"The Foundation of Future Global Finance is Robinhood Chain"

Can a brokerage firm disrupt not just the commission system, but the entire underlying architecture of global asset trading? Robinhood seems to have its own answer. At the recently concluded press conference in Cannes, France, this giant that has stirred up the American securities industry with zero commissions, threw out an extremely imaginative vision: using blockchain and tokenization to comprehensively push stocks, derivatives, and even private equity on-chain, and ultimately create a new Layer2 public chain - Robinhood Chain - capable of carrying global real assets.

This press conference was more than just a product list; it was Robinhood's declaration of its blueprint for the next decade. The European, American, and global markets were defined with different breakthrough points, yet interconnected, jointly depicting a new trading order driven by tokenized assets. This article will be divided into three parts, deeply analyzing this "on-chain brokerage" strategy based on Robinhood's on-site conference information and industry background.

Targeting the European Market: Tokenized US Stocks + Perpetual Contracts + All-in-One Investment App

Main Product Information:

1. Robinhood launches tokenized trading of 200+ US stocks and ETFs, based on Arbitrum, expanding more targets by year-end

2. European App upgraded from Robinhood Crypto to "Robinhood", positioned as a comprehensive investment platform

3. Perpetual contracts launching this summer, with more concise mobile ordering

4. Bitstamp as the liquidity engine for perpetuals and derivatives

5. Tokenized stocks support real-time dividends and stock splits synchronization

6. Covering 31 European countries, SpaceX and OpenAI private placement tokens available from July

Notable Details:

1. Three-stage path:

a. TradFi custody → Robinhood minting tokens

b. Bitstamp handling weekend trading → 24/5 liquidity

c. Eventually supporting self-custody and cross-chain

2. 2% bonus for deposits before July 7

3. App renaming and UI upgrade, strengthening "super investment App" positioning

Robinhood views European users as the vanguard of its tokenization strategy, which is not hard to understand: the EU recently implemented MiCA (Market in Crypto-Assets), with clearer regulations compared to the US, and Robinhood's penetration in the EU is far from saturated.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms and preserving the XML tags.]2. Mid-term switching between Bitstamp/TradFi liquidity

3. Long-term allowing self-custody and cross-chain migration

Notable details:

1. SpaceX and OpenAI private equity tokens will be the first to go online, with private equity tokens seen as key to breaking high-net-worth barriers

2. Collaborating with regulators to promote compliant on-chain listing, and future opening to developers to drive RWA ecosystem

All the products mentioned above will ultimately converge into Robinhood's "global chessboard" - Robinhood Chain.

Robinhood Chain, evolved from the Arbitrum technology stack, is positioned by Robinhood as the "first Layer2 public chain dedicated to real assets". It will not only carry Robinhood's tokenized stock trading but also support future tokenization of full-category real assets including real estate, bonds, art, and carbon credits.

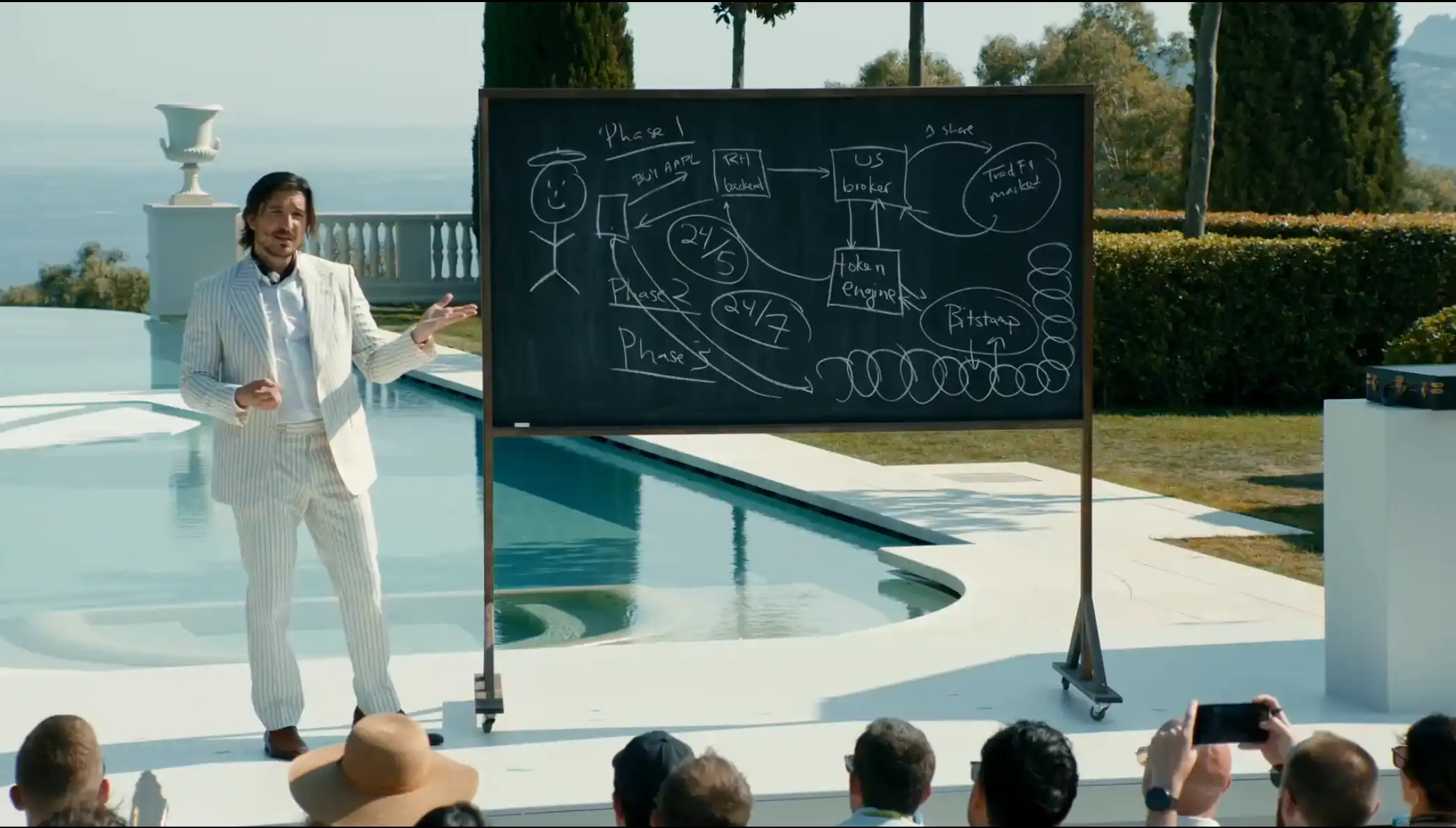

At the press conference, Vlad Tenev outlined a "three-stage" plan:

Stage One: After user order, Robinhood's US broker purchases and custody stocks from traditional exchanges, with Robinhood generating and simultaneously distributing tokens, ensuring 1:1 correspondence with physical assets

Stage Two: Integration of Bitstamp and TradFi liquidity, enabling trading even when traditional stock markets are closed (such as weekends and holidays)

Stage Three: Fully unlocking token self-custody transfer capabilities, allowing users to cross-chain migrate these Robinhood-generated assets to personal wallets or other DeFi protocols

In other words, Robinhood Chain is not just Robinhood's "Layer2 settlement network", but will also become a public chain ecosystem open to global developers, allowing third-party projects to issue real asset tokens.

This model forms positive competition with the RWA (Real World Assets) strategies recently actively explored by Coinbase and Kraken. The difference is that Robinhood has broker qualifications and starts from US stock tokenization, possessing a complete compliant brokerage chain, enabling faster bridging of traditional finance and blockchain compliance channels compared to pure exchange platforms.

Notably, Robinhood simultaneously announced the immediate distribution of OpenAI and SpaceX private equity tokens on-site. In the future, these tokens can remain liquid through Robinhood Chain even on weekends, not dependent on a single custody party, and allow subsequent free cross-chain usage. This attempt may change the liquidity structure of the entire private investment industry, possessing disruptive potential similar to Robinhood's zero-commission revolution.

Industry observers believe that if Robinhood successfully makes Robinhood Chain the global real asset foundation, not just stocks or futures, but including real estate, art, and even carbon emission indicators could become composable assets in Robinhood users' wallets, which would profoundly reshape the global financial system.

The Embryonic Form of an On-Chain Broker

From zero commission to fractional stock trading, to today's "Robinhood Chain", Robinhood is writing a highly continuous innovation path: each step targets barriers and inefficient segments in the traditional financial system, significantly lowering entry barriers through technological means.

When tokenization moves from a single Apple stock to an entire building, a private equity share, or even an artwork, blockchain is no longer just a speculation tool but truly embodies the "asset internet" concept. Robinhood sees this opportunity and hopes to be the first to run in the window of gradually clarifying regulations, leveraging its user base and brand trust.

A Ripple and BCG report predicts that the global tokenized real asset market could reach $18.9 trillion by 2033. Robinhood clearly doesn't intend to be just a participant but aims to be the foundation builder of this market. The declaration at the Cannes conference might serve as a conclusion: "The foundation of global finance in the future is Robinhood Chain."