Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The beginning of what a US Congressional Committee has dubbed “Crypto Week” saw the largest cryptocurrency by market capitalisation fly through multiple new ATH’s, touching a top as high as $123K. Since then, signs of profit-taking has seen BTC drop to $116K. All three measures of directional sentiment: volatility smiles skew, funding rates, and futures spot-yields all surged in response to the moves in the spot market, though have abated slightly since. ETH recovered to $3,000, the first time it hit that level since February 2025 and for a brief period of time, 25-delta 7-day OTM calls for ETH carried a more than 7% volatility premium relative to 25-delta put options at the same expiry. On the macro front, the past week has been characterised by increased tariff pressure from President Trump.

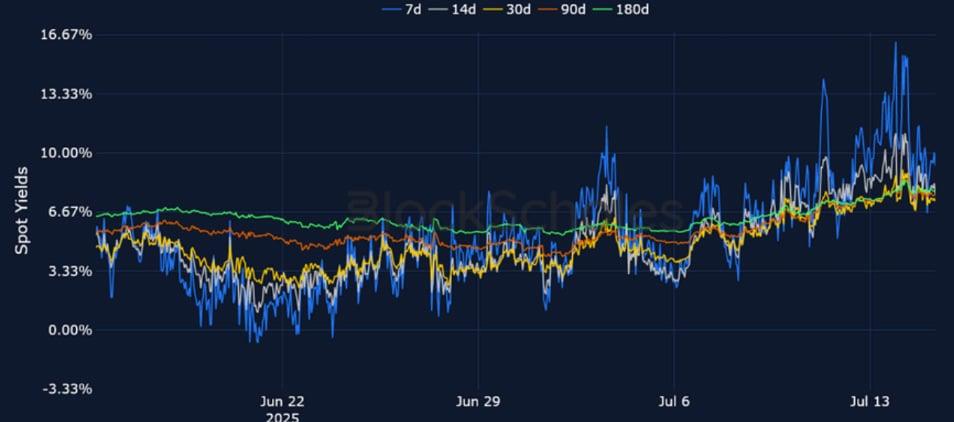

Futures Implied Yields

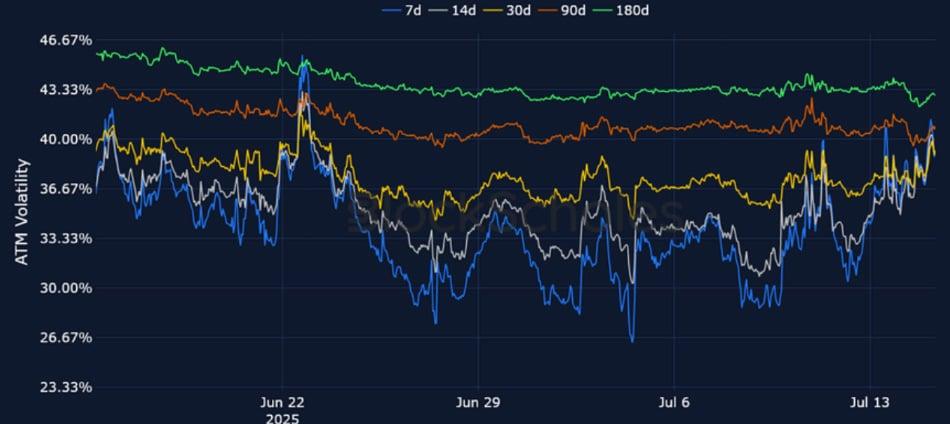

1-Month Tenor ATM Implied Volatility

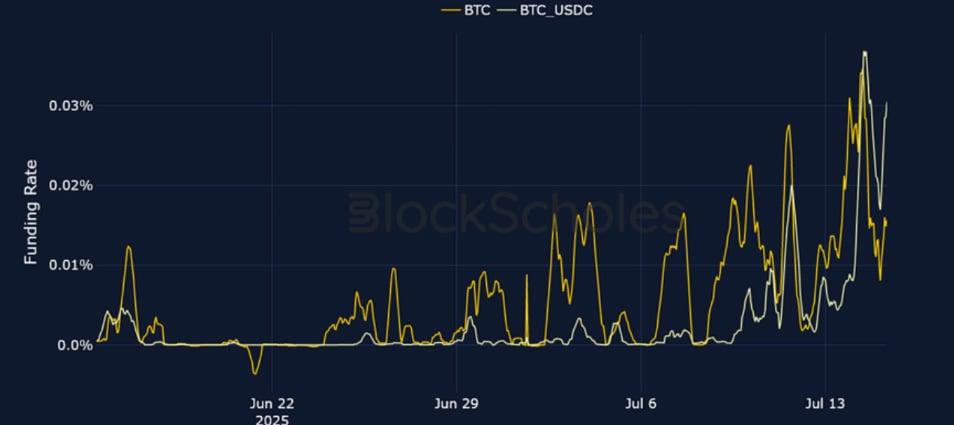

Perpetual Swap Funding Rate

BTC FUNDING RATE – Yesterday, BTC funding rates spiked to their highest levels since January 2025, as spot price rallied past $123,000.

ETH FUNDING RATE – ETH spot price surged to $3,000, a level last seen in February 2025, spurring a jump in funding rates.

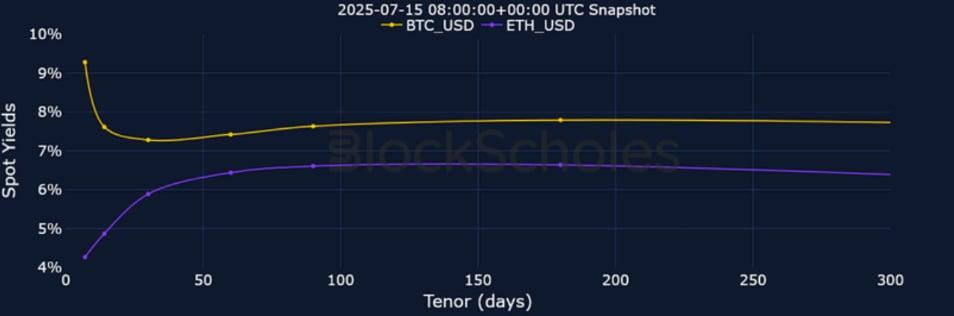

Futures Implied Yields

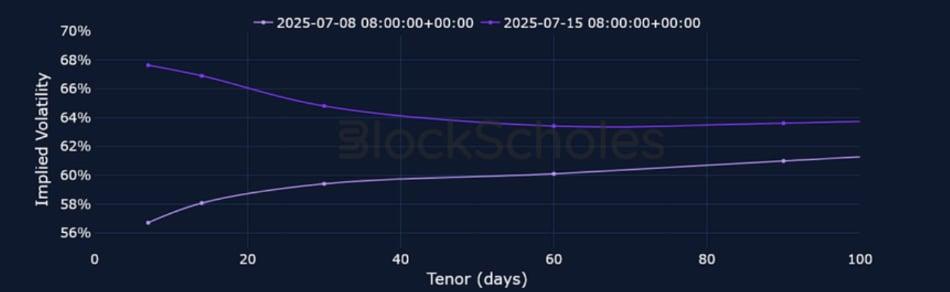

BTC Futures Implied Yields – Compared to a week earlier (July 8), BTC futures term structure is now inverted, as 7-day spot yields rose as high 16.28%.

ETH Futures Implied Yields – Similar to funding rates, ETH spot yields surged, though not to levels as high as those seen in BTC – stopping just short of 10%.

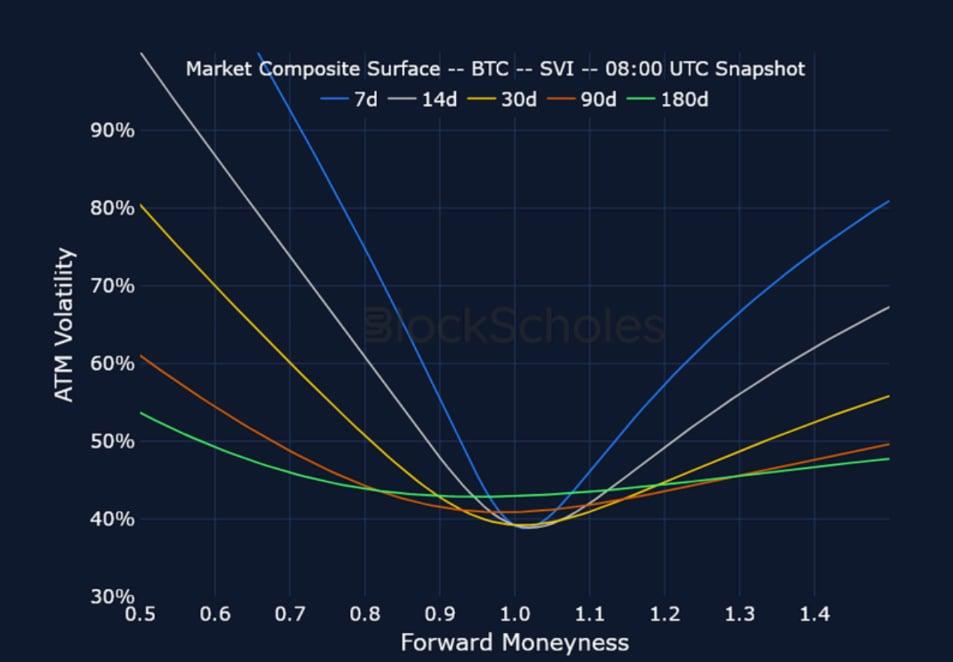

BTC Options

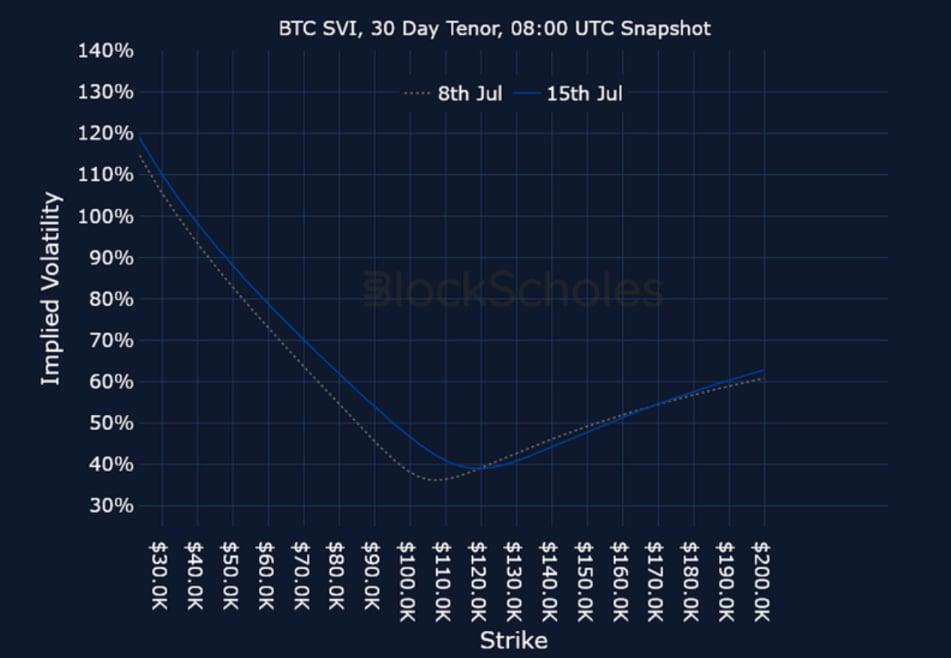

BTC SVI ATM IMPLIED VOLATILITY – After historically low levels of volatility, 7-day IV bounced 8 points over the past week, flattening the term structure.

BTC 25-Delta Risk Reversal – The pullback in spot price from the ATH of $123K has seen skew shift from 6% towards OTM calls to 4% in favour of puts.

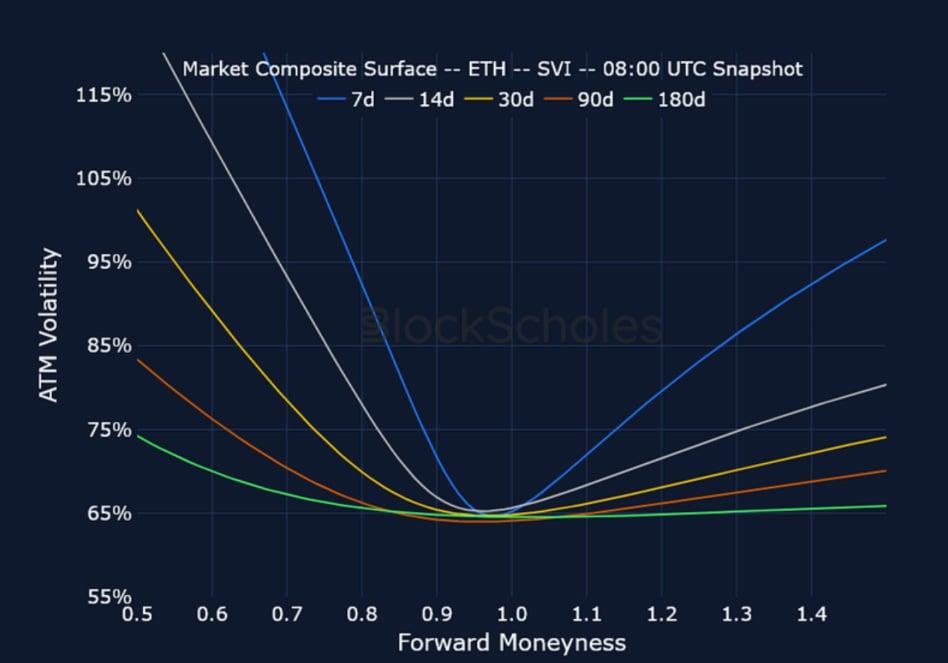

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure of volatility is relatively flat, with outright levels between 60 and 63%.

ETH 25-Delta Risk Reversal – ETH short-tenor smiles skewed towards OTM calls by 7% as its spot price rallied to $3,000, though has abated now to 3%.

Volatility by Exchange

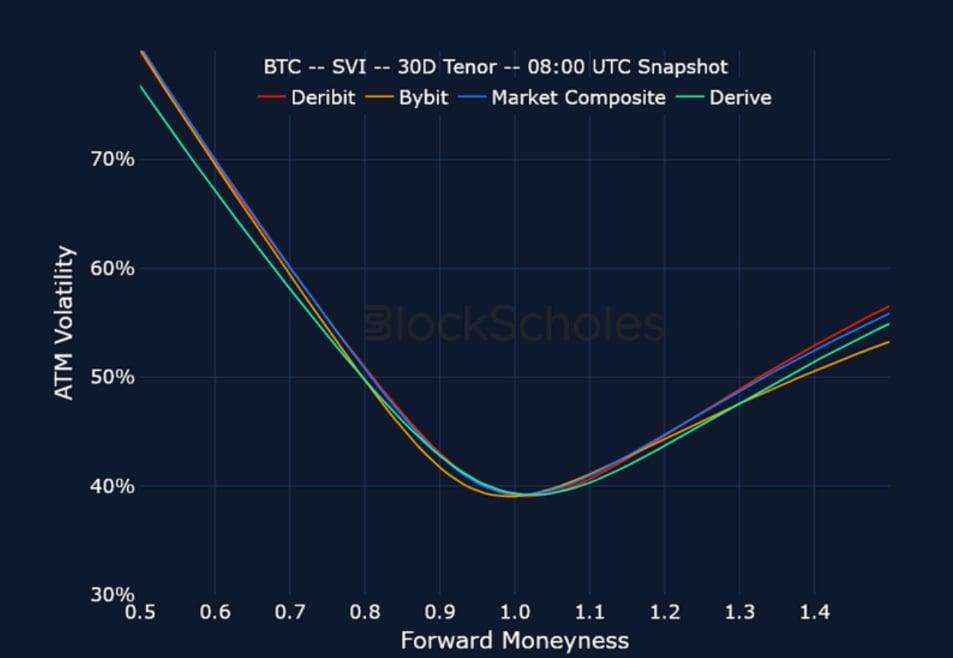

BTC, 1-MONTH TENOR, SVI CALIBRATION

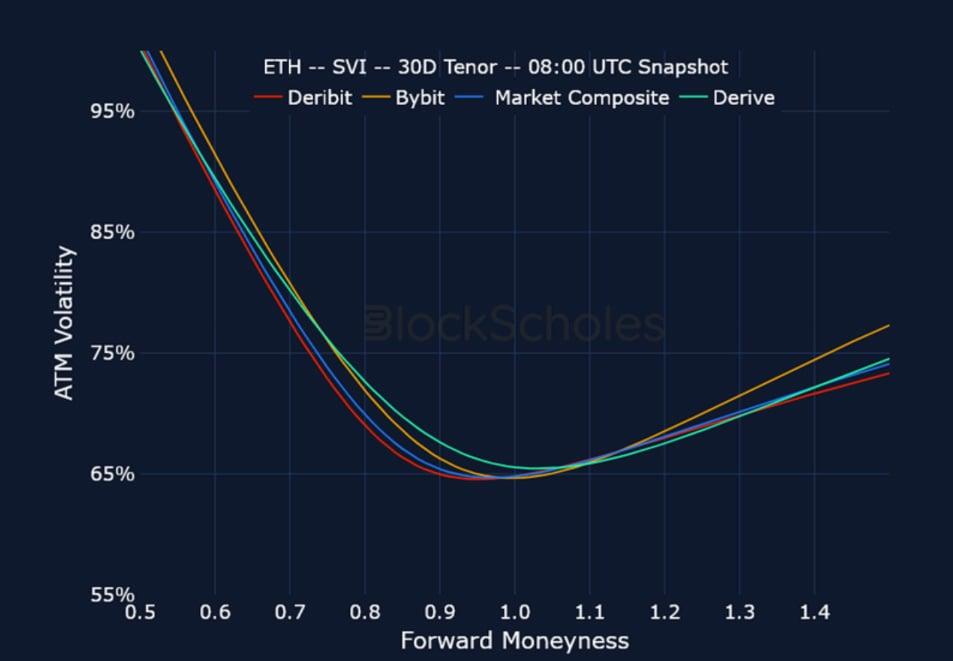

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

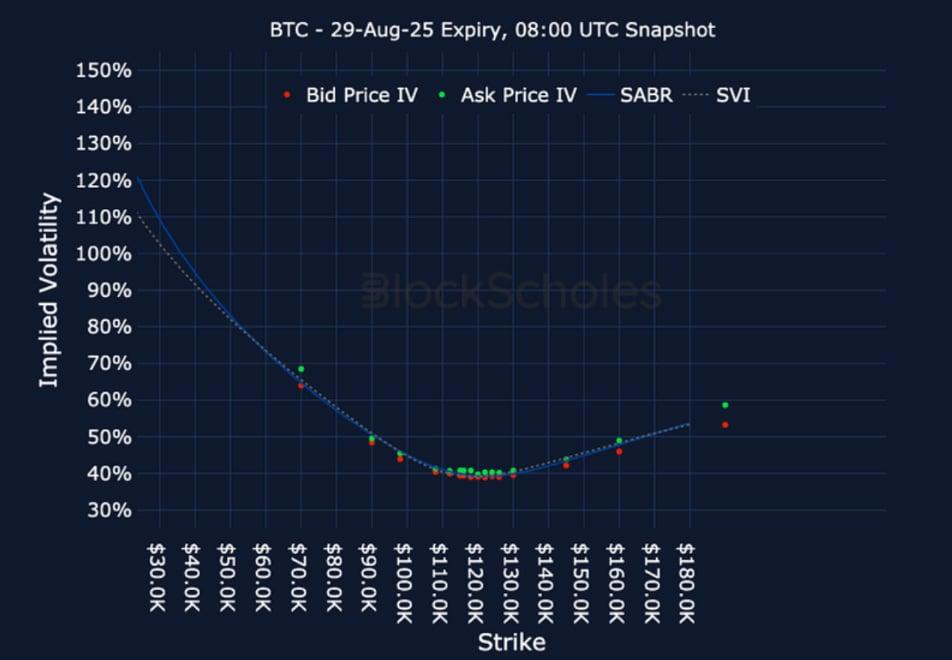

Listed Expiry Volatility Smiles

BTC 29-AUG EXPIRY – 9:00 UTC Snapshot.

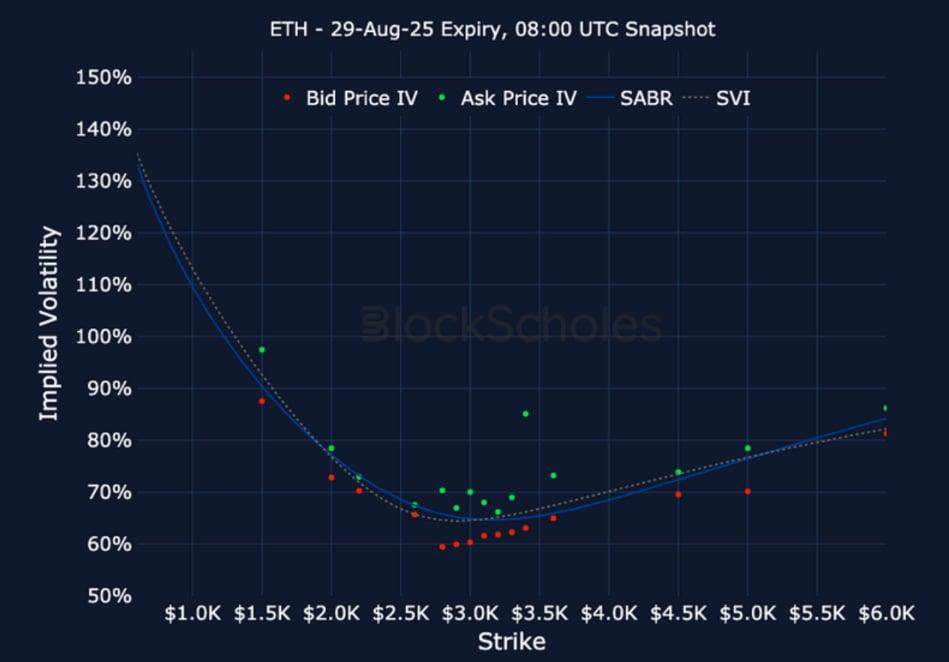

ETH 29-AUG EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)

Trading with a competitive edge. Providing robust quantitative modelling and pricing engines across crypto derivatives and risk metrics.

RECENT ARTICLES

Crypto Derivatives: Analytics Report – Week 29

Block Scholes2025-07-16T07:53:03+00:00July 16, 2025|Industry|

Skew Curves Shift Towards Calls

Imran Lakha2025-07-09T18:17:43+00:00July 9, 2025|Industry|

Crypto Derivatives: Analytics Report – Week 28

Block Scholes2025-07-09T07:35:41+00:00July 9, 2025|Industry|

The post Crypto Derivatives: Analytics Report – Week 29 appeared first on Deribit Insights.