In this market trend, the third wave of upward movement has entered a critical stage. #BTC shows signs of a stage-top formation, while ETH is fully powered and taking over the upward momentum, gradually transitioning from a surge to a slow rise. In the short term, the bulls' momentum seems somewhat exhausted.

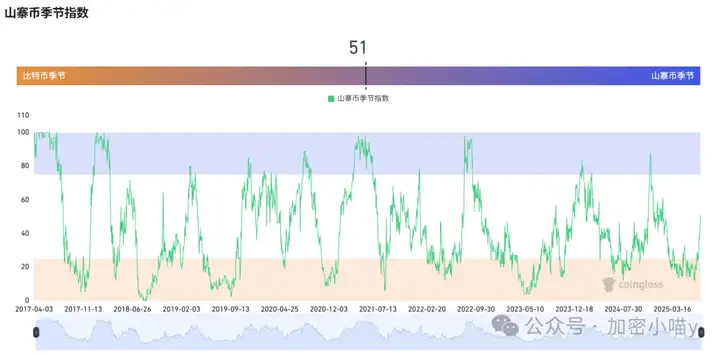

However, the opportunity is just beginning to shift from mainstream to Altcoin! The market has entered a sector rotation and catch-up period, with Altcoins becoming increasingly active, and the trend is evolving towards a "final hundred-day sprint". The biggest driving force behind this sprint is the new narrative of simultaneous rise in US stocks and crypto.

ETH leads the charge, Altcoins fully ignited

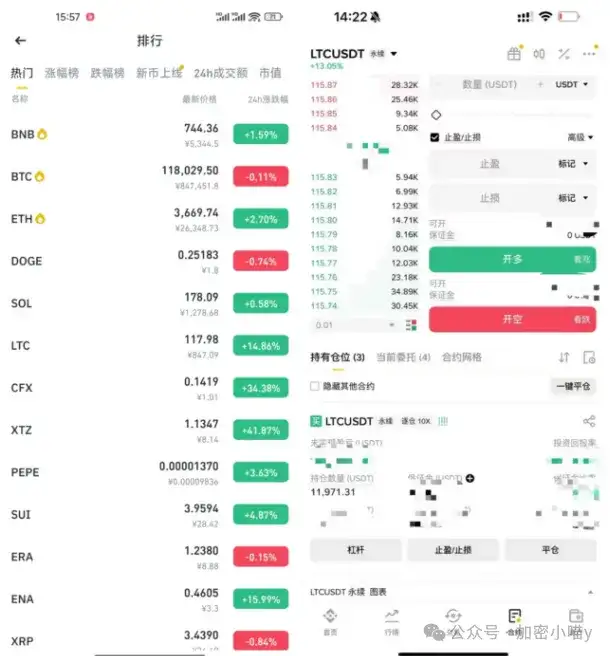

ETH once challenged the key resistance of 3700, and although experiencing short-term oscillation, the overall trend remains healthy. As we expected, the market has begun the Altcoin season, with funds gradually flowing from large-cap coins to smaller ones, namely BTC rises first → ETH follows → on-chain meme takes off and chaos ensues. #LTC has been cleaned out and is expected to start a catch-up, potentially hitting a new all-time high; #FTT shows a Double Botto with volume, and if it breaks through the previous high of 1.3, it may see a short-term surge; XTZ surges in volume, resembling EOS from back then, with a target of 2 dollars and a potential 4x upside.

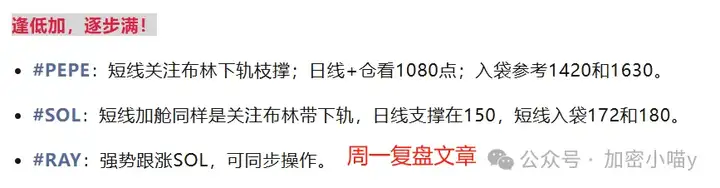

#DOGE successfully broke through the previous high point, with the next resistance level at 0.303; #UNI maintains the 9.8 platform, with major positive news in August, suggesting a medium-term slow rise; CFX, SUI and other domestic chains are also expected to rotate and take over. Currently, Altcoins are generally at low levels, and once rotation starts, their elasticity will far exceed mainstream coins.

Revealing fund flows, is the main battlefield shifting?

In the past 15 days, BTC fund accumulation once reached 4.4 billion, but now only 1.5 billion remains - with minimal price decline, the fund outflow is obvious, indicating a withdrawal from BTC in search of higher returns, with Altcoins becoming the next destination.

ETH's trend is complex, but with main forces, institutions, and spot trading taking turns, its strength remains. In comparison, BTC is no longer the current fund's main battlefield. Last week, I partially reduced PEPE, SOL, and RAY as planned. Although these three coins have stable trends, they haven't yet exploded, especially PEPE and SOL, and I'm looking forward to a catch-up this week.

#RAY despite the project team spending 190 million to repurchase, has shown a flat response, even dropping to 2.54, with its narrative overshadowed by BONK and PUMP. #SUI has approached its previous high of 4.3, expected to have another third wave peak, looking bullish to 5.3 is not excessive, with pullback support in the 3.55-3.3 range, which is an ideal entry point for me.

In the short term, the market is still "afraid of heights", with many people missing the pump and hesitant to enter. But I want to say: The current trend is not overheated, but rotating! The main rise does not mean it's over, but precisely that opportunities are changing hands!

Looking back at this rise, the fundamental driver is still US stocks. US stocks repeatedly hitting new highs, crypto policy implementation, and continuous traditional fund inflow have provided the foundation for the trend. Including ETF landing, ETH version of MicroStrategy, BNB/TRON enterprise linkage, and other new narratives have formed a win-win cycle for stocks and crypto. Data shows:

- LTC recorded the highest net inflow of $29.83 million;

- SOL, BCH, ENA, BNB and others also recorded significant increases;

- In contrast, BTC had a net outflow of $156 million in a single week, with DOGE, XTZ, XRP, TRX and other mainstream coins showing varying degrees of withdrawal.

This means: Hot money is starting to change tracks. The current DeFi round is almost complete, and next week #AI and #meme will likely take the stage. The overall rhythm is still good, with meme directions like #pnut, #neiro, #bome already strategically positioned, just waiting for a surge to lift the entire market.

Summary

The big trend continues, sectors are rotating, and the third wave is not over. Although ETH has short-term top formation expectations, it doesn't mean a complete top, but rather a transition to a slow rise and oscillation period, which is favorable for Altcoins. Funds are still present, hot spots remain, and sectors continue to rotate.

Don't forget, in every major upward wave, the Altcoin explosion period quietly begins after the mainstream stabilizes.

That's it for the article! If you're feeling lost in the crypto world, consider joining me in layout and harvesting from the market makers! Follow the public account: Crypto Meow y

You can join the community via WeChat+QQ group to get market analysis and Altcoin operation strategies.... WeChat: c13298103401 or QQ: 3806326575