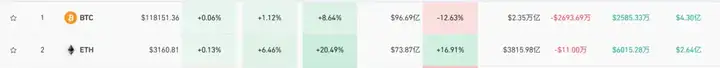

In the past two days, the market suddenly reversed. #Bitcoin pulled back from its high, while Ethereum seized the opportunity and directly broke through the 3,200 mark, leading the entire market. Although Bitcoin was surging just the day before yesterday, briefly touching 123,300, it dropped to around 117,000 within just two days, but fortunately stabilized at this level.

Many people say this drop was caused by ancient whales transferring BTC, and on-chain data indeed supports this: after breaking 115,000, the number of BTC transferred to exchanges increased from an average of 30,000 to 50,000 per day, indicating rising cash-out sentiment. However, the so-called "whale selling pressure" only increased by slightly over 3,000 BTC and was not a direct market dump. What's truly concerning is that over 13,000 BTC are net inflow on exchanges and remain stationary - these coins could potentially be dumped at any negative news.

There have indeed been constant rumors: legislative obstacles, Trump's attitude reversal, with the market betting on upcoming voting results. Although prices slightly rebounded, on-chain data shows that existing funds haven't flowed out, and the market remains in a negotiation phase. Ultimately, Bitcoin's price is more influenced by retail sentiment and overall liquidity, rather than whale movements.

ETH Takes the Baton, Altcoins Collectively Revive

In stark contrast - ETH is truly energized. After the stablecoin bill passed, #ETH's ecosystem expectations were immediately maximized, institutional barriers lowered, and liquidity increased. Ethereum strongly rebounded to 3,200, with 3,400 not being a dream, and even potentially reaching 3,600 or 4,000!

Yesterday's article already told everyone that Ethereum's pullback was small, clearly showing institutional entry, catching this wave...

With Ethereum's movement, altcoins became restless. The altcoin season index has risen from 15 in June to 39, showing that over one-third of mainstream cryptocurrencies have outperformed BTC. This is the familiar rhythm: BTC takes off → ETH takes the baton → Altcoins bloom comprehensively.

Now everyone's attention is shifting from top coins to those "not yet risen but with potential" - ambush opportunities have arrived!

Recently, fans often ask how to choose altcoins.

The safe approach is to follow leading coins and hot trends. Market repetitions prove that choosing the right track is key to getting on board.

For example:

- DeFi sector rotation is obvious: #REZ performs eye-catchingly, #CRV is slow but well-positioned, $aevo and $cow have been performing well recently;

- Monthly line potential ambush: #sushi has always been a must-rise rotational familiar;

- Low-price coin script replication: #OM follows the classic "descending wedge + oversold + low-price high-burst" path, with a first wave of doubling followed by dumping - a standard harvesting script;

- Game sector rising: #Alice almost always rises 50%-100% in each bull market cycle, this time I entered around 0.48, waiting for explosion;

- Practical case: $GALA, which we've been watching for weeks, has indeed broken through the downward channel, maintaining a strong structure, with next targets at 0.0188 and 0.021.

The macro environment is changing, and research must keep up.

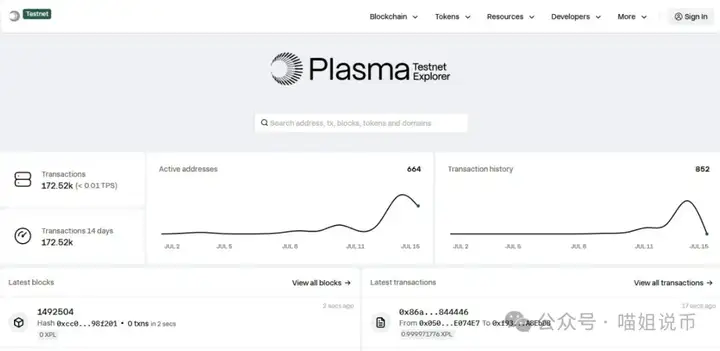

Projects like Plasma, backed by Tether and Peter Thiel, raising $27.5 million in just two months and reaching a $500 million market cap, indicate that the bull market has indeed returned. DefiLlama's TVL rankings also provide many directions, with Lido, EigenLayer, and #AAVE remaining high-quality reference objects.

Would Crypto Die Without Altcoin Season?

Many overlook that each altcoin season is when retail investors' money-making effect is strongest.

Although BTC has broken new highs, previous breakouts (last March and December) saw altcoins surge for a few days before completely collapsing, with many being "fooled twice" and now becoming cautious. Low search popularity and quiet discussion circles indicate that people are still waiting and afraid of being cut.

But if this bull market doesn't have an altcoin season, retail investors might stop playing, and crypto could lose half its users. Without a money-making effect, who would stay? If only institutions trade BTC, crypto would become entirely "institutional-driven", and retail investors would say goodbye.

This is a critical moment: BTC is adjusting, Ethereum is taking off, and altcoins are stirring. Having missed BTC and ETH before, don't hesitate this time. Catch leaders, choose rotations, follow sentiment - don't be greedy, don't linger, catch one wave and multiply your investment.

Just because you're not buying doesn't mean the market won't rise.

Just because you're not researching doesn't mean others aren't making money.

Article ends here!