Written by: The Kobeissi Letter (@KobeissiLetter)

Translated by: Ethan (@ethanzhang_web3)

Editor's Note: This is not another bull market replay, but a Bitcoin "crisis market" emerging amidst fiscal flood, dollar depreciation, and financial order restructuring. When gold and BTC surge simultaneously, Wall Street ETF funds rush in, and even "conservative" funds no longer hesitate, we must admit: the market is entering an unprecedented new cycle. Why is Bitcoin becoming the winner under "non-conventional" macroeconomic backgrounds? Is this wave of growth a bubble, a hedge, or a repricing of power? Odaily will help you see the direction capital is truly betting on.

Original Text Below

The current market is far from "normal". Bitcoin's rise is crazy, currently soaring along a steep linear trajectory. Interest rates continue to climb, the dollar has depreciated 11% in six months, and the total crypto market value has surged by one trillion dollars in just three months.

What exactly is happening? The answer is clear: Bitcoin has entered "crisis mode".

Bitcoin's momentum is now so fierce that it can refresh its all-time high (ATH) multiple times in a single day. Since the US House of Representatives passed the "Big and Beautiful Act" on July 3rd, Bitcoin's price has surged by $15,000. If gold fails to raise an alarm, Bitcoin's wild rise should be enough to sound the warning.

Are there more obvious signals? Look at the trend comparison between Bitcoin and the US Dollar Index ($DXY) from the beginning of the year, with two clear divergence points:

April 9th (after the 90-day tariff suspension period ended)

July 1st (when the "Big and Beautiful Act" was passed)

Everything is self-evident.

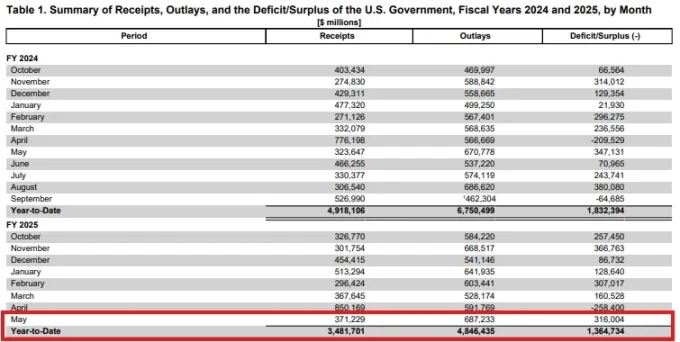

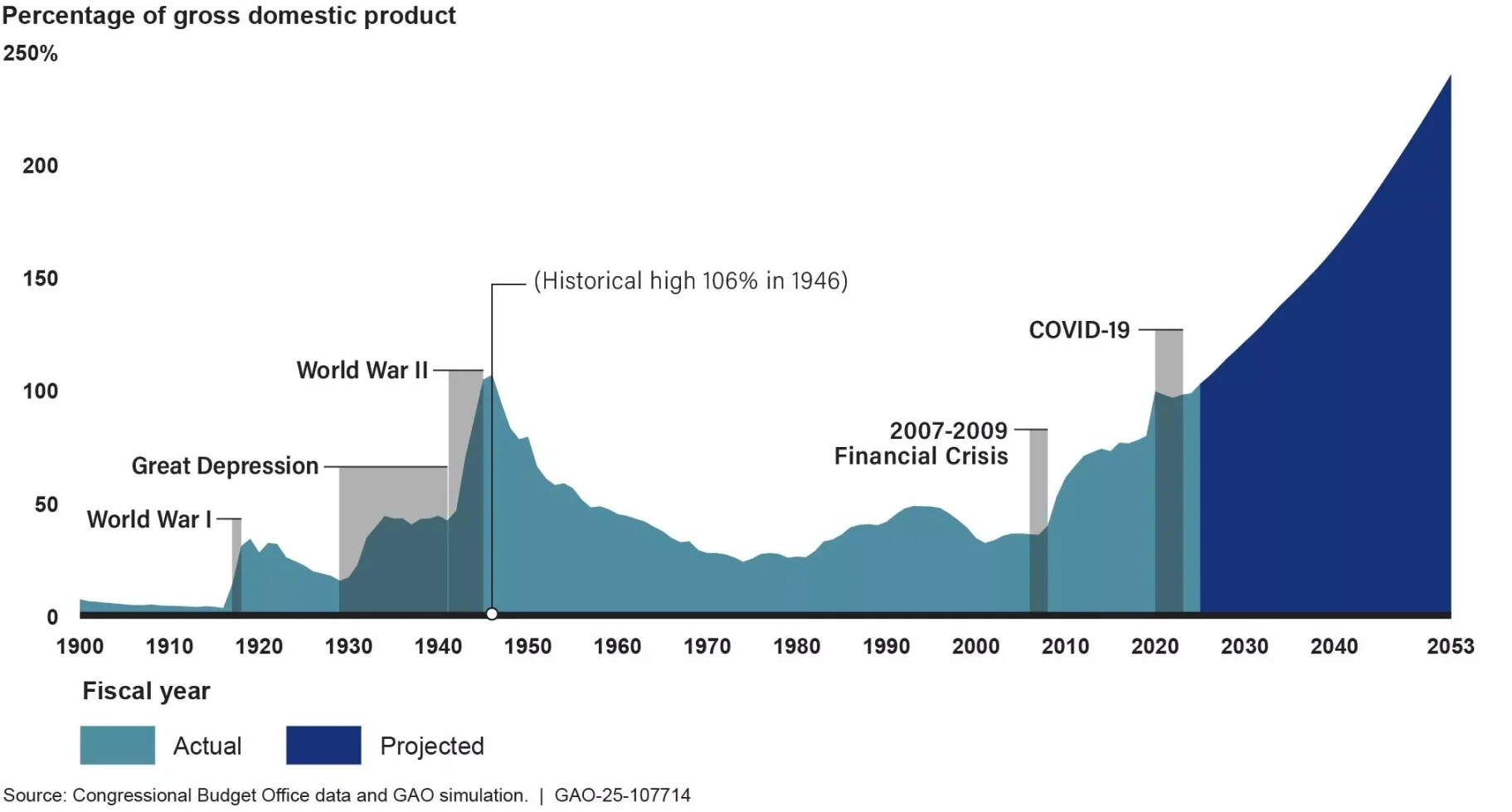

Entering July, market data shows that the US recorded a fiscal deficit of $316 billion in May 2025 alone. This is the third-highest monthly deficit level in history. Initially, the market held expectations due to Musk's opposition to the spending bill.

However, this hope quickly faded in early July.

At the time, Bitcoin's rise seemed to benefit from market expectations of a trade agreement. But it proved that regardless of whether the trade agreement was announced, the market results were surprisingly consistent: bond yields rose, Bitcoin surged, the dollar fell, and gold increased.

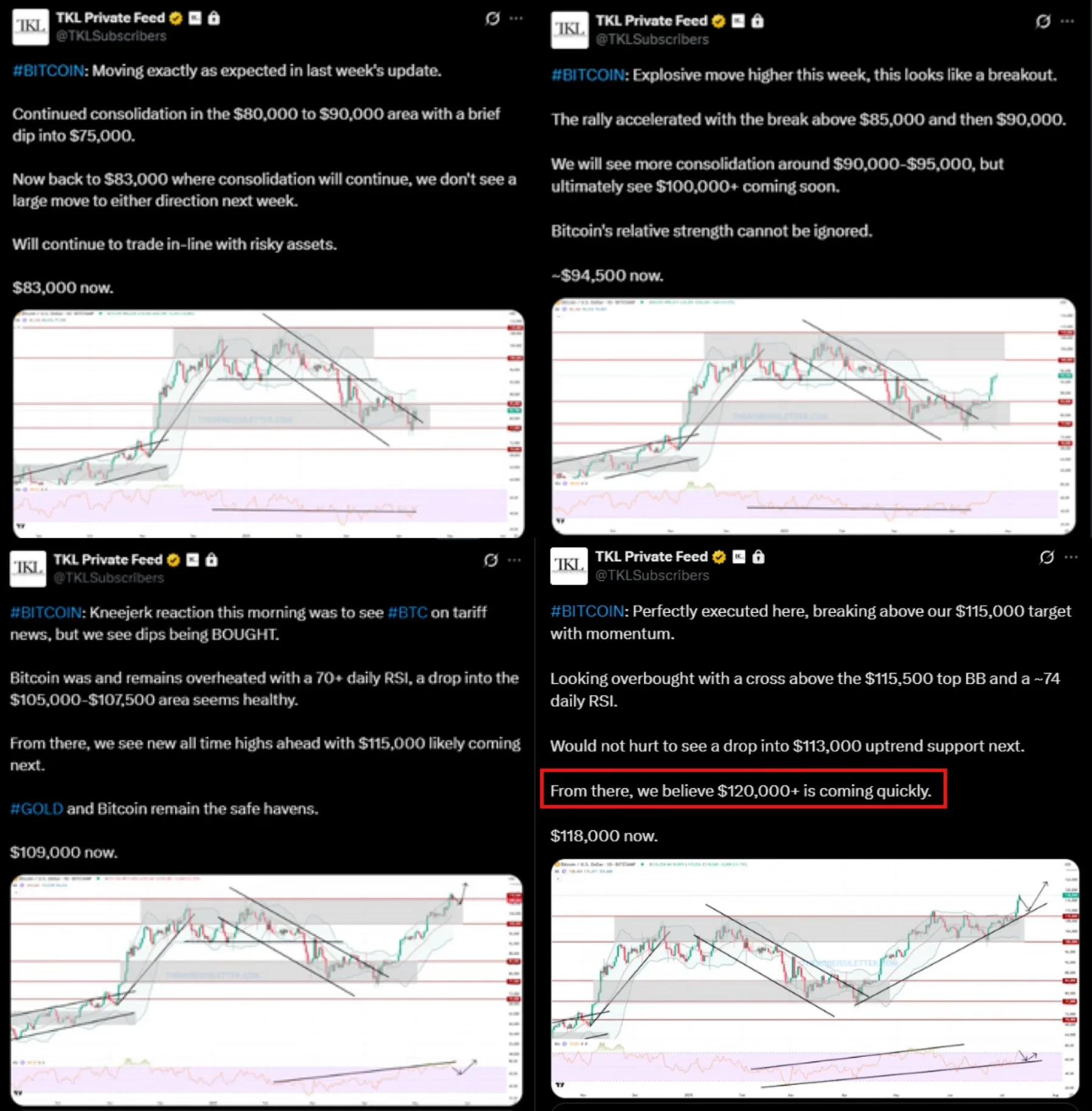

This is far from a "normal" market condition. We had predicted and captured this trend in advance: we decisively bought during pullbacks at $80,000, $90,000, and $100,000, and precisely predicted a target price of $115,000.

Last Friday, we further raised our target to above $120,000 - a price level just reached.

This is undoubtedly a double boost for gold and Bitcoin.

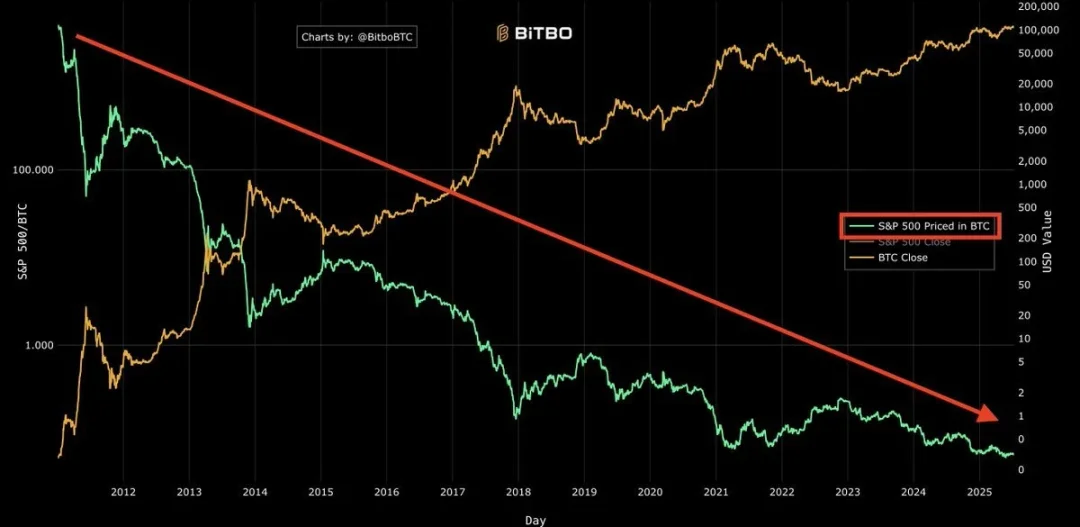

Year-to-date, the S&P 500 has dropped 15% when priced in Bitcoin. Looking back to 2012, the S&P 500 priced in Bitcoin has plummeted by a shocking 99.98%. The current situation is: Bitcoin's value is soaring, while the dollar's value is shrinking.

Again, closely monitor the US fiscal deficit.

More importantly, institutional funds seem to be rushing in, chasing this Bitcoin market.

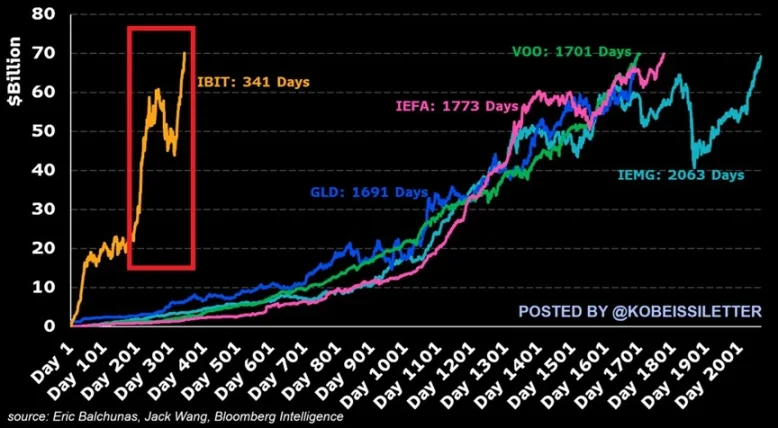

The AUM of Bitcoin ETF IBIT has rapidly climbed to a record $76 billion in less than 350 days. In comparison, the world's largest gold ETF, GLD, took over 15 years to reach the same scale.

In our in-depth discussions with institutional investors, we noticed a recurring consensus: broadly speaking, family offices, hedge funds, and other institutional capitals can no longer ignore Bitcoin. Even "conservative" funds are considering allocating about 1% of their AUM to Bitcoin.

It should be noted that when we say Bitcoin has entered "crisis mode", we are not bearish on other assets. In fact, the short-term "stimulus" effect of more deficit spending is "bullish", and risk assets may continue to rise in the short term.

Of course, its long-term negative impacts cannot be ignored.

Ironically, solving the deficit problem would resolve multiple US challenges. It could lower interest rates, suppress inflation, and boost the dollar. But Bitcoin "knows well" that this is almost impossible - just look at how its momentum accelerated after the spending bill passed.

Changes in the economic landscape are precisely where investors' opportunities lie. As the market gradually digests this ongoing deficit spending crisis, capital is undergoing large-scale rotation, and asset prices are consequently experiencing violent fluctuations.

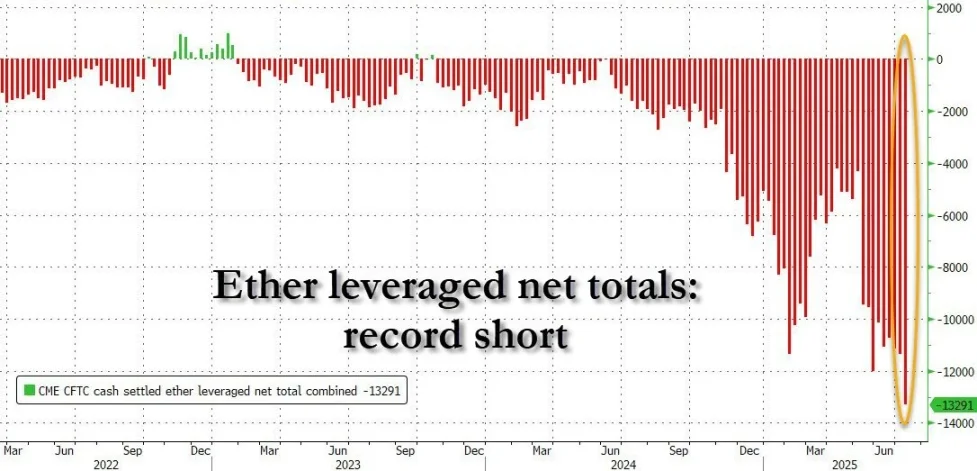

Lastly, interestingly, according to ZeroHedge, ETH's leveraged short positions are currently at a historical high. This is similar to what we observed before the market bottomed in April 2025.

Is a large-scale crypto market short squeeze about to unfold? Things may be brewing...