The Bitcoin holdings leader among U.S. listed companies, MicroStrategy (now renamed Strategy), once again proved its belief in Bitcoin through action. MicroStrategy founder Michael Saylor announced on X platform on July 21 that the company used approximately $739.8 million between July 14 and 20, buying 6,220 Bitcoins at an average price of $118,940 per Bitcoin.

7.4 Billion USD Increase Details: Fund Source and Operation Rhythm

According to the document submitted to the SEC, this round of Bitcoin purchase funds mostly came from the issuance proceeds of its common stock MSTR and preferred stocks STRK, STRF, and STRD. Unlike previous large-scale debt issuances, Strategy reduced single debt risk through the "42/42 Plan" and opted for equity financing to ensure that its cash can be converted to Bitcoin positions at any time.

Saylor previously stated that Bitcoin's scarcity and fixed issuance are the core reasons for MicroStrategy's long-term bet; in his view, this investment is not just asset allocation, but an insurance against inflation.

Holdings Reach 607,770 Coins: Floating Profit Exceeds 28 Billion USD

With the completion of the latest transaction, Strategy now holds 607,770 Bitcoins, with a total purchase cost of approximately $43.61 billion and an average purchase cost of $71,756.

At current prices, the market value of MicroStrategy's Bitcoin holdings is about $71.77 billion, with unrealized gains of approximately $28.16 billion. For many institutions, buying MSTR is almost equivalent to buying an "enterprise Bitcoin ETF".

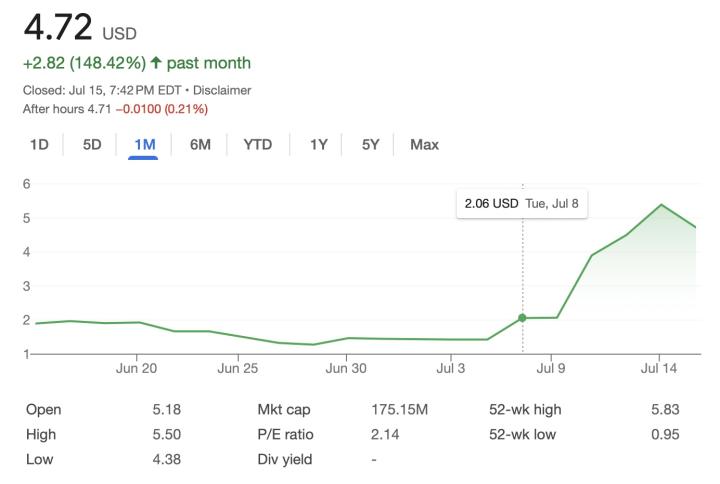

MSTR Stock Price

According to the latest data from Google Finance, MicroStrategy's stock MSTR was trading at $426 after hours, up 0.72%, with a market value of about $121.6 billion.

It's worth noting that from the beginning of this year, MicroStrategy's stock price has risen from around $289 to over $450 before a slight decline, with a gain of nearly 50%, making it one of the most eye-catching stocks in the U.S. market.

High Returns Accompanied by High Volatility: Investors Need to Self-Assess Risks

However, behind the glamorous numbers are multiple hidden concerns. On one hand, Bitcoin's price is highly volatile, and if the market reverses, MicroStrategy's massive holdings will put pressure on its financial statements. Additionally, while equity financing has alleviated its debt, continuous stock issuance may also dilute shareholders' equity. Therefore, as Strategy transitions from a software supplier to a "Bitcoin asset manager", both returns and risks are simultaneously amplified.

In summary, Strategy has pushed its Bitcoin holdings close to the 610,000 coin threshold through another increase, becoming an unavoidable heavyweight participant in the crypto market. For investors, MSTR provides a high-leverage, high-volatility channel to share Bitcoin's growth dividends, but this path is not easy: although the floating profits are dazzling, risks are equally real, so investors need to remain cautious at all times.