Capital is shifting from Bitcoin to Altcoins, with TOTAL2 (total market capitalization of cryptocurrencies excluding BTC) reaching $1.5 trillion on Friday, testing the long-term resistance level last seen in January 2025.

Although the market may stagnate in this range, the long-term trend still provides opportunities to break through $1.5 trillion and move towards the historical market cap of $1.72 trillion.

VX: TZ7971

If TOTAL2's monthly closing price exceeds $1.51 trillion, it will be the highest closing price in the history of this Altcoin index.

Stablecoins Continue to Drive Quarterly Altcoin Uptrend

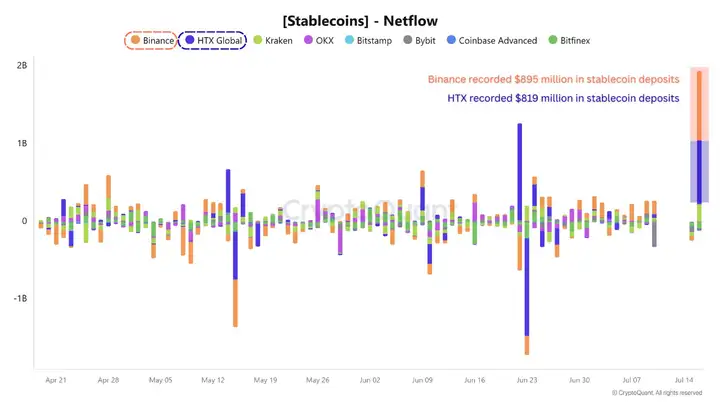

Binance's USDT and USDC balances hit a new high of $31 billion in June 2025. With a surge in stablecoin inflows from centralized exchanges like Binance and HTX, this liquidity wave remains strong, reaching $895 million and $819 million respectively that week.

This shift reflects the continued interest in Bitcoin and the potential for deeper accumulation of major Altcoins.

On Wednesday, over $2 billion in stablecoins (primarily USDT) were deposited into major derivatives exchanges, indicating an increased demand for leverage among professional investors. Tether Treasury continues to issue USDT, further confirming the growing institutional demand for USDT and increasing risk appetite.

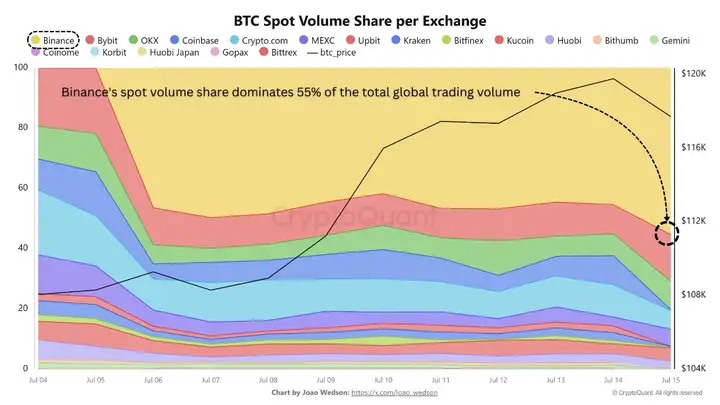

Binance dominates over 55% of global trading volume, with daily trading exceeding $8 billion. Meanwhile, whale users reduced BTC deposits to the exchange by $2.25 billion, suggesting easing selling pressure on Bitcoin. This could open the door for capital to shift towards Altcoins.

While Bitcoin remains the center of market liquidity, current data suggests that institutional and large-scale traders are quietly restructuring their portfolios, preparing for the next breakthrough in the Altcoin market.

Altcoin Season Just Beginning - TOTAL3 Target is $5 Trillion

The TOTAL3 index (total market cap of Altcoins excluding Bitcoin and Ethereum) is currently around $1 trillion, still in the early stages of the cycle. It is expected to reach $5 trillion in this cycle, a 400% increase.

Altcoin cycles typically occur in stages: first breaking through the long-term accumulation zone, then steadily rising, and finally experiencing a sharp increase in just a few months of candles - a period that brings explosive profits but can easily leave latecomers behind.

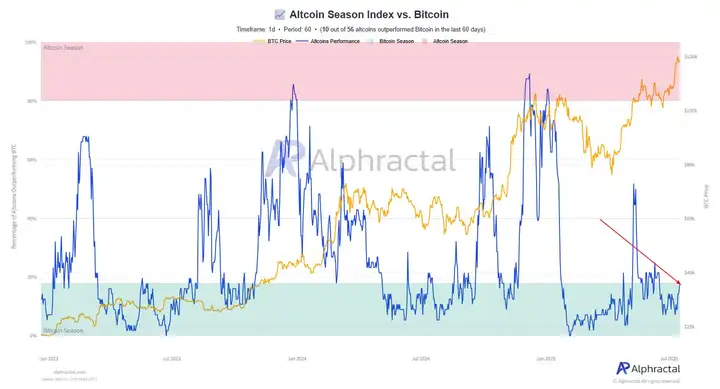

The Altseason Index data also indicates that a trend is forming. The 30-day indicator has just broken through 75, suggesting funds are gradually shifting towards Altcoins. However, the 60-day indicator remains low, indicating that few Altcoins can outperform Bitcoin in the long term.

Positive sentiment is warming up, and capital flows are beginning to recover. Investors are advised to maintain patience and adopt a rigorous strategy to maximize investment opportunities in the coming period.

From Bitcoin to Ethereum, everything points to a core trend: Where institutional funds are, the market's focus will be. This means that if this "Altcoin season" begins, it may be more driven by institutional funds rather than traditional sector rotation or speculative fervor. In other words, tracks that can carry large amounts of capital or sectors where institutional funds overflow may be more attractive. Moreover, institutional fund participation not only brings more stable capital flows but may also push the market towards a more mature and rational direction.

This entire rhythm is essentially a natural chain of "liquidity sinking". Starting with BTC leading the rise, funds gradually migrate: ETH, mainstream Altcoins, mid-cap coins, then Meme and small-cap tokens. In this process, volatility and market acceleration continuously increase.

Structurally, we are standing at the beginning of the "ETH stage": rotation is just emerging, not yet overheated, with the opportunity window still open. ETH's strength will further drive liquidity to continue migrating downward, while retail FOMO sentiment has not yet been fully ignited. The Fear and Greed Index still has room before reaching extreme emotions. This also means that this cycle still has considerable upside potential.

The market's direction is now very clear: BTC has lit the fuse, ETH is taking over and accelerating, and high-cap tokens will quickly catch up. After this, the true comprehensive Altcoin season will arrive as scheduled, with mid-cap coins, Memecoins, and various concept coins taking turns, until all liquidity is exhausted.

ETH's leading performance is not only a confirmation of the trend but also the starting point of the next stage.