Nearly one-third of South Korea's population is involved in cryptocurrency trading, with 16 million holders, already exceeding the number of stock investors in the country.

Written by: Thejaswini M A

Translated by: Saoirse, Foresight News

On that bizarre night in December 2024, former President Yun Suk-yeol announced the implementation of military control, deployed troops to the National Assembly, and even attempted to take military action against North Korea. He probably never imagined that this political suicide-like farce would give rise to one of the world's most radical cryptocurrency policy agendas.

[The rest of the translation continues in the same professional manner, maintaining the original meaning and tone while translating into English. All specific terms like Foresight News, Block, Circle, Tether, USDT, TRON, ETH, HT, USDC, RON, and ONG are kept as they are.]Institutional Transformation

In 2017, due to concerns about speculation and money laundering, South Korea implemented restrictive measures, prohibiting companies, institutions, and financial firms from opening cryptocurrency exchange accounts. Only individuals could use verified real-name accounts for cryptocurrency trading. Institutional and corporate accounts were banned, and banks faced strict compliance obligations. The current government has initiated a phased process to lift these restrictions.

In the initial phase (mid-2025), non-profit organizations and some public institutions are now permitted to convert cryptocurrencies obtained through donations or seizures into cash, provided they meet strict compliance requirements, such as using verified Korean won real-name exchange accounts and establishing internal audit committees.

By the end of 2025, the government will extend cryptocurrency exchange account eligibility to approximately 3,500 listed companies and professional institutional investors through pilot projects. These accounts must be real-name verified and comply with strict anti-money laundering (AML) and KYC protocols. Financial authorities have announced that listed companies will ultimately be authorized to directly participate in cryptocurrency trading, which will drive large-scale adoption at the corporate level.

Major domestic exchanges have launched or upgraded "institutional-grade" products, custody solutions, and support services to address potential growing demand from large enterprises and professional investors.

Currently, traditional financial institutions such as banks, asset management companies, and brokers remain excluded from direct cryptocurrency trading. This setup ensures that the first wave of institutional cryptocurrency activity in South Korea will be led by non-financial enterprises, potentially giving them a competitive advantage when regulatory doors open further.

Political Recognition

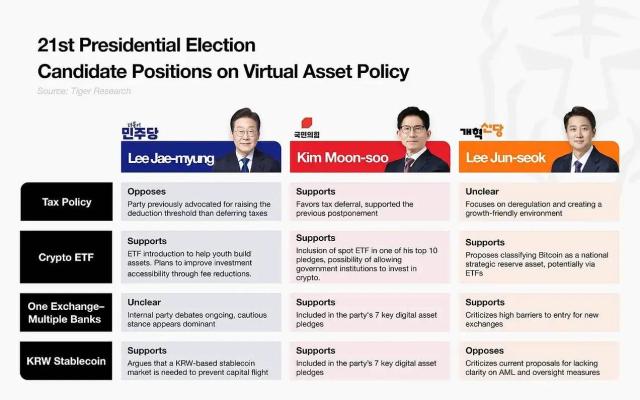

Lee Jae-myung's cryptocurrency agenda has received broad political support, not limited to his Democratic Party. In recent campaign activities, both major parties promised to legalize cryptocurrency ETFs, a rare bipartisan consensus moment in South Korean politics. The Financial Services Commission, previously opposed to discussing cryptocurrency ETFs, has now submitted a roadmap planning to approve spot Bitcoin and Ethereum ETFs by the end of 2025.

This political shift reflects cryptocurrency's emergence as a significant voter issue. Over 16 million cryptocurrency holders in South Korea represent approximately one-third of the total population, transforming digital asset policy from a niche technical policy to a mainstream political topic.

The government has also taken broader measures to support cryptocurrency enterprises. The Ministry of SMEs and Startups announced plans to remove restrictions, no longer preventing cryptocurrency companies from obtaining venture enterprise status, enabling them to enjoy significant tax benefits, including a 50% corporate income tax reduction for five years and a 75% real estate purchase tax reduction.

South Korean investors have responded enthusiastically to these policy developments. Stablecoin trademark applications triggered significant bank stock increases. Kakao Bank's stock rose 19.3% the day after submitting a cryptocurrency-related trademark application, while KB Financial Group's stock increased 13.38% after a similar application.

More notably, in June 2025, South Korean retail investors invested nearly $450 million in Circle Group's stock, making it the most sought-after overseas stock that month. Since listing in June, Circle's stock has risen over 500%, as Korean investors view it as a bellwether for global stablecoin applications.

This investment pattern reflects investors' profound understanding of how South Korea's stablecoin policy might drive global stablecoin infrastructure demand. Korean investors are positioning themselves for South Korea's potential influence on the global digital asset market.

Lee Jae-myung's cryptocurrency strategy faces significant external pressure. US President Donald Trump threatened to impose reciprocal tariffs up to 50%, which could severely impact South Korea's export-dependent economy. With exports comprising 40% of GDP, trade disruption could trigger an economic recession, during which cryptocurrency investment funds would be constrained regardless of regulatory sophistication.

Temporal urgency has created a race between policy implementation and economic deterioration. South Korean authorities are rushing to establish cryptocurrency infrastructure to prevent potential trade conflicts from making the economic environment too challenging and hindering new investment initiatives.

Domestically, the central bank's opposition to private stablecoins might generate ongoing regulatory tension. South Korean bank officials prefer placing stablecoin issuance under banking sector supervision rather than allowing tech companies to enter monetary infrastructure domains.

Tax policy remains undetermined. The planned 20% capital gains tax on cryptocurrency earnings exceeding 2.5 million Korean won annually has been repeatedly postponed but remains intended for implementation. How this tax interacts with new corporate cryptocurrency access rules will influence institutional application patterns.

South Korea's cryptocurrency policy's global impact is being closely monitored by the international community, potentially serving as a template for other countries facing similar economic pressures and technological application models. The combination of regulatory clarity, institutional access, and domestic stablecoin infrastructure constitutes a comprehensive digital asset integration approach.

If successful, the South Korean model might influence policy-making in other Asian economies and provide a template for nations seeking to embrace digital asset innovation while maintaining monetary sovereignty.