Article source: Talk Li Talk Outside

Today is another rainy day, so the little kid didn't make a fuss about going out to play, but instead sat obediently at the table drawing. I could also write an article at home. While writing, there was lightning and thunder outside, so I asked her: Do you know why there's lightning in the sky?

She looked up at me as if I were a fool and decisively answered: Because there's a power bank in the sky.

This answer was completely unexpected, but I didn't immediately correct her. After all, for a kindergarten child, I felt her answer was quite creative. I'll explain the knowledge about lightning to her when I have time tonight.

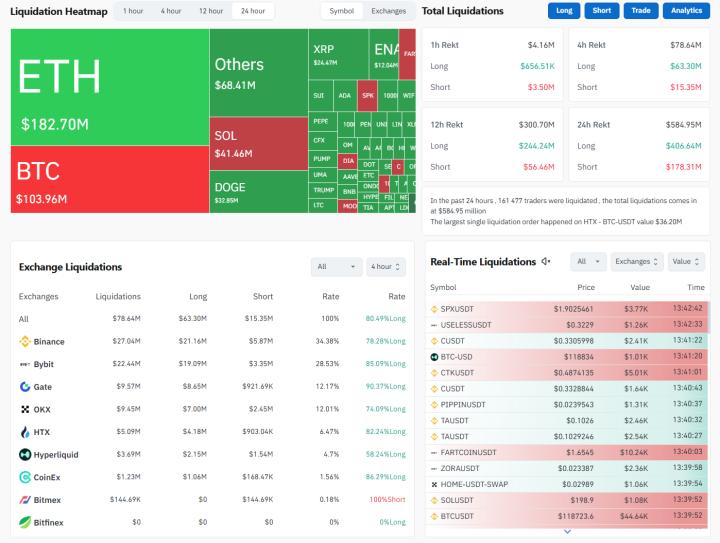

Back to the market. With Bitcoin creating a new historical high again, ETH has also been performing well in recent days, currently maintaining a price around $3,000. I hope this momentum can continue. If ETH can continue to break through and rise, we might welcome a new mini Altcoin season.

Actually, for quite a long time, the topic of Altcoin Season has been discussed by many people, almost to the point of "crying wolf". Now, whenever Altcoin Season is mentioned, most people will scoff because every time everyone has high expectations, but each time ends in disappointment. Therefore, a relatively unified view has basically formed - that the traditional Altcoin Season (characterized by a comprehensive, rotational surge of altcoins) is difficult to reproduce.

Including the other day when some partners in the group were discussing this topic, someone joked that Altcoin Season might as well be renamed Altcoin Week, Altcoin Day, Altcoin Second...

Rather than saying everyone is waiting for Altcoin Season, it's more accurate to say people are just hoping to make money more easily during a bull market. However, the market rarely moves as most people expect. When most people start to go long, it will likely drop, and vice versa. As we mentioned in an earlier article: The main logic of the market is to make as many people lose money as possible.

For example, BANANAS31, which appeared multiple times in the recent price increase rankings, after being pulled to a stage high point yesterday (July 11), when everyone's emotions were at their peak, started a sharp decline today, with a single-day drop of 77%. As shown in the image below.

It's hard not to sigh that yesterday was "Altcoin Season", today it directly became "Altcoin Sacrifice". Many people hope to easily make money during a bull market, but the result is often easily losing money during the bull market.

Originally, during a bear market, no one was making money, and everyone seemed equal and equally poor. But during the bull market, people end up losing money. Why is this?

We've discussed this issue many times in previous articles. To summarize simply:

Many people completely forget their trading discipline after continuously seeing others making money or becoming overnight millionaires. The FOMO emotions during the bull market drive people to constantly chase hot spots, buy at high prices, and use leverage, thus losing the cautious mindset from the bear market. They always feel the lost money can be quickly recovered in the bull market, but this turns the original investment plan into gambling, ultimately leading to more and more losses.

Therefore, the first thing we need to overcome in this matter is our FOMO mentality. As we mentioned in the previous article (July 10): As long as the market exists, we won't lack trading opportunities. We just need to persist and not be eliminated by the market. If your position management is not good or disciplined enough, causing most of your investment portfolio to be lost (or trapped), then we won't have enough funds to seize new, potentially better opportunities.

Continuing back to the Altcoin Season topic. Although the anticipated "Altcoin Season" often turns into an "Altcoin Sacrifice", as we said at the beginning of the article, if this recent upward momentum can continue, especially if ETH can continue to break through and rise, we might welcome a new mini Altcoin Season.

Our definition of a mini Altcoin Season in previous articles differs from the traditional Altcoin Season: instead of a comprehensive, rotational surge of altcoins, it becomes a structural market, meaning a short-term explosion in a specific sector (like AI, RWA) or individual projects (like PEPE, TRUMP) experiencing huge gains in a specific small cycle.

Remember in the July 1st article, we discussed the potential situation in the third quarter, focusing on several aspects:

- From a large cycle perspective, the third quarter this year should be a relatively important market period. We might call it: the intersection of crypto regulation and market transformation. Whether at the macro, political, policy, or market level, we might continue to witness some different changes.

- If the development direction based on macro or policy aspects cannot meet market expectations (a new black swan event), we can't rule out a callback or significant volatility starting in the third quarter. However, if the script remains unchanged, we are likely to continue seeing Bitcoin break new historical highs in the third quarter.

- If Bitcoin can continue to break new highs similar to the previous bull market (comparing the current situation with the market in September 2021), then Bitcoin's dominance will likely decline, and we'll have the opportunity to see a fourth mini Altcoin Season.

- Besides Bitcoin, if hoping to allocate some positions in altcoins, it's best to focus on narrative domains like Stablecoin and RWA. Taking Stablecoin as an example, projects related to stablecoins like AAVE and ENA still have some performance potential.

Looking at the actual market trend in the past two weeks, due to relatively optimistic macro and policy environments (no new black swan events), Bitcoin broke its historical high earlier than we originally expected. Ethereum has also broken through key short-term resistance levels, and many altcoins have risen over 10%. For instance, AAVE has seen a highest increase of around 18% in the past 7 days, and ENA has seen a highest increase of around 50% in the past 7 days.

For example, Backed Finance, the recently very popular xStocks is a product they launched. xStocks are a series of tokenized securities collateralized 1:1 with real stocks. The product was officially launched at the end of June, and so far has launched over 60 tokenized stocks, including Apple, Tesla, Nvidia, etc. They are expected to continue expanding to more DeFi platforms in the third and fourth quarters of this year. However, the project has not yet launched its own platform or governance token, only xAssets (tokenized real-world assets).

For instance, Chintai Network (they plan to introduce RWA assets into the Bitcoin ecosystem), Robinhood (one of the main promoters of Tokenized Stocks), Lendr Fi (reportedly about to launch its mainnet and will introduce a liquidity token called LsRWA to participate in protocol collateral and earnings)... and so on. Interested friends can further expand their attention from here.

That's what we'll discuss today. The sources of pictures/data involved in the text have been supplemented in the Notion, and the above content is just a personal perspective and analysis, only for learning records and communication, and does not constitute any investment advice.

Article source: https://mp.weixin.qq.com/s/6I3f88pKZ0JiDabwNWo60Q