Article source: Talk Li Talk Outside

Summer vacation continues, and yesterday I braved the scorching heat and was taken out by a child for a stroll. Wandering around feels more exhausting than writing an article, so I slept deeply last night and didn't even know that Beijing experienced a heavy rainstorm at night. I only found out this morning through videos sent by others that many roads were flooded. However, compared to extreme weather, the market performance these days seems relatively good, with BTC creating a new historical high of $112,040, and discussions in the group becoming more lively than in previous days. As shown in the image below.

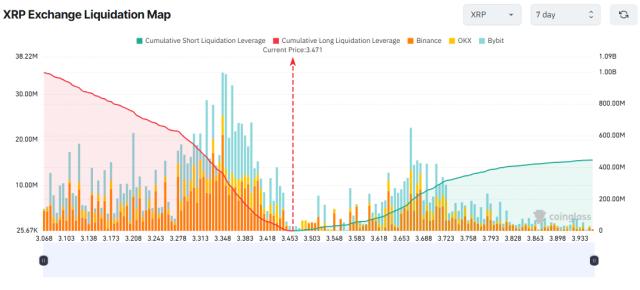

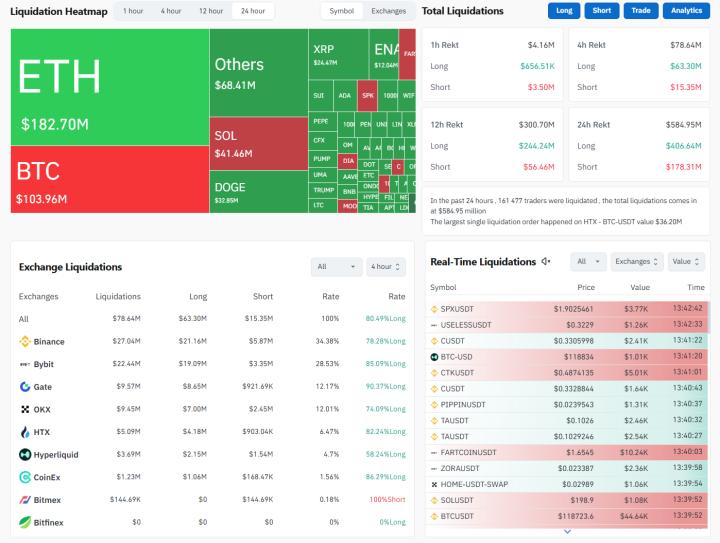

Meanwhile, some Altcoins are also performing well, with many cryptocurrencies experiencing daily gains of over 10%, as shown in the image below.

Since the beginning of the year, many people online have been calling for a bear market for quite some time, but BTC continues to disappoint them with new highs time and again.

In the previous article, we mentioned a hypothesis: In the past year, BTC seems to be entering a structural fund reallocation process, with early whales starting to exit, while some medium-sized players like institutions/funds begin to take over and gradually build positions. In the short term, whale sell-offs may suppress the stage's price, but as long as medium-sized players can continue to accumulate, the market remains worth anticipating in the medium to long term. However, in this human wealth migration game, retail investors are likely to be the most hurt.

Below is a BTC price prediction chart (forecast from July 10, 2025). From the trend of the prediction chart, we might see a BTC price of $150,000 this year, followed by a deep market correction, with the potential to reach $260,000 by 2029, as shown in the image below.

Of course, this prediction chart is based on the price trend of the past 1,458 days, speculating on the possible price trend of the next 1,458 days, and the result may not be accurate. As mentioned in our previous articles, market prices are determined by multiple dimensions including macro factors, policies, supply and demand, and sentiment. The accuracy of such predictions mainly depends on whether BTC's subsequent behavior can perfectly repeat historical cycles.

However, the market is always changing, but human nature rarely changes. Although we may face many unknown situations in the future, if you still believe in BTC's future, then as we said in our earlier articles: If your goal is 10 or 20 years from now, then BTC is never too expensive to buy now.

Everyone's understanding of cycles differs. Some see 1-2 months as a cycle, some view 4-5 years as a cycle, and more extreme individuals might consider 10-20 years as a cycle. For making money, some focus on current price levels, while others emphasize cyclical patterns.

If we simply review based on existing crypto cycle patterns:

The 2017 bull market was mainly due to ICO hype. At that time, retail investors could gain significant returns with small investments, though returns were proportional to risks. It felt like "thousands" of projects were raising funds through ICO, with some becoming overnight millionaires while others lost everything (many air and scam projects also used ICO for fundraising). For instance, BNB's ICO price was $0.11, and EOS was $1. According to historical data, approximately 2,300 ICO projects from 2017 can be traced, with only about 5% surviving, while 95% either disappeared, became zero-value, or turned into zombie coins.

The 2021 bull market was primarily driven by massive capital inflows (COVID-19 outbreak, Federal Reserve's large-scale interest rate cuts + quantitative easing), marking the entry of institutions (mainly represented by Musk and Tesla). It was also the most innovative crypto cycle, experiencing L1 public chain wars and golden moments of various innovative narratives like DeFi, Non-Fungible Token, GameFi, and metaverse. Many project prices reached historical peaks, especially during the market's craziest phase - it wasn't an exaggeration to say you could make money by blindly buying on OK or BN. This bull market was likely when many people started seriously engaging with cryptocurrencies.

The 2025 bull market is primarily driven by institutional momentum. Major institutions have finally officially entered and begun to control discourse. With the successful ETF compliance process, traditional capital inflow, and auxiliary narratives like AI and RWA, BTC successfully broke through the historical $100,000 mark, creating a milestone. Additionally, the US Bitcoin strategic reserve plan and ongoing crypto-related laws and policies suggest this bull market marks a crucial phase of crypto transitioning from a marginal asset to mainstream integration.

In fact, reviewing past bull markets reveals that as large participants (represented by nations and institutions) increasingly engage, this market seems to become less friendly to retail investors (simply put, it's becoming harder for ordinary investors to make money). However, from another perspective, this might also signify a new market's maturation.

Especially since 2025, major institutional investors continue accelerating BTC accumulation, while US regulatory measures and planned laws seem to be expediting global crypto adoption. Laws like 'The GENIUS Act' and 'The CLARITY Act' we previously mentioned could potentially become catalysts for tens of trillions of dollars in market liquidity.

This is both the worst and best of times. Currently, the crypto market's infrastructure has become relatively complete after years of development, and market regulation (primarily in the US) is becoming clearer. Cryptocurrencies were once niche and for retail investors; now they belong to institutions, and future cryptocurrencies will be global. As ordinary retail investors, we need the courage to burn our boats. The past decade's failures and successes have shown us a window, and we might see a door in the future. Stepping through, we might discover a different, broader world.

As Lu Xun said: There was originally no path, but one is formed when many walk it. The development of any market follows similar principles. The crypto path is gradually paved by early believers. Initially, cryptocurrencies were merely a "geek toy" and "Ponzi scheme". The 2017 ICO boom transformed crypto from a bubble, but it was still seen as "valueless" and a "air scam". However, with time, mainstream finance is slowly accepting cryptocurrencies.

In short, believe in it and hold it, adding an extra life bet to your future. Don't believe in it, stay away and continue doing what you currently think is right. Ultimately, everyone must be responsible for their choices, and each person can only be responsible for their own choices.

Many people looking at the $110,000 BTC would reminisce about the $1 BTC (In January 2011, Bitcoin's trading price first broke through $1), and thus hope to find the next get-rich-quick asset, but no one can predict what that asset will be. What we can do is seize current opportunities (if you also believe BTC will reach $1 million in 10 years), while keeping a broader perspective, being prepared, and maintaining an open attitude.

For some, trading is an investment, while for others it's merely speculation. But ultimately, we only need to do two things: how much money can be earned at the right time, and how much loss can be sustained at the wrong time. For instance, since this bull market, many have watched BTC rise from under $20,000 to $110,000, lamenting why they didn't buy BTC earlier, why they have so little BTC... Meanwhile, they also sigh about why they kept adding positions to certain Altcoins despite losses, and why they listened to others and FOMO'd into on-chain meme tokens, resulting in total loss.

Summarizing this situation, it roughly breaks down into two aspects: on one hand, facing "certain" trading opportunities makes it difficult to form scaled or continuous investment, such as believing BTC will rise but thinking at $20,000 the growth potential is limited. On the other hand, facing "uncertain" trading opportunities leads to large bets, believing their theory is definitely correct and their understanding or technology will definitely defeat the market and bring huge returns.

For myself, I mainly consider doing "certain" trades, because while "uncertain" opportunities might have potentially massive returns, they also face enormous risks. Such trades are also very hard to completely master through fixed techniques or skills (at most only improving probability). In contrast, certain trades can be continuously improved and optimized through specific methods.

Investment seems very simple, just buying low and selling high, but achieving correct investment (the two things we mentioned) is actually very difficult, requiring finding balance points between investment theories and market changes.

Therefore, my investment experiences over the years have taught me one most important thing: strictly manage positions (risk management), especially never being too attached to losing trades. Remember, the market is always right.

As long as the market exists, we won't lack trading opportunities. What we need to do is persist without being eliminated by the market. If your position management is insufficient or undisciplined, causing most of your investment portfolio to be lost (or trapped), then we won't have enough funds to seize new, potentially better opportunities.

Thus, clearly understanding one's risk tolerance is crucial in investing. We need to deeply comprehend: how much can be earned when right, and how much can be lost when wrong. Over these years, I've seen many examples and encountered numerous people with larger capital and more advanced skills, but many have left this field due to losses. Yet I continue to persist. Looking back over these years, especially the first few years entering this field, I've made many trades and experienced numerous losses. But in actual results, most profits were actually obtained from just a few trading categories (BTC, ETH). This is why I've always insisted on this phrase: maintain focus, maintain thinking, maintain patience. I've also placed this in my public account signature, hoping to continue encouraging everyone.

That's all for today. The sources for images/data mentioned in the text have been supplemented in the Notion. The above content represents personal perspectives and analysis, serving only as a learning record and communication, and does not constitute any investment advice.

Article source: https://mp.weixin.qq.com/s/fCrVOb-n4IUwJMZLlJaSBA