On the evening of July 10, 2025, Beijing time, Bitcoin strongly broke through its previous high, standing above $117,000 for the first time and creating a new all-time high (ATH). Moreover, the total market capitalization of the crypto market exceeded $2.9 trillion within 24 hours, with mainstream currencies surging, instantly igniting market sentiment.

But what structural signals are worth our attention behind this "Bitcoin deification moment"? This article, produced by WEEX exchange, will break down the key variables in this market trend from five dimensions, helping users understand the trend, comprehend the cycle, and make judgments.

I. Surge in Trading Volume: Not Just a Price High, But a "Volume Confirmation" of Funds

Data from multiple mainstream platforms like Binance, Coinbase, and WEEX shows that Bitcoin's trading volume in this rally has significantly exceeded the ETF phase of late 2024. According to Coinalyze data, the 24-hour spot and perpetual contract trading volume for Bitcoin has exceeded $8 billion, creating a single-day trading peak since 2021.

More notably, this volume surge is not a "pump and dump" false high, but comes from the continuous stacking of long-term bullish funds. Unresolved contracts, including CME futures, continue to refresh highs, indicating that Bitcoin is gaining favor from cross-market and multi-type capital.

II. Multiple Momentum Drivers: Policy, ETF, and Institutional Buying Resonate

Market surges are never coincidental. Since 2025, three macro momentum sources have jointly provided strong underlying support for Bitcoin's new high.

First, regulatory sides continue to "de-risk": The US Congress passed a stablecoin regulation bill, clearly incorporating USD-pegged assets into the compliance system; Hong Kong and the UAE simultaneously promote virtual asset trading license mechanisms; multiple Latin American countries expand digital asset landing through national wallet projects. These policy dividends are substantially lowering entry barriers for users and institutions.

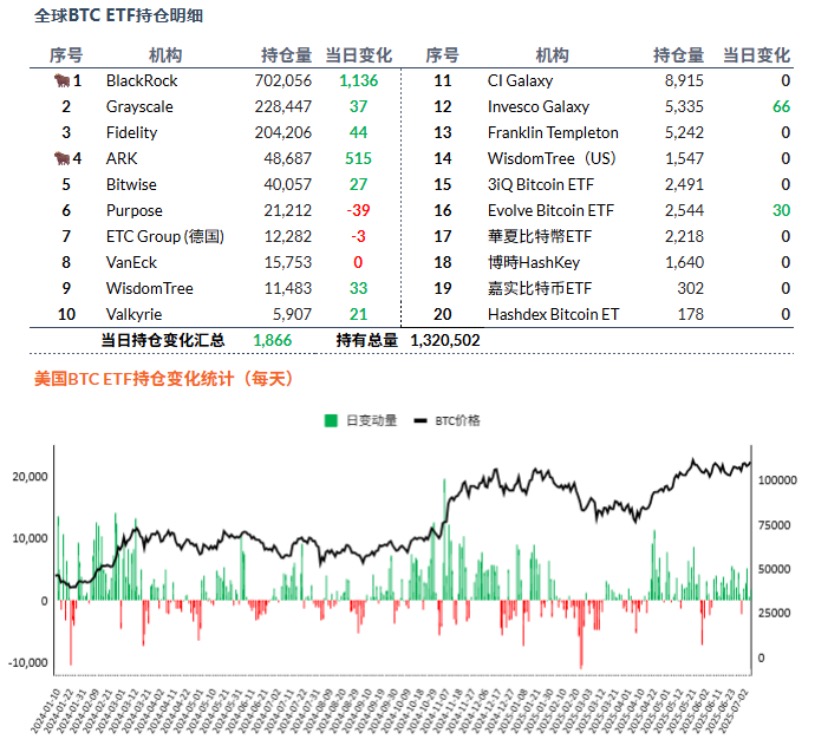

Secondly, ETF's continuous capital inflow cannot be ignored. Taking BlackRock's IBIT as an example, the daily average net inflow since July has reached $500 million, with monthly cumulative inflow close to $3.5 billion, almost matching the historical record of the initial ETF approval in 2024.

ETF products provide a low-threshold, highly compliant, and penetrable institutional entry path, serving as crucial "fuel" for this market trend.

Furthermore, continuous actions by giants like Metaplanet and Strategy to add Bitcoin holdings continuously strengthen market signals, creating a chain effect that drives more companies to diversify financial asset allocation.

III. On-Chain Data Confirmation: Retail Investors Return, Whales Haven't Left

According to on-chain data platforms like glassnode and CryptoQuant:

• Newly created Bitcoin wallet addresses continue to grow, with daily active addresses exceeding 1.1 million;

• Small wallet (< 1 BTC) growth rate slows but remains steady;

• Large wallet (100–1,000 BTC) shows no obvious exodus signals, instead continuing to "accumulate" during range-bound periods.

This means Bitcoin's fundamentals are in a healthy structure of "retail investor enthusiasm returning + stable institutional holdings".

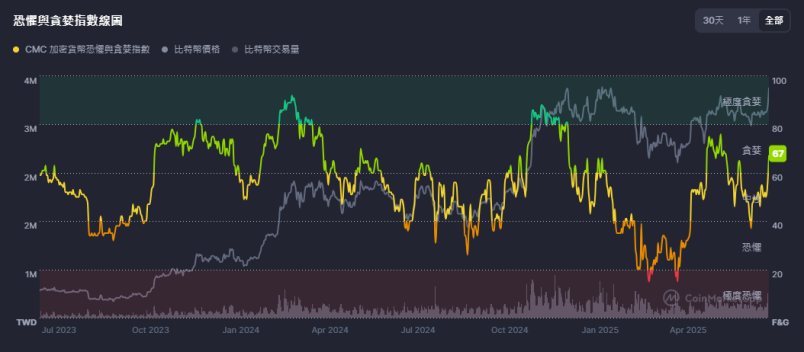

Interestingly, the "Fear and Greed Index" has steadily maintained in the "greed zone" since early June but has not reached the extreme overheated edge, indicating that while the market is optimistic, there are no excessive FOMO out-of-control signs.

Bitcoin Active Address Data Changes

Fear and Greed Index Changes

IV. Who is Seen in This Bull Market? Brand Trust May Be Re-evaluated

This breakthrough market trend not only brings market heat back but also looks like a silent "trust vote": Whose users are willing to stay in the market? Whose services can remain stable during intense fluctuations? Whose brand has truly accumulated user reputation?

After Bitcoin broke through $110,000 in 2025, the latest CoinMarketCap exchange ranking shows that many compliant and technically solid trading platforms have significantly risen, especially emerging platforms like WEEX exchange, which has maintained a global top 20 ranking on CMC for consecutive months through stable trading depth and system performance, ranking in the top 10 among contract platforms.

V. From Trend to Consensus: More Than One Bull Market Signal, Cycle Still Accelerating

If previous bull markets' core logic was "halving + speculation + liquidity flooding", this 2025 market trend is more like a composite drive of "compliance + institutional + structural accumulation".

Looking back at Bitcoin's historical bull market peaks (2013/2017/2021), the period from "breaking previous high" to "market top" usually spans 5-8 months. Considering this breakthrough time is July 2025, we have reason to believe this bull market is far from over.

This time, Bitcoin's social cognition as an asset class has fundamentally changed, moving from marginal speculation to mainstream global asset allocation, with its "consensus foundation" significantly expanding.

How Does WEEX Understand This Market Trend?

As a platform focused on global trading depth and compliance layout, WEEX exchange has always maintained a calm assessment of cycle trends. Since launching its global strategy in 2021, we have continuously invested in markets like the Middle East, Latin America, and Southeast Asia, establishing localized operation centers in multiple compliant jurisdictions.

Currently, with Bitcoin breaking through to new highs, we believe the market has entered a new stage of "structural long", rather than a bubble peak. At such a point, users need to choose a trading platform with stable products, transparent mechanisms, and reliable safety to accompany them through the entire bull market cycle.

In the future, WEEX exchange will continue to focus on policy changes, on-chain data, institutional behaviors, and other key variables, providing users with in-depth insights in the first instance to help make more prudent investment decisions.