I. Project Overview

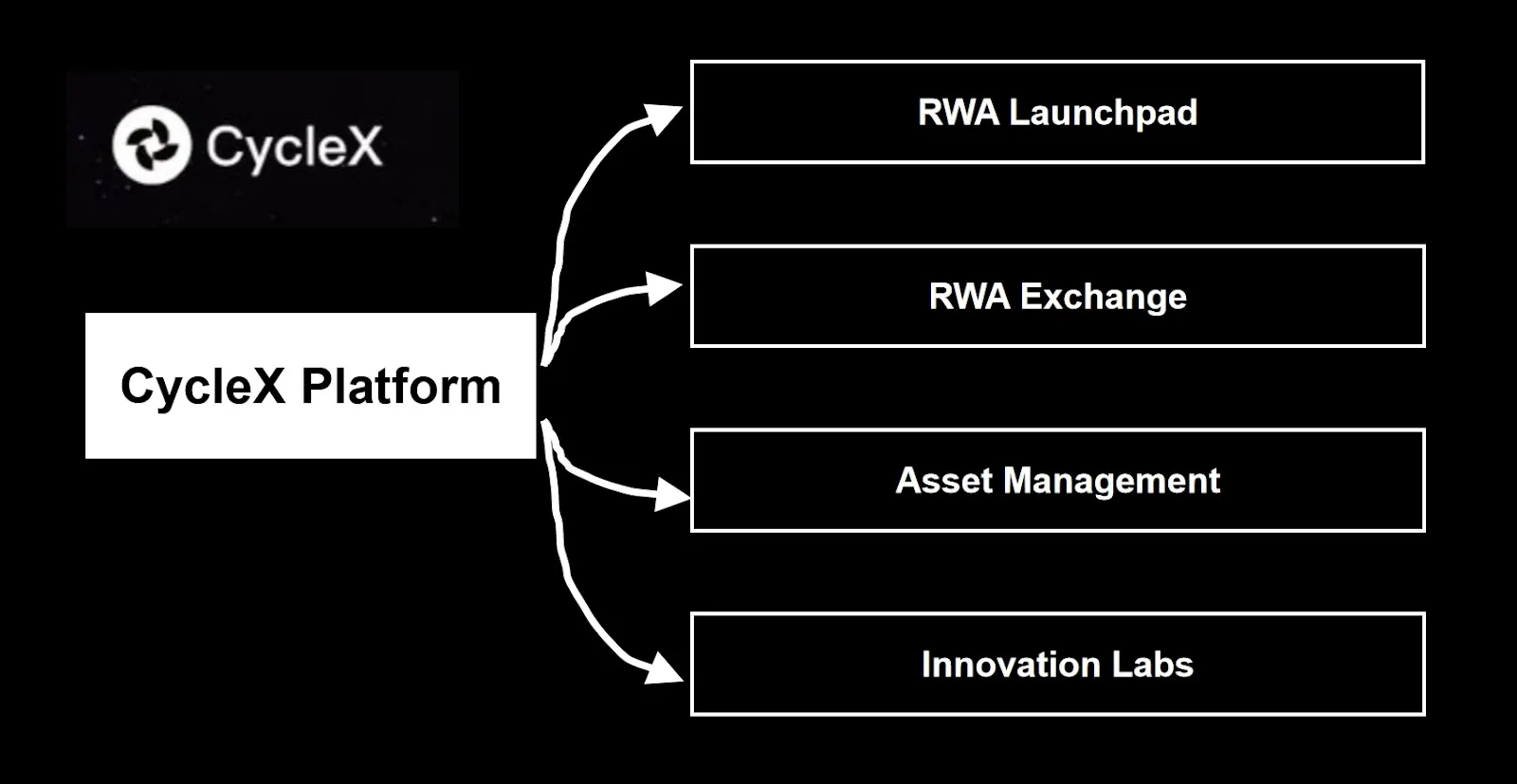

CycleX is an asset tokenization trading platform focusing on the Real World Assets (RWA) track, aiming to achieve on-chain issuance and circulation of traditional financial assets. The project is dedicated to building a bridge connecting global financial assets and investors, reducing transaction barriers and costs across regions and jurisdictions. CycleX provides diversified product services including asset tokenization, fund issuance, and transaction matching, promoting the digital circulation of real-world assets!

CycleX belongs to the parent company WhaleFlow Labs and has reached a strategic cooperation with the Hong Kong-listed company Stellar Group (8297HK). Registered in the United States, it primarily provides financial services to the global market. CycleX has garnered attention and support from institutions including Chainlink, Plume Network, Kucoin Labs, and JuCoin.

II. Key Highlights

- **Comprehensive Asset Coverage:** CycleX 2.0 supports multiple asset categories including stocks, bonds, real estate, art, and media assets, covering on-chain and off-chain institutions, meeting diverse investment needs, including cash assets, credit assets, over-collateralized assets, cryptocurrencies, and alternative investments.

- **Innovative Fund Structure:** Adopting a diversified fund architecture compliant with ERC1400 standard, combining SPE and SPV to construct RWApool, achieving multi-asset integration and risk classification management. Fund shares are circulated on-chain in the form of Non-Fungible Token or ERC-20, enhancing liquidity and transparency.

- **Native On-Chain Asset Management:** Through dedicated SPV pools and Chainlink real-time data integration, combined with Cobo custody and independent auditing, ensuring high security and transparency in asset management, guaranteeing user fund safety and operational compliance.

- **Secondary Market Liquidity Release:** Leveraging DEX pricing mechanisms, CycleX 2.0 supports seamless trading of fund shares in the secondary market, enhancing token liquidity and investment flexibility, creating an efficient on-chain trading experience.

- **Compliance and Institution-Friendly Design:** Providing multi-entry support for institutions and retail investors, combining regulatory compliance framework and necessary licenses, safeguarding fund safety and legality, empowering institutions to easily enter the new on-chain financial market.

VI. Investment Logic:

6.1 Track Logic: RWA Asset Tokenization Possesses Medium and Long-term Growth Certainty

The RWA track enters the substantive application and scale expansion stage, with an expected large number of traditional financial assets to be issued and traded on-chain in the next 3-5 years. As a crucial infrastructure connecting on-chain and off-chain markets, RWA platforms are gradually becoming the preferred path for institutions to enter the crypto market. CycleX focuses on fund-type RWA products and secondary market trading system construction, combining compliance and asset-side layout, covering key processes from asset issuance to circulation, and possessing the potential to achieve rapid volume growth during the industry's dividend period.

6.2 Project Advantages: Product Implementation and Institutional Endorsement Construct Competitive Barriers

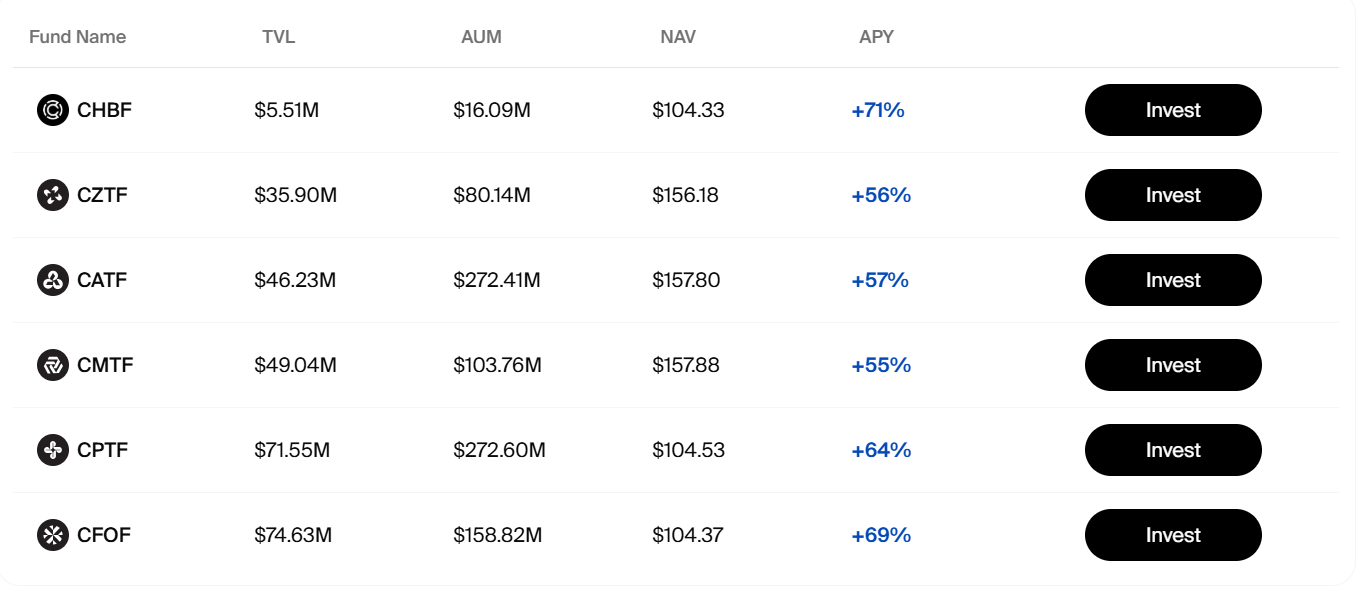

CycleX leverages traditional financial background resources from WhaleFlow Labs and Starry Group, combined with crypto ecosystem partners like Chainlink, Plume Network, and JuCoin, forming an industrial collaborative advantage across on-chain and off-chain, crypto and traditional domains. The project's already implemented multiple RWA fund products cover categories such as cash, bonds, and alternative assets, validating the commercial feasibility of asset tokenization and secondary market trading. Through innovative advantages in fund structure design, asset transparency, and liquidity support, CycleX is poised to establish a standardized RWA product matrix, creating a long-term competitive moat.

6.3 Investment Expectations: Potential High-Quality Early-Stage Target, Token Issuance Worthy of Focused Attention

As of now, CycleX has not yet launched a platform token, remaining in an early stage with unreleased token value. Combining the project's fund product dividend mechanism and trading platform attributes, subsequent platform coin or fund asset token issuance is expected to grant core rights to holders such as fee reduction, governance participation, and profit sharing, releasing value increments from platform scale growth!

VII. Conclusion

As an emerging RWA infrastructure platform, CycleX, backed by powerful traditional financial cooperation resources and crypto industry institutional support, has achieved initial implementation in asset tokenization fund issuance and on-chain trading system construction. Through its unique model and multi-asset compliance management system, CycleX is gradually establishing product and technological barriers in the RWA track, with a clear growth path!

From a data perspective, CycleX's total managed asset scale has exceeded $900 million, with core fund products maintaining an annual return rate between 55%-70%, demonstrating the stability and attractiveness of product design and asset-side operations. Considering the continuing strengthening of RWA asset tokenization trends and CycleX's current early stage with unreleased token economics, the project possesses certain medium to long-term allocation value. It is recommended to focus on subsequent token issuance milestones and asset scale expansion progress, viewing it as a promising high-quality early-stage target in the RWA track, suitable for medium to long-term strategic deployment!