Traditional financial institutions are accelerating stablecoin adoption to stay competitive, modernize payment systems, and tap into global financial inclusion opportunities.

Regulatory clarity from laws like the GENIUS Act and MiCA lowers entry barriers, boosting institutional confidence in issuing compliant stablecoins.

Stablecoins offer speed, lower costs, and global reach, but raise concerns over regulation, security, financial stability, and competition from crypto-native firms.

In recent years, the stablecoin market has surged at an astonishing pace, becoming a critical bridge between the digital economy and traditional finance. By 2025, enthusiasm for stablecoins among traditional financial institutions continues to grow, with banks and fintech companies worldwide accelerating their entry into this sector in an effort to seize the initiative amid the digital finance wave.

STABLECOIN BOOM AND ACTIVE PARTICIPATION BY TRADITIONAL FINANCIAL INSTITUTIONS

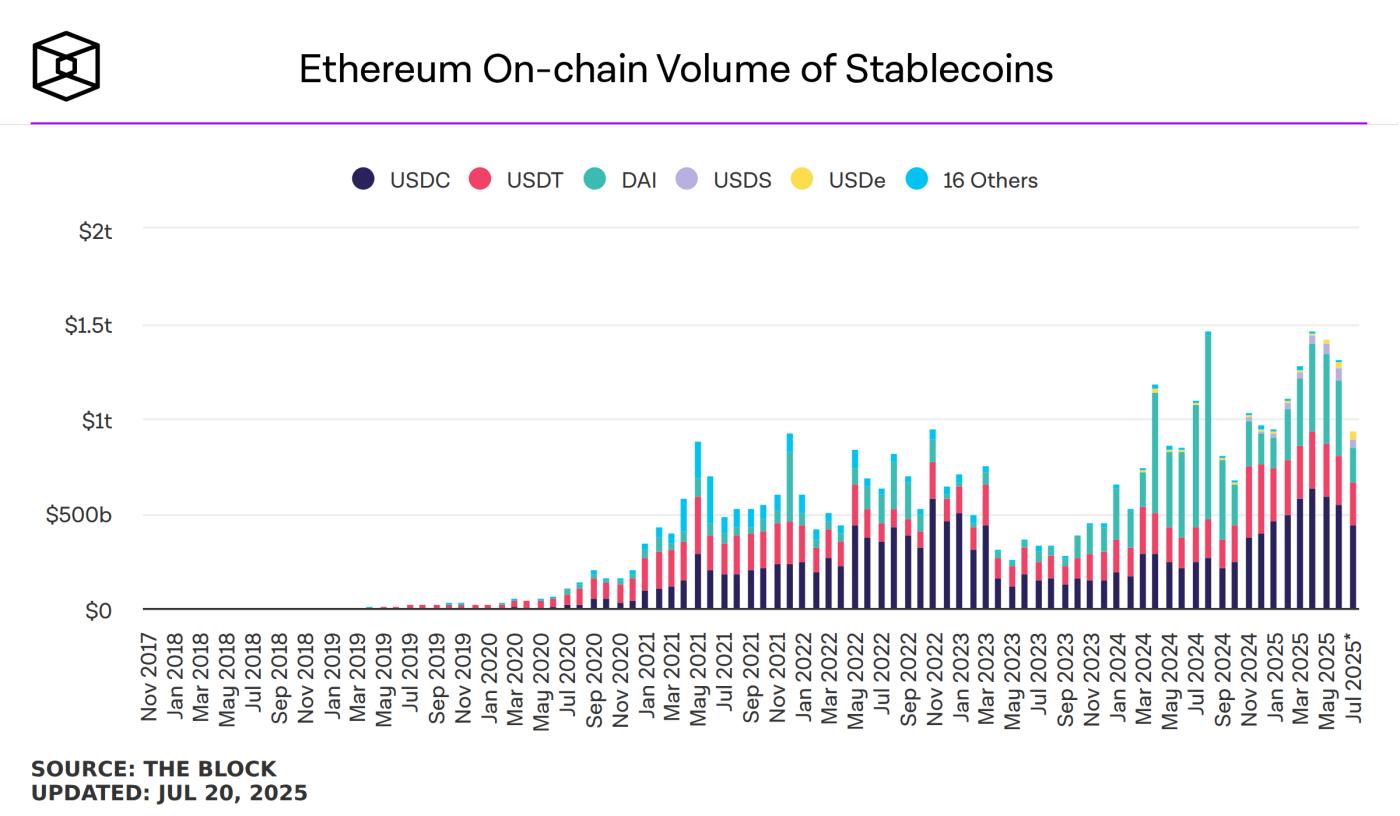

In 2025, the scale and influence of the stablecoin market continue to expand. According to the latest data from Chainalysis, monthly trading volume for stablecoins has surged to the trillion-dollar level, accounting for 60% to 80% of total cryptocurrency transactions.

This explosive growth has drawn widespread attention from traditional financial institutions, which are now accelerating their integration into the digital economy through stablecoin issuance, blockchain network participation, and related financial services. For example, U.S. financial giants like JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are exploring the possibility of jointly issuing a stablecoin.

At the same time, fintech companies are also stepping up their efforts. Stripe has launched stablecoin accounts in 101 countries, while PayPal is expanding its global presence through its PYUSD stablecoin, leveraging stablecoins for real-time cross-border payments, particularly excelling in emerging markets.

These developments indicate that traditional financial institutions are embracing stablecoins with concrete actions, aiming to secure a strategic position in the digital finance landscape.

DEEP-ROOTED REASONS BEHIND TRADITIONAL FINANCE’S ENTRY

The interest of traditional financial institutions in stablecoins is not a passing trend but the result of multiple market and technological drivers. Firstly, stablecoins are popular among users due to their typically low volatility, as they are pegged to fiat currencies like the U.S. dollar.

According to ARK Invest, global stablecoin users have reached 170 to 230 million, accounting for 15% to 20% of non-U.S. dollar holders. This widespread user base offers a massive market opportunity for financial institutions. By issuing stablecoins, banks and fintech companies can meet customers’ needs for secure and stable digital assets while strengthening brand trust.

For instance, JPMorgan’s JPM Coin has been widely adopted within its enterprise payment systems, demonstrating stablecoins’ potential in optimizing financial services.

Secondly, the efficiency advantages of blockchain technology are a key driver behind traditional financial institutions’ entry into the stablecoin market. Compared with the traditional SWIFT system, blockchain-powered stablecoin transactions can achieve near-instant settlement at significantly lower costs.

Wells Fargo’s blockchain pilot projects show its cross-border transfer efficiency far exceeds that of traditional systems. Australia’s National Australia Bank (NAB) has also introduced a AUD-pegged stablecoin, AUDN, which shows similar advantages in pension payments and carbon credit trading.

In addition, competitive pressure cannot be ignored.

With stablecoins like Tether (USDT) and Circle (USDC) dominating the market, traditional financial institutions face threats from crypto-native companies and emerging fintech firms. Tether and Circle collectively hold $166 billion in U.S. Treasuries, making them major players in the bond market. If banks fail to participate actively in the stablecoin market, they risk losing competitiveness in the payments and settlement space.

REGULATORY ENVIRONMENT AND GLOBAL MARKET OPPORTUNITIES

The increasingly clear regulatory environment provides a solid compliance foundation for traditional financial institutions entering the stablecoin market. In July 2025, the U.S. passed the GENIUS Act, establishing the first federal regulatory framework for payment stablecoins, requiring issuers to hold 100% of reserves in liquid assets (such as USD or short-term Treasuries) and disclose reserve compositions regularly.

This act significantly reduces legal risks for banks entering the market. The EU’s Markets in Crypto-Assets Regulation (MiCA), which came into effect in mid-2024, also offers a clear compliance path for stablecoin issuance. Similarly, Hong Kong, Singapore, and the UK have introduced supportive policies. These regulatory frameworks not only boost market confidence but also provide traditional financial institutions with a “safe harbor” for market entry.

Meanwhile, stablecoins are playing an increasingly prominent role in global financial inclusion, especially in emerging markets. Companies like Yellow Card are using stablecoins to help African businesses conduct real-time cross-border payments, bypassing the delays and high fees of traditional banking systems.

Through stablecoin issuance, traditional financial institutions can serve over one billion people currently underserved by conventional banking, expand into new markets, and enhance customer stickiness. For instance, Ripple’s RLUSD stablecoin has chosen BNY Mellon as its reserve custodian, emphasizing its enterprise-grade security and compliance, attracting many institutional clients.

OPPORTUNITIES BROUGHT BY STABLECOINS: REDEFINING THE FINANCIAL ECOSYSTEM

The entry of traditional financial institutions into the stablecoin market is not only a response to market trends but also brings profound development opportunities. Firstly, stablecoins offer the potential to modernize payment systems. Through blockchain technology, stablecoins can replace traditional payment networks like SWIFT, Visa, and Mastercard, significantly reducing transaction costs and accelerating settlement speeds.

For example, Amazon and Walmart are considering adopting stablecoins to reduce credit card processing fees. Banks, in turn, can offer stablecoin payment solutions to attract more corporate clients.

Secondly, stablecoins breathe new life into the dominance of the U.S. dollar in global finance. According to ARK Invest, stablecoins indirectly fuel demand for U.S. short-term Treasuries through global users’ demand for USDT and USDC, effectively acting as a “Trojan horse” for the dollar.

By issuing USD-pegged stablecoins, traditional financial institutions can not only reinforce the dollar’s international status but also gain strategic advantages in the digital economy.

Additionally, the flexibility of stablecoins allows them to seamlessly integrate into financial services like asset tokenization, liquidity management, and trade finance.

CHALLENGES AND RISKS

Despite the vast opportunities, traditional financial institutions face multiple challenges when entering the stablecoin market. Firstly, regulatory compliance complexity and cost are major hurdles. While frameworks like the GENIUS Act and MiCA provide guidance, issuers must meet strict Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements and ensure transparency in reserve assets.

Chainalysis data shows that about 63% of illicit crypto transactions involve stablecoins, prompting stricter regulatory scrutiny and increasing banks’ compliance burdens.

Secondly, the rapid expansion of the stablecoin market may trigger financial stability risks. The U.S. Federal Reserve warns that a “run” on the stablecoin market—similar to the 2022 TerraUSD collapse—could force issuers to sell U.S. Treasuries rapidly, causing market volatility. TerraUSD’s crash once wiped out $45 billion in market value, highlighting the potential instability of stablecoins.

Moreover, technology risks must not be overlooked. The blockchain infrastructure on which stablecoins depend requires strong security and risk resilience, necessitating significant investments in tech upgrades and cybersecurity by traditional financial institutions.

Lastly, market competition and trust issues are also crucial. Tether was fined $41 million due to reserve transparency issues, underscoring the need for banks to build trust through rigorous audits and transparency. At the same time, they must compete fiercely with established stablecoin issuers.

〈Why Are Traditional Financial Institutions Accelerating Their Presence in the Stablecoin Market?〉這篇文章最早發佈於《CoinRank》。