In the past two days, the biggest event was the token presale of the meme launch platform Pump.fun.

After long anticipation, PUMP launched its presale on July 12th, selling out a total of $500 million worth of shares in just 12 minutes. This can't help but make people realize that the market isn't lacking money, but rather the money in the market tends to wait and strike for major projects.

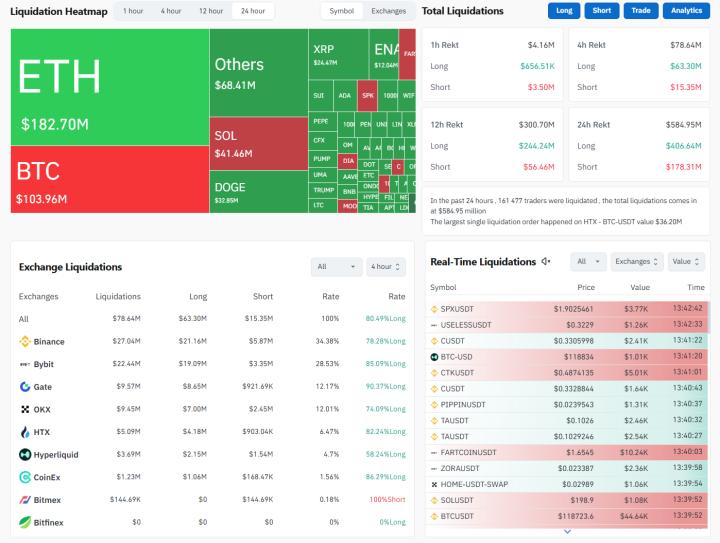

As Bitcoin breaks through to a new high, the PUMP presale seems to be positioned at a subtle moment when market sentiment shifts from bearish to bullish, with more people starting to FOMO, and whales continuously opening long positions on Hyperliquid.

In contrast, another group of people missed out on obtaining PUMP through CEX.

Pump.fun's official website data shows that several CEXes that previously announced presale cooperation have 0% share in the successful PUMP presale channels; while other CEXes with data like Kraken, Kucoin, and Gate account for only around 10% of the total PUMP presale.

If you also tried to participate in the PUMP presale through CEX, you probably came up empty-handed.

But don't be upset just yet, here are more data points that might balance your emotions, pointing to a clearer conclusion --- the PUMP presale might be a carnival for a few.

Kraken, a Carnival for Two

In the pre-arranged plan, Pump.fun's presale collaborated with 6 CEXes; regardless of the specific process and reasons, from the result, three of them have zero presale data, which draws attention to the other three CEXes.

Kraken is the CEX with the most shares, generating a total of $30 million in new token allocation.

You might think many users obtained PUMP through Kraken, but the actual situation is --- only 2 people got the allocation.

According to Twitter user @splinter0n's monitoring of presale interface data, the "number of participants" column for Kraken during the presale was 2, meaning only 2 people participated in the new token allocation (2 independent addresses), and they collectively obtained a $30 million allocation.

In the comments of the post, everyone was discussing who these two people were, but overall social media tends to believe these were strategic moves by powerful whales, and ordinary investors couldn't obtain such a large amount, and couldn't participate when CEXes collectively had issues.

Additionally, the blogger showed more data, indicating that only 15 people participated through Gate, totaling a $5 million allocation; Kucoin had 120 participants, totaling nearly $16.5 million in allocation.

In other words, the total number of participants across these three exchanges that could obtain PUMP shares was less than 140 people; considering that one person might have multiple addresses, this number is likely even smaller.

It's worth noting that regarding the authenticity and credibility of the data, the total number of presale participants and total amount in the blogger's monitored data are almost identical to the data shown by Pump.fun's official website.

So for the number of people participating in PUMP allocation through these CEXes, although the official hasn't explained, we have reason to believe this is close to the real situation.

Anyway, obtaining PUMP through CEX allocation belongs to a minority, with most experiencing disappointment.

Most People Only Bought $500 Worth

If users who tried to participate through CEX failed due to process issues, did retail investors who went directly to the official website make a fortune?

Let's speak with data.

The overseas media and data analysis platform Blockworks recently launched a data panel that can clearly show various data from this PUMP presale.

First, a total of 10,000 unique addresses participated in the purchase, with the most concentrated purchase amount between $100-1000, and the median purchase at around $540.

Note this is the median, not the average, which statistically excludes the situation where the average is pulled up by a few super whales' purchases.

This means most addresses only participated with $500; and on Twitter's timeline, you might find numerous posts complaining about not being able to buy or FOMO, seemingly as if they missed out on purchases of hundreds of thousands of dollars.

There's often a huge gap between real data and social media sentiment. Emotions can be amplified, but the money in wallets remains the same.

Looking at large holders, 202 wallets purchased over $1 million, and 138 wallets purchased over $500,000.

Additionally, some interesting data is worth noting.

Among all presale wallets, nearly 45% were newly created addresses less than 24 hours old.

If there's a purchase limit per wallet, large holders and institutions can create new wallets in batches to bypass restrictions and maximize their purchase amount.

In contrast, wallets existing for over a year and participating in the presale account for less than 5%. This also supports a community discussion point --- the presale favors large holders, and old investors might become "exit liquidity".

Finally, if examining the funding sources for those who directly participated in the Pump official website presale, you'll find that besides self-created independent addresses, most off-chain funds actually came from Bianance withdrawals, even exceeding the total number of withdrawal addresses from all other CEXes.

On-chain, Solana ecosystem's DeFi projects like Raydium, SolFi, and Jupiter contributed a large portion of funding sources. Looking at them together, the proportion of funds from independent addresses and DEXes among the 10,000+ addresses already exceeds 60%, with CEX accounting for less than 30%.

This again emphasizes the importance of channels.

For most crypto projects, the shorter the participation path, the better; people tend to prefer convenience, and if they have to withdraw from CEX to their own address to participate in the presale, their willingness to participate will naturally decrease.

So now we see each CEX embedding on-chain new token allocation and creating their own on-chain wallets in their APP entrances, which is understandable.

Marginal Players

Looking at these PUMP presale data together, the seemingly open decentralized presale increasingly shows a centralized tendency at the data level.

Low-cost new wallet creation, pre-market long and short trading on Hyperliquid, CEXes' final participation channels having issues... All these make the PUMP presale look more like an elite game and arrangement, rather than a community-driven opportunity.

This is also not the first time we've seen FOMO and criticism emotions around a token being amplified on social media. Investors always chase the phantom of the "next 100x coin", but often find themselves marginal participants when facing the data.

And as we continue to observe in this "disappointment", the market will increasingly rely on fund flows from a few.

Standing at this Bitcoin all-time high point, marginal players still feel the chill of being at the top.

Click to learn about BlockBeats job openings

Welcome to join BlockBeats official community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Communication Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia