1. Introduction

On July 14, the price of Bitcoin exceeded $120,000, setting a new record high. At the same time, Altcoin also ushered in a long-awaited general rise. This market change quickly triggered investors to discuss the "Altcoin season" in the market. With the expectation of the Federal Reserve's interest rate cuts rising, macroeconomic policies turning to easing, and institutional capital continuing to flow into Bitcoin and Ethereum, the market's risk appetite has increased significantly. However, the BTC dominance rate is still high, the ETH/BTC ratio has not broken through the key resistance, and the flow of funds has shown selective diffusion characteristics. Is the current rise in Altcoin a real signal of the start of the real "Altcoin season" or a short-term agitation driven by funds?

This article will conduct a comprehensive and in-depth analysis from multiple dimensions, including macro background and institutional capital layout, capital flow and index analysis, on-chain activity and ecological recovery, market sentiment and changes in popularity. Through rigorous data interpretation, it will help investors sort out the current complex market situation, and take stock and analyze popular and potential tracks. It is hoped that it will help investors understand the essence and seize opportunities and risks in a chaotic and complex market environment.

2. Macro-level analysis

1. The macro environment tends to be loose

The global macro environment continues to lean toward easing in the near future, with positive factors continuing. First, the Fed's monetary policy has turned moderate: the minutes of the meeting released in July showed that the hawkish and dovish differences within the Fed have intensified. Waller proposed a rate cut in July, and Bowman supported an early rate cut, but most officials still prefer to wait and see. Federal funds rate futures show that the probability of a rate cut in September is about 65%, a significant increase from previous expectations, and the Fed's own economic forecasts also rarely show a hawkish and dovish confrontation: 12 officials support a cumulative rate cut of 50 basis points in 2025, and 7 support 100 basis points. On the one hand, the loose funding environment has pushed up the valuation of Bitcoin and crypto assets; on the other hand, the high interest rates have not been reduced, which has also made the market more sensitive to the timing of rate cuts. Once the central bank announces a dovish signal, the upward momentum of Bitcoin may be sharply amplified.

The recent easing of global trade frictions has also provided a more friendly macroeconomic background for the crypto market. In addition, geopolitical risks have eased, and the market's sensitivity to geopolitical risks is declining. The US regulatory level has also recently released support signals: the replacement of the head of the SEC, the advancement of the stablecoin bill (GENIUS Act), the establishment of a strategic reserve of Bitcoin, and the White House's release of a digital asset policy blueprint have all reduced regulatory uncertainty and boosted investor confidence.

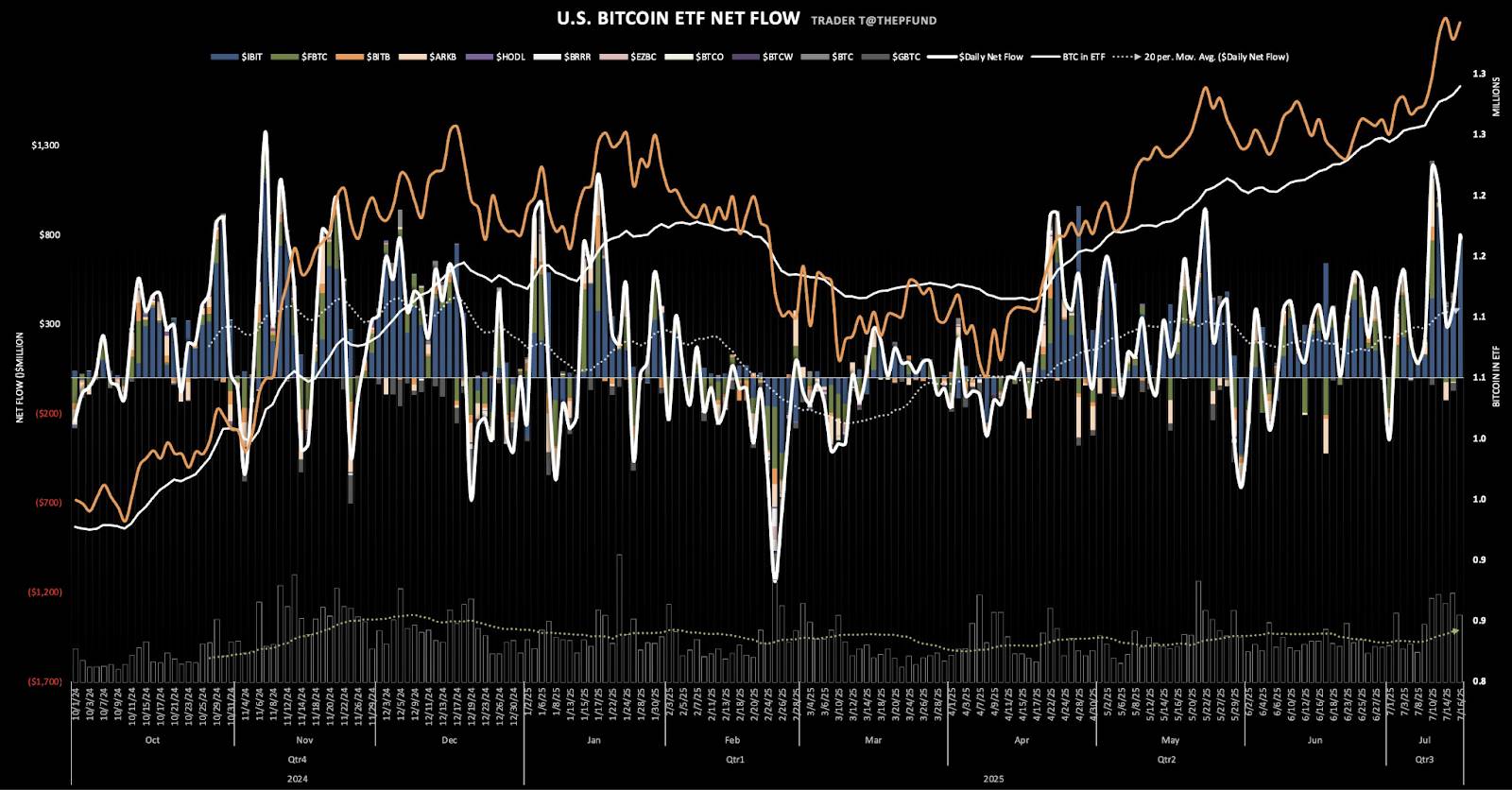

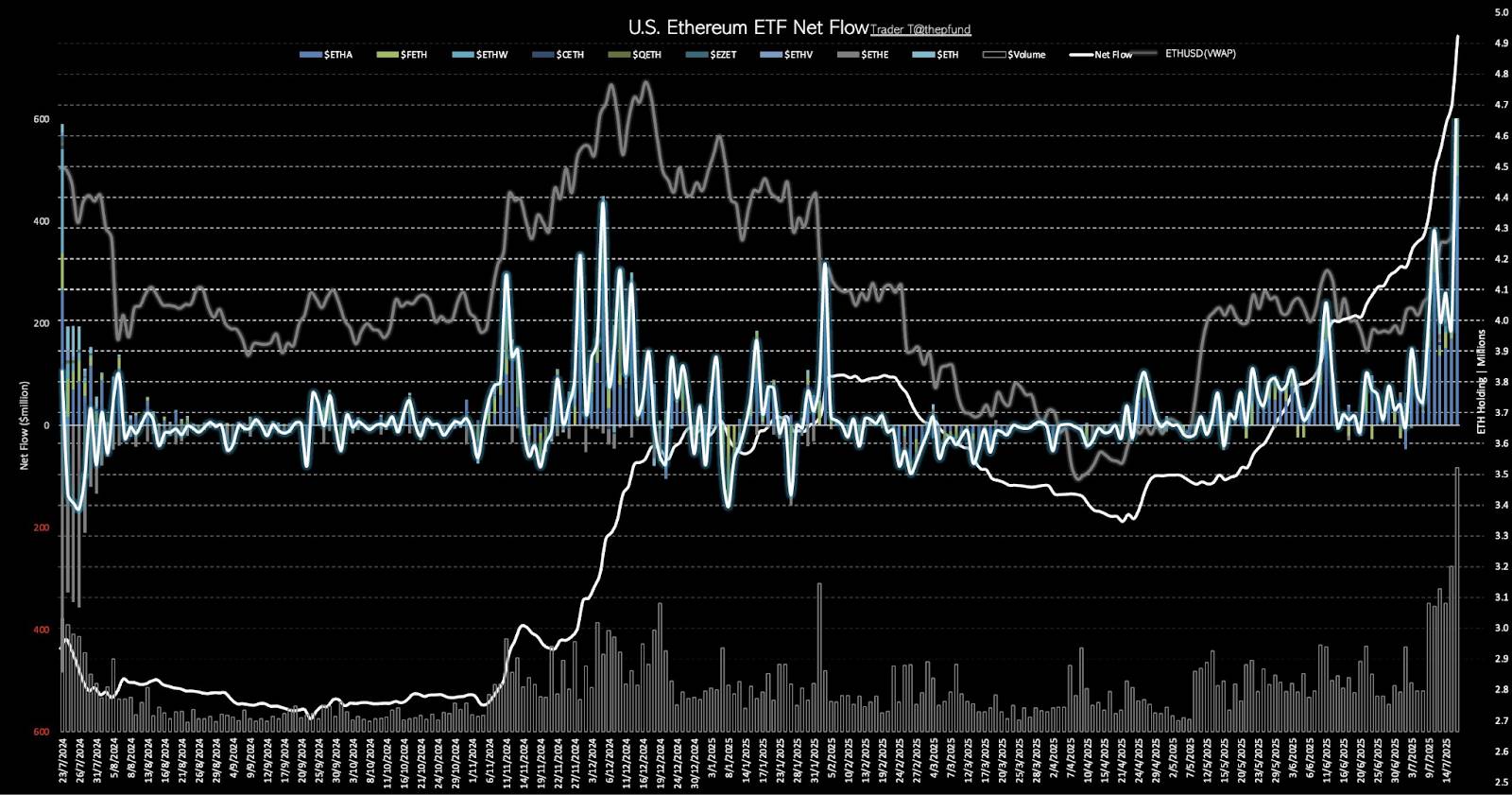

2. Institutional capital continues to flow in

The continued influx of institutional capital is an important driving force for the market's prosperity. Overall, institutional investment is gradually expanding from focusing on Bitcoin and Ethereum to other public chain asset areas. On July 16, Bitcoin spot ETF had a net inflow of US$799.5 million, with an asset size of US$148.84 billion, marking the 10th consecutive day of net inflow; Ethereum spot ETF had a net inflow of US$716.63 million, with an asset size of US$13.25 billion, marking the 9th consecutive day of net inflow. Although the increase in Ethereum spot prices has lagged behind Bitcoin since 2025, institutional funds have accelerated their entry through ETFs. As ETH returns to above $3,000, the water storage effect of ETFs has become more obvious, which in turn has boosted the market popularity of Ethereum and Altcoin.

Source: https://x.com/thepfund

In addition to BTC and ETH, institutional funds are also gradually laying out the public chain track other than Ethereum. Currently, VanEck, Bitwise and other companies have submitted applications for Solana spot ETF to the SEC. Grayscale, the largest crypto asset management company, has established a trust product that includes a basket of Altcoin. On July 15, the US asset management company ProShares launched the 2x long Solana futures ETF (code: SLON) and the 2x long XRP futures ETF (UXRP), and officially listed them on NYSE Arca. This reflects that mainstream altcoin assets are gaining more attention and allocation from mainstream investors.

Some listed companies have begun to include crypto assets other than Bitcoin in their balance sheets. On July 15, SharpLink Gaming (NASDAQ: SBET) held 296,508 Ethereum, worth approximately $997 million, surpassing the Ethereum Foundation to become the company with the most ETH in the world, known as the "MicroStrategy of Ethereum". The number of institutions holding more than 100,000 ETH has increased to 7, namely: SharpLink Gaming (280,600), Ethereum Foundation (241,500), PulseChain Sac (166,300), Bitmine Immersion (163,100), Coinbase (137,300), Golem Foundation (101,200), and Bit Digital (100,600).

In addition, the "SOL version of MicroStrategy" DeFi Development Corp already holds 640,585 SOL and its equivalent assets, with a total value of US$98.1 million. On July 17, SRM Entertainment officially changed its name to Tron Inc, changing its stock code from "SRM" to "TRON". Tron previously announced that it would go public through a reverse merger with it and launch a TRX strategic reserve. SRM has pledged all of its TRX to obtain staking income.

3. Fund Flow and Index Analysis

1. Bitcoin Dominance Rate

BTC Dominance is an indicator that measures the proportion of Bitcoin's market value to the entire crypto market. The peak and decline of Bitcoin's share is one of the typical signals that the "altcoin season" has begun. On July 14, the price of Bitcoin broke through a new high of $120,000, but Bitcoin's dominance (BTC Dominance) showed a downward trend and is currently 62.88%, but it is still at a historically high level. The continued high level of Bitcoin's dominance means that Bitcoin has absorbed a large amount of new funds, and Altcoin have not yet been fully sought after. Only when the ratio drops significantly and funds shift from Bitcoin to smaller-cap assets, there may be clear signs of an Altcoin season.

Source: https://www.tradingview.com/symbols/BTC.D

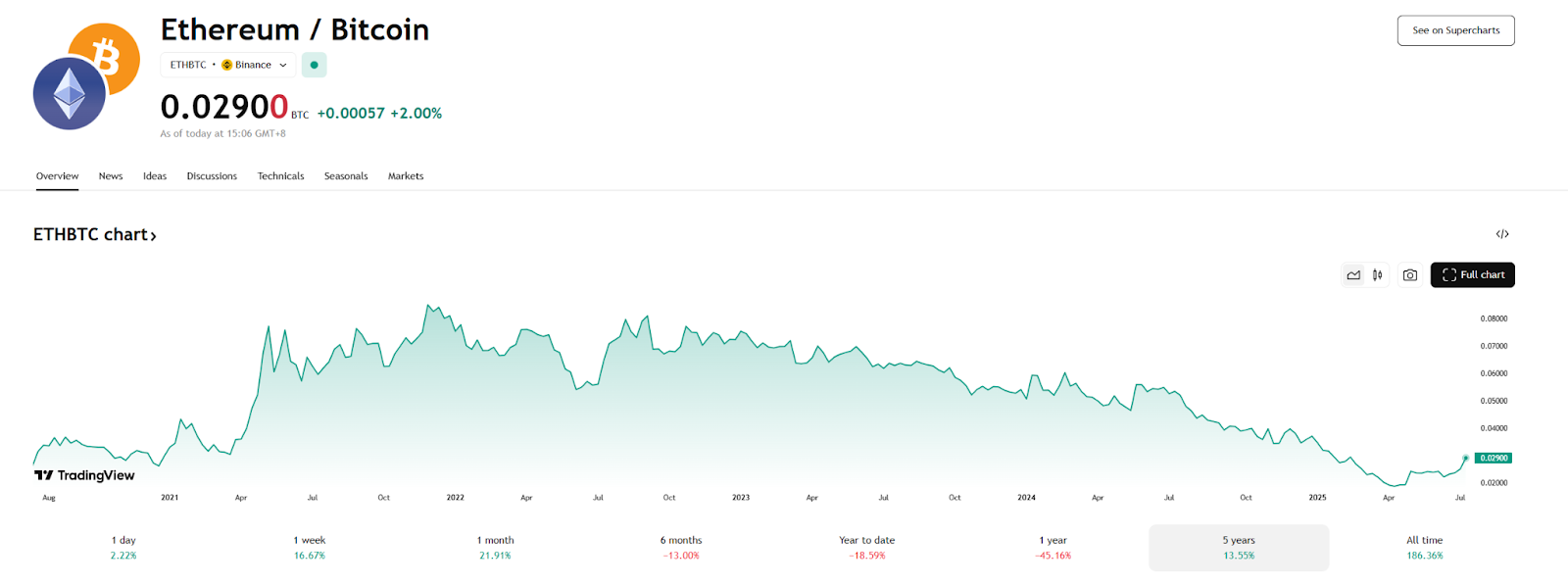

2.ETH/BTC ratio

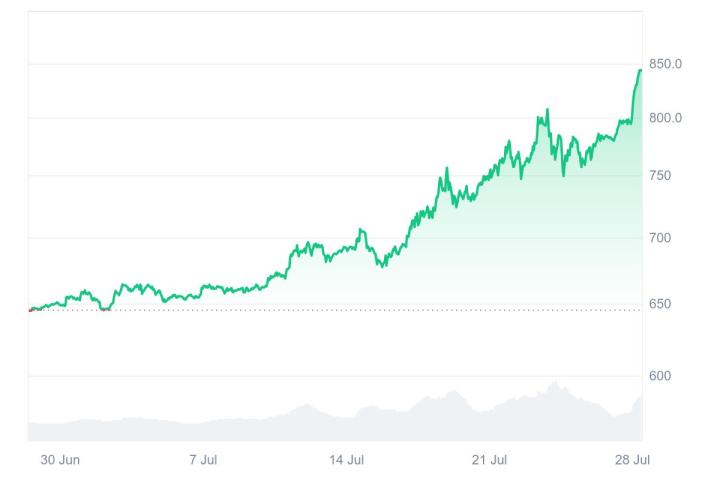

The ETH/BTC ratio reflects Ethereum's relative performance to Bitcoin and is considered a leading indicator of Altcoin capital flows. An increase in the ETH/BTC ratio often indicates that Altcoin capital inflows may be opening up. If this ratio continues to rise, it indicates that more funds are flowing from Bitcoin to Ethereum and other Altcoin, which will provide strong support for the altcoin bull market. The current ETH/BTC ratio is on an upward trend, indicating that Ethereum capital inflows are accelerating. The current ETH/BTC ratio has rebounded from the low of 0.017 in Q1 to 0.029. On the technical side, some analysts pointed out that if the ETH/BTC ratio can effectively break through 0.03, it means that the market risk preference will switch from Bitcoin to Ethereum and altcoins, or trigger a new round of altcoin market, fully awakening the activity of the Altcoin market.

Source: https://www.tradingview.com/symbols/ETHBTC/

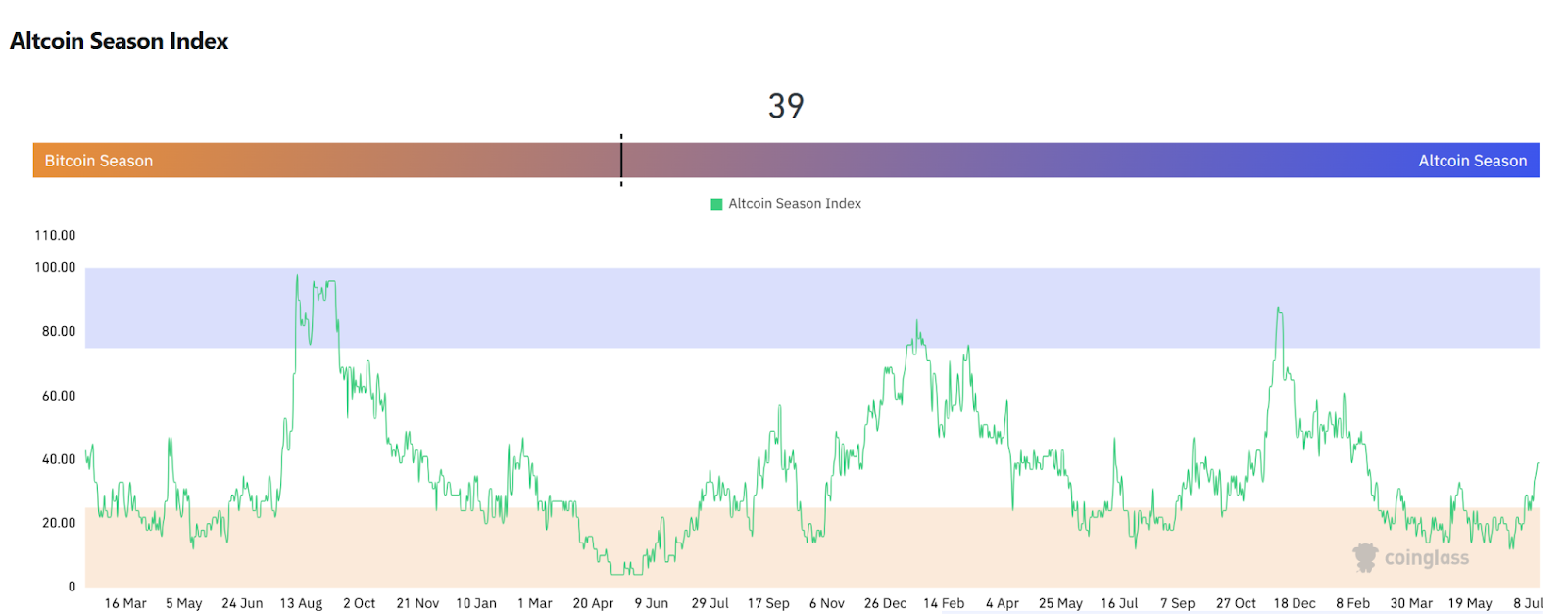

3. Altcoin Quarterly Index

The Altcoin Season Index is used to measure whether non-Bitcoin assets (Altcoin) have outperformed Bitcoin as a whole over the past 90 days. According to CoinMarketCap's algorithm, when at least 75% of the top 100 cryptocurrencies (excluding stablecoins) outperform Bitcoin, it is considered an Altcoin season; and if only 25% or less of Altcoin outperform Bitcoin, it is a Bitcoin season. The Altcoin Season Index has recently reheated: it fell back to around 15 in mid-June, but began to rebound rapidly in July and has risen to 39 this week. The index is calculated based on the number of Altcoin that have outperformed Bitcoin in the past 90 days. Currently, nearly 40% of mainstream coins have outperformed BTC, which shows that Altcoin are becoming more active in the current market.

Source: https://www.coinglass.com/pro/i/alt-coin-season

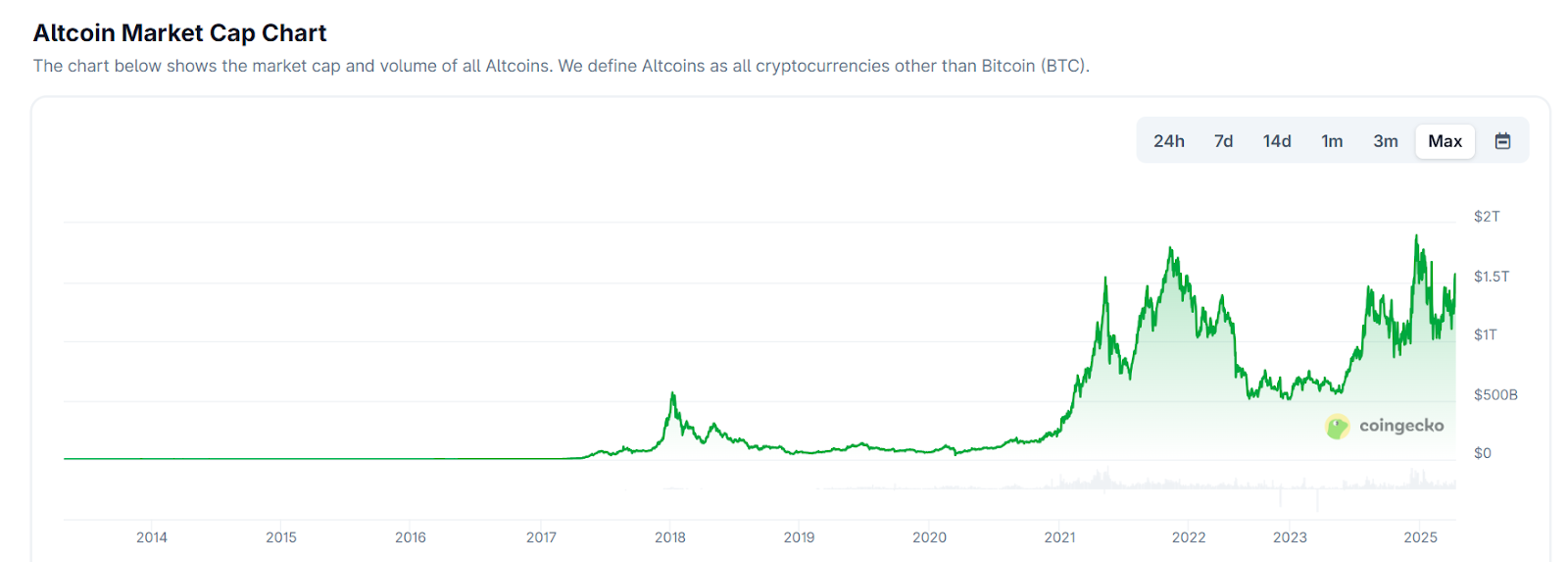

4. Altcoin market share and trading volume

According to Coingecko data, the current 24-hour trading volume of the overall crypto market is about 243.7 billion US dollars, of which Bitcoin trading volume accounts for about 21%, Ethereum trading volume accounts for about 17.5%, and other tokens account for about 61.5%, and the trading volume ratio has risen sharply. This is mainly because with the sharp rebound of Ethereum, the mainstream Altcoin are already at a low level after a continuous decline, coupled with the rise in narratives, so the market has shown signs of "buy the dips fishing". It should be noted that although the relative trading volume of Altcoin has increased, it is not a general increase, but a selective rotation of funds among hot topics. The current capital flow shows the characteristics of "actively looking for the next theme and blue chip" rather than "fully embracing all Altcoin".

Source: https://www.coingecko.com/en/global-charts

IV. On-chain activity and ecological recovery

1. On-chain activity

On-chain activity indicators (such as the number of daily active addresses and the number of daily transactions) reflect network usage and user engagement. Data shows that on-chain activity has rebounded significantly recently. Ethereum regained the top spot in gas fee revenue in June, and Solana continued to lead the activity list, with more than 29.7 billion transactions in the past June (about 4.8 million daily active addresses), far exceeding Ethereum and Bitcoin.

As of July 17, 2025, the number of daily active ERC-20 addresses on Ethereum is about 510,000, an increase of about 50.8% over the same period last year. This substantial increase reflects that more users and applications are using the Ethereum network. On the other hand, the DApp ecosystem is also active, with the average daily active wallet number (dUAW) rising to 25 million, an increase of 8% month-on-month. DeFi TVL and NFT trading volumes soared by 25% and 40% respectively, further indicating that the overall activity of users on the chain has increased. These data mean that the entire on-chain ecosystem is heating up, whether in terms of capital or user participation, providing a basic environment for the rotation of the Altcoin market.

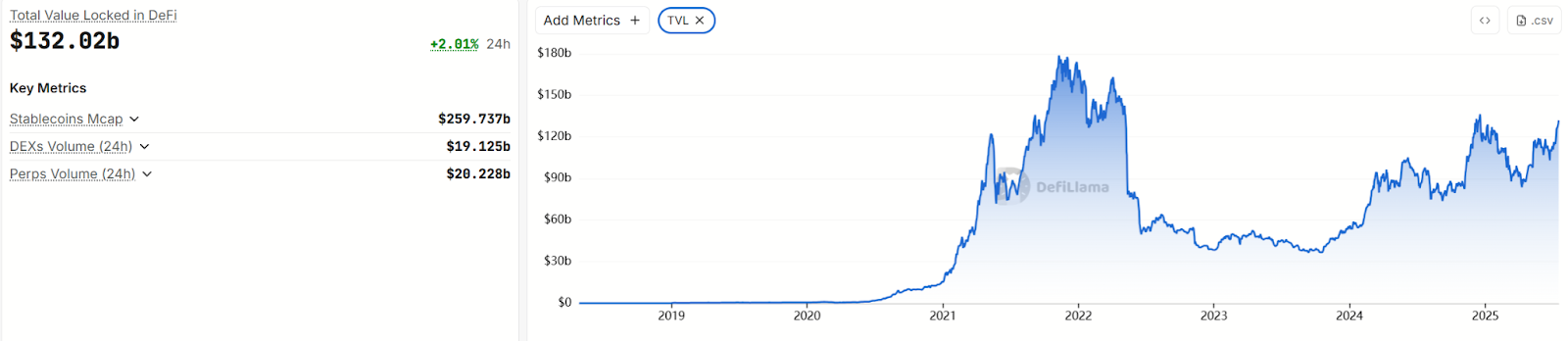

2. DeFi’s locked assets TVL

DeFi's asset lock-up TVL rebounded. Ethereum's 40% surge led to a surge in TVL for many protocols. The TVL of leading protocols such as Aave increased by about 20% month-on-month. Although Lido, EigenLayer, etc. fluctuated, the overall lock-up was still huge. In terms of Layer-2, Base rose rapidly, with a total of 292 million transactions in June and an average of 1.71 million daily active addresses. Arbitrum (ARB) and Optimism (OP), as leaders of Ethereum Layer-2, also continued the recent narrative heat. Although ARB has not yet approached its high last year, it has received financial support in re-empowering DeFi applications. Chainlink (LINK) has a dominant position in the data market thanks to the recovery in oracle demand. Aptos (APT) has seen a significant increase in community activities and its price has risen to about $5.9, indicating that the DeFi ecosystem is regaining vitality and attracting funds to re-enter.

As of July 17, the total locked value (TVL) of the DeFi market increased from US$89 billion at the beginning of the year to approximately US$132 billion in June, with innovative projects and new financial protocols in particular gaining favor with capital.

Source: https://www.coingecko.com/en/global-charts

5. Market sentiment and heat index

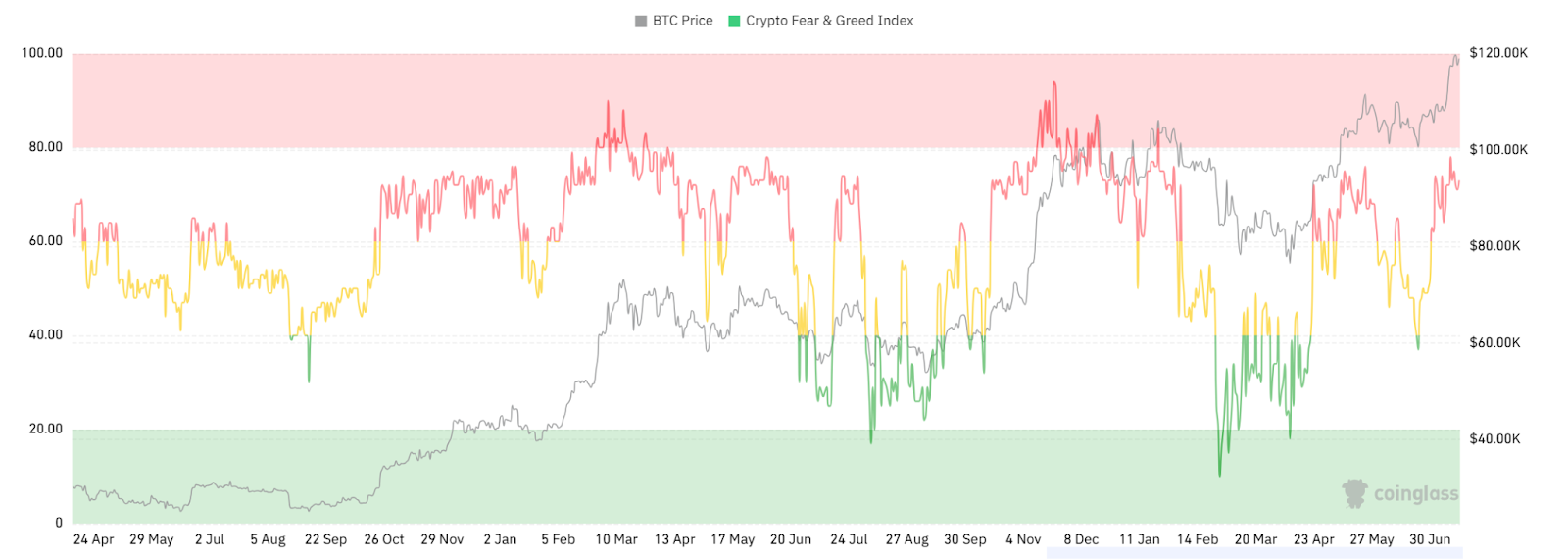

Market sentiment often indicates the rotation of funds in and out. The Fear & Greed Index is a common indicator to measure the overall market sentiment. As of mid-July, market sentiment was clearly optimistic and investors' FOMO sentiment was accumulating. Since July, the Crypto Fear & Greed Index has continued to rise, climbing to the "greed" level of more than 70 points.

Source: https://www.coinglass.com/pro/i/FearGreedIndex

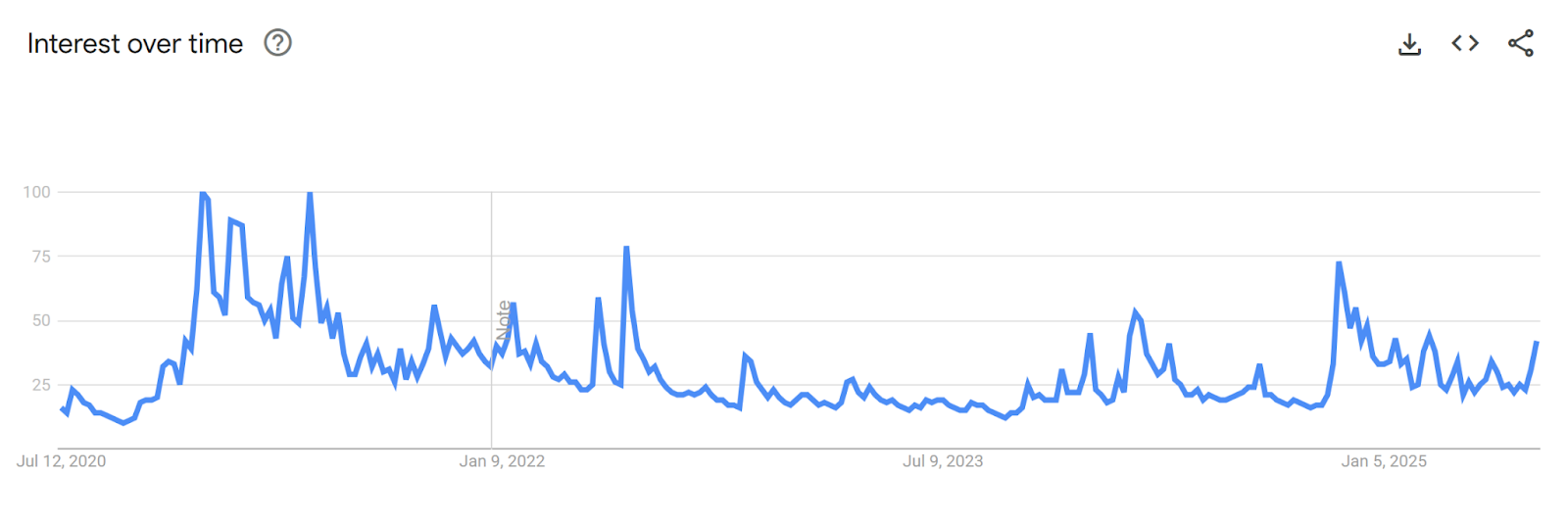

Compared with the price increase, public attention has not yet risen very high. Google Trends shows that while the current price of Bitcoin has reached a new high, its search popularity is far lower than the peak of the bull market in 2017 and 2021. This means that although a large amount of funds have poured in, the enthusiasm of retail investors and the general public is still in the cultivation stage. The discussion of Altcoin on social platforms such as X is also relatively flat, and there are no explosive topics. Overall, there is an obvious FOMO atmosphere in the market, but also a certain degree of caution. Although Google Trends shows that the popularity of Bitcoin keywords has not reached the previous climax, the number of searches related to Altcoin has increased, suggesting that retail investors' attention is partially shifting from Bitcoin to more Altcoin.

Source: https://trends.google.com/trends/

6. Inventory of popular and potential Altcoin tracks

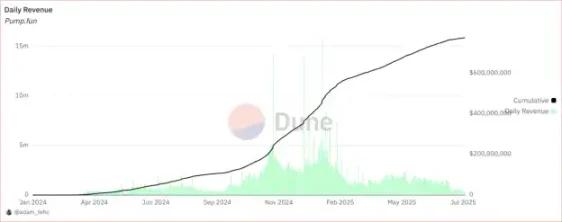

- Meme: CoinGecko data shows that the total market value of Meme-type currencies is about 78.9 billion US dollars, with an average increase of 25% in the past 7 days. The top projects include DOGE, SHIB, PEPE, BONK, TRUMP, PUMP, PENGU, etc. At the narrative level, cat-dog-themed and frog-themed Meme coins have a broad community base, and emerging Memes such as TRUMP, PENGU, and USELESS are hyped by celebrities, NFT/IP associations, and the emerging ecology of Launchpad. Overall, the Meme sector still has a "hype cycle", but it is very volatile.

- Emerging Layer1: The Layer1 track focuses on expansion and upgrading, such as Solana, BNB, Hyperliquid expansion plans, etc. As well as public chain ecological incentives, such as the capital inflow brought by official incentives such as Sui, Berachain, Sonic, and the progress of major public chains in upgrading performance, security, and application ecology. Overall, the Layer1 track has a stable position and tends to accumulate ecology in the medium and long term.

- Layer2 Ecosystem: Layer2 focuses on Ethereum expansion, and the leading projects include Mantle, Arbitrum, Polygon, Stacks, Optimism, Immutable X, Starknet, zkSync, etc. Layer2 benefits from the expansion topic, and the ecological internal testing and airdrop expectations are high. In terms of projects, most of them are upgrading functions and cross-chain interoperability, such as Arbitrum expanding ecological applications and Optimism launching a new network plan. Overall, if the concept of "cross-chain interoperability + airdrop" continues to gain momentum, this track will still be of interest in the second half of the year, but we need to beware of the risk of saturation of the overall market demand for Layer2.

- LSD/Restaking: With the rebound of ETH prices, the staking and restaking track continues to heat up. The prices of tokens such as LDO, EIGEN, BABY, and ETHFI in the market have recently rebounded and climbed. The LSD field protocol continues to develop new products, and Pendle promotes V2 expansion and opens up traditional financial markets. Overall, LSD/Restaking essentially relies on PoS Ethereum, has a solid ecological foundation, and still has the potential to attract money in the second half of the year.

- RWA: RWA has recently received institutional attention. Major projects include Ondo, Centrifuge (CFG), Goldfinch (GFI), TrueFi (TRU), Maker (MKR), Reserve Rights (RSR), etc. For example, Ondo focuses on the tokenization of treasury bonds and credit assets. Currently, the total TVL of the U.S. Treasury tokenization pool (OUSG/USDY) is about US$1.4 billion. Recently, it has launched a US$250 million fund with Pantera to deploy RWA projects; Centrifuge is also deploying offline mortgage assets. The topic of RWA is gradually heating up in social media, and many institutions are cooperating with project parties. In terms of fundamentals, regulatory compliance and off-chain asset yields drive this sector, and MakerDAO and others are also actively launching RWA collateral. On the whole, the RWA track is supported by actual assets, with stable returns and favored by capital; with the advancement of compliance and asset securitization, it is expected to continue to attract new funds in the second half of the year.

- AI: The AI track is active based on popular concepts such as generative AI and smart contracts. The leading projects include ICP, FET, VIRTUAL, etc., which have been popular recently. These projects have seen a technical rebound recently. At the same time, the popularity of "AI Agents" in Google searches has increased by 320% year-on-year, which has enhanced the market topicality of AI tokens. The global AI wave has driven the attention of AI chain tokens, especially when mainstream technology companies deploy encrypted AI projects, related tokens often see capital inflows. In short, the AI track is strongly driven by macro-themes and is a hot investment direction. If AI applications continue to explode in the second half of the year, its representative projects will have greater potential upward momentum.

VII. Conclusion and Recommendations

Based on the above indicators, the crypto market is currently experiencing the initial stage of the transition from Bitcoin to Altcoin in the bull market cycle. External factors such as loose liquidity, friendly regulation, and institutional buying provide solid support for the market; the fear and greed index has reached extreme greed, and the market is optimistic; the ETH/BTC ratio and ETH growth rate are significantly ahead of BTC; most mainstream Altcoin have outperformed Bitcoin in the short term; DeFi TVL, stablecoin supply, and on-chain activity are all on the rise. All these suggest that with the warming of market sentiment and the favorable macro environment, the demand for Altcoin allocation is accumulating momentum.

However, Bitcoin's market share is still high, and the ETH/BTC ratio has not yet made a significant technical breakthrough; the capital rotation shows a "point-to-point" selective feature, and there is no atmosphere for all projects to take off together. This means that the current market is more likely to be a "partial altcoin rise" led by large market capitalization and hot topics, and has not yet formed a widespread speculative frenzy. Therefore, from a trend perspective, the current Altcoin market tends to be in the early stages of a substantial launch.

Looking ahead, if the easing cycle and institutional inflows continue and the macro environment stabilizes and warms up, the overall crypto market will still be in an upward channel, and the bull market wave in the second half of the year should not be over yet. The signals from various dimensions of the market are diverse and positive, and there are indeed signs of the initial emergence of the "altcoin season". Investors can pay moderate attention to competitive altcoin assets, while closely tracking market trends and key indicators, and be wary of the risk of retracement under extreme emotions. In the transition period when future trends are not yet fully clear, maintain flexibility, prudent diversification, dynamically adjust positions, seize opportunities, and control risks.

about Us

As the core investment and research center of the Hotcoin ecosystem, Hotcoin Research focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a three-in-one service system of "trend analysis + value mining + real-time tracking". Through in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluation of potential projects, and 24-hour market volatility monitoring, combined with the weekly "Hotcoin Selection" strategy live broadcast and "Blockchain Today's Headlines" daily news delivery, we provide investors at different levels with accurate market interpretation and practical strategies. Relying on cutting-edge data analysis models and industry resource networks, we continue to empower novice investors to establish a cognitive framework, help professional institutions capture alpha returns, and jointly seize value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile and investment carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com