, up 4%. This was driven by increasing investor optimism ahead of the company's upcoming earnings report.

The company announced on July 15 that they will release their Q2 2025 financial results on August 5, before market opening. Galaxy's CEO, Michael Novogratz and the management team will host an earnings call on the same day at 8:30 AM ET to provide updates on the company's performance and strategy.

In pre-market trading today, GLXY was trading at $29. The potential increase in investor demand after market opening could push the stock to $30.

GLXY Price Analysis. Source: TradingView

GLXY Price Analysis. Source: TradingViewConversely, any selling pressure could push the price below $28.20.

RYVYL Inc. (RVYL)

RYVYL Inc.'s stock closed Friday at $0.33, up 5.10%. This occurred a few days after the company announced the successful completion of a public offering.

The San Diego-based fintech company raised approximately $6 million by selling 15.38 million common shares and accompanying options at $0.39 per share. These options are immediately exercisable and expire after five years.

In pre-market trading today, RVYL was trading at $0.34. The stock could rise to $0.45 if demand increases when the market opens.

RYVL Price Analysis. Source: TradingView

RYVL Price Analysis. Source: TradingViewHowever, if the price momentum decreases, RVYL risks falling below the support level of $0.30.

Digi Power X (DGXX)

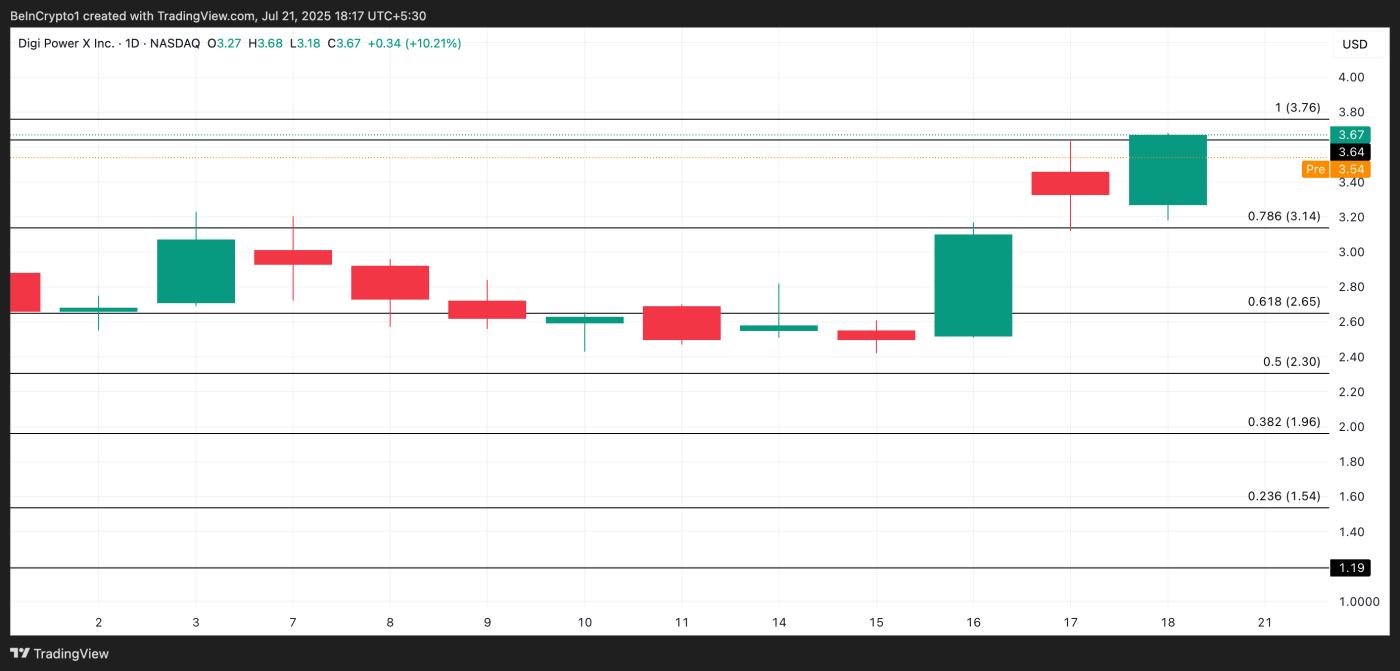

DGXX increased 7.51% to close at $3.58 on Friday. This followed the company's announcement of a firm order with Super Micro Computer, Inc. to provide systems using NVIDIA B200 for its new NeoCloud platform.

In pre-market trading on Monday, DGXX was trading at $3.54. If buying activity increases when the market opens, the stock could rise to $3.67.

DGXX Price Analysis. Source: TradingView

DGXX Price Analysis. Source: TradingViewHowever, a decrease in buying pressure could trigger a decline below $3.14.